Chapter 7: Appendix Investment Analysis and Portfolio Management

advertisement

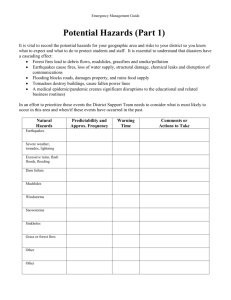

Investment Analysis and Portfolio Management Eighth Edition by Frank K. Reilly & Keith C. Brown Chapter 7: Appendix Chapter 7 - Appendix Questions to be answered: What components of modern portfolio theory (MPT) are being questioned? – MPT is a one period model. Does it still hold when the time horizon is extended? – MPT assumes normality. Are financial markets really normal? » Evidence from Mandlebrot on the normality of markets » Evidence regarding Power Functions 2 3 Total Real Return Indices January 1802 – June 30, 2005 $632,680 $1,000,000. STOCKS $100,000. $10,000. BONDS $1,000. $1115 $292 $100. BILLS $10. GOLD $1. $0.1 DOLLAR $1.38 $0.06 $0.01 1801 1811 1821 1831 1841 1851 1861 1871 1881 1891 1901 1911 1921 1931 1941 1951 1961 1971 1981 1991 2001 4 Annual Stock Market Returns Updated through June 30, 2005 LongTerm Major SubPeriods 1802-2005 6.8% I 1802-1870 7.0% 6.6% 6.7% 6.8% 10.0% -0.4% 13.6% 8.9% II 1871-1925 III 1926-2005 1946-2005 1946-1965 Post-War Periods Real Returns 1966-1981 1981-1999 1984-2005 5 Annual Bond Market Returns Updated through June 30, 2005 LongTerm Major SubPeriods 1802-2005 3.5% I 1802-1870 4.8% 3.7% 2.3% 1.5% -1.2% -4.2% 8.4% 7.2% II 1871-1925 III 1926-2005 1946-2005 1946-1965 Post-War Periods Real Returns 1966-1981 1981-1999 1984-2005 6 Long and Short-term Risk of Stocks and Bonds 7 Holding Period Risk for Annual Real Returns Historical Data and Random Walk (Dashed Line) 1802 – 2004 20% 20% Actual Stocks 18% 18% Actual Bonds 16% 16% Actual Bills 14% 14% 12% 12% Risk 10% 10% 8% 8% 6% 6% 4% 4% 2% 2% 0% 0% 1 2 5 10 20 30 Holding Period 8 Is there a “Corporate El Dorado”? Quotation from Foster and Kaplan’s Creative Destruction: p. 9 “McKinsey’s long-term studies of corporate birth, survival, and death in America clearly show that the corporate equivalent of El Dorado, the golden company that continually performs better than the markets, has never existed (emphasis theirs). It is a myth.” Top Performing Stock From 1925-2004 – Philip Morris, Return 17.36% vs. 10.04% Market. Top Performing Stock From 1950 – Philip Morris, Return 17.87% vs. 11.47% Market. Top Performing Stock from original S&P 500 in 1957 – Philip Morris; Return 19.72% vs. 10.86% for S&P 500. $1,000 put in S&P 500 when it was founded would turn into $138,549 by the end of 2004. $1,000 put in Philip Morris at the same time would grow to over $5.5 million. 9 Dividend Yield and Relative Performance $1,000,000 $100,000 Dividend Yield Highest High Return 14.22% 13.28% Risk 19.09% 16.49% Middle Low Lowest 10.60% 9.84% 9.53% 16.35% 18.57% 23.52% S&P 500 11.17% 16.84% High Div Yield $517,188 $351,581 S&P 500 $144,996 $113,894 $ 82,341 $ 72,068 Low Div Yield $10,000 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 1975 1973 1971 1969 1967 1965 1963 1961 1959 1957 $1,000 10 Which Stock is Better Growth Measures Revenue per share Dividends per share Earnings per share Sector Growth* IBM 12.19% Standard Oil of New Jersey 8.04% 9.19% 7.11% 10.94% 7.47% 14.65% -14.22% * Change in Market share of technology & energy sectors, 1957 - 2003 11 Which Stock is Better? Valuation Measures Average P/E IBM Standard Oil 26.76 12.97 Average Dividend Yield 2.18% 5.19% 12 Which Stock is Better? Return Measures IBM Standard Oil Price Appreciation 11.41% 8.77% Dividend Return 2.18% 5.19% Total Return 13.83% 14.42% 13 Which Stock is Better? If you had invested $1,000 in each of IBM & Standard Oil in 1950, by 2003 your shares would be worth: – Standard Oil $1,260,000 – IBM $961,000 Your terminal wealth was $300,000 or 31% more in Standard Oil (even though the average annual was only 0.59% higher in Standard Oil) 14 Are Financial Markets Normal? Following data is from The (Mis)Behavior of Markets: A Fractal View of Risk, Ruin & Reward by Benoit Mandelbrot In the summer of 1998, the improbable happened – On August 4th, the Dow Jones fell 3.5% – Three weeks later, it fell again by 4.4% – On August 31, it fell by 6.8% 15 Are Financial Markets Normal? If markets follow a normal distribution, the probability of the fall on August 31, 1998 was one in 20 million. – If you traded daily for 100,000 years, you would not expect to see it once The probability of three such declines in one month – about one in 500 billion Was this just a freak accident, an “Act of God” so rare that it would never happen again? 16 Are Financial Markets Normal? In 1997, the Dow fell 7.7% in one day (Probability – one in 50 billion) In July, 2002, the index had three sharp falls in seven trading days (Probability – one in 4 trillion) On October 19, 1987 the index fell 29.2%, the worst day in history (Probability – one in 1050) Mandelbrot believes that we need to scrap the entire concept of MPT, as its basic premise of normally distributed returns is false 17 Ubiquity: Why Catastrophes Happen by Mark Buchanan Sarajevo, 11:00 AM, June 28, 1914 A car carrying the Austro-Hungarian Archduke Franz Ferdinand & his wife Sophie takes a wrong turn It stops directly in front of Gavrilo Princip, a 19 year old Bosnian Serb student and member of the Serbian terrorist organization Black Hand. Princip pulls a gun from his pocket and kills the Archduke and his wife 18 War Within hours the political fabric of Europe began to unravel – Austria used the assassination as an excuse to plan an invasion of Serbia – Russia guaranteed protection to the Serbs – Germany offered to intercede on behalf of Austria if Russia become involved – Within 30 days, this chain reaction of threats and promises had mobilized vast armies and tied Austria, Russia, Germany, France, Britain and Turkey into a deadly knot 19 War When the first world war ended five years later, 10 million lay dead Twenty years of uncomfortable peace were followed by WWII and another 30 million dead Was this all due to one chauffeur’s mistake? Although many explanations have been given for WWI, it must be remembered that the century preceding 1914 had been like a “long peaceful afternoon in European history and that to the historians of the time, wars seemed to erupt like terrifying and inexplicable storms in a 20 Earthquakes Kobe, Japan is one of the gems of modern Japan It lies along the southern edge of Honshu, the largest of the Japanese islands Its port is the 6th largest in the world and handles nearly a third of all Japan’s imports and exports The city has excellent schools and calls itself an “urban resort” At 5:45 am on January 17, 1995 a few rocks began to crumble on the ocean floor, 20 kilometres southwest of Kobe In 15 seconds the earth ripped apart along 21 Earthquakes The resulting earthquake had the power of a hundred nuclear bombs It ruined every road and rail link into Kobe 100,000 buildings were damaged or destroyed Only 9 out of 186 berths in the port of Kobe remained operable 5,000 people died, 30,000 were injured and 300,000 were left homeless Although Japan is known for 22 Forest Fires Not far to the west of Wyoming’s vast Bighorn Basin, the wild and unrestrained landscape of Yellowstone National Park climbs into the Rockies Yellowstone is America’s most beautiful national park, set aside for protection back in 1872 and the holiday destination of more than 1 million visitors a year Lightning sparks several hundred forest fires a year in the park. Most burn less than a few acres before dying out. Prior to 1988, the largest fire ever recorded, in 1886, had burned just 25,000 acres In June, 1988, a lightning bolt sparked a 23 Forest Fires The fire was named Shoshone and the Forest Service began to monitor its progress On July 10, rain fell in Yellowstone and the fires seemed well under control It did not turn out that way By mid-July, several other fires had sprung up and began burning large swaths of land – – – – Clover spread to 4,700 acres Fan covered 2,900 acres Mink Creek fire covered 13,000 acres Shoshone covered 30,000 acres in just a few days By August 200,000 acres of Yellowstone had been consumed by fire 24 Forest Fires Over the next two months, more than 10,000 fire fighters using 117 aircraft and more than 100 fire engines struggled to contain the blaze When it was finally over, more than 1,500,000 acres of Yellowstone had been burned and $120 million in funds spent fighting the fire 25 Financial Markets On September 23, 1987 the headline in the Wall Street Journal read, “Stock Prices Soar in Heavy Trading: Industrials Rise Record 75.23 Points” It had been an incredible summer and almost every week records were broken and new highs obtained There was a minor correction in late summer but the surge of September 23 was what most traders expected – it was the natural end of a minor correction and it set the stage for further gains – “In a market like this” one trader said, “any news is good news. It’s pretty much taken for granted now that the market is going to 26 Financial Markets When the market opened for trading on October 6, 1987 most analysts fully expected stock prices to keep climbing When prices began to tumble, at first there was little concern It was obvious to most analysts that this was merely another insignificant correction, a temporary setback caused by investor uncertainly about interest rates or the value of the dollar But for some reason this tiny correction took and by the end of the day the bulls were bloodied. As one said, 27 Financial Markets The market continued to slide over the next week and then October 14, 15 and 16th saw three considerable losses in a row. But according to a Wall Street Journal article on the 16th, – “It was the third major decline in as many days. But several technical analysts said that the big volume accompanying Friday’s session might mean better things ahead” Reality was somewhat different When trading opened on Black Monday, October 19, 1987, it was immediately swept away in a mad panic. Prices began to plummet 28 Financial Markets The rush to sell was so overwhelming that by late afternoon over $500 billion of wealth had been erased It was the largest one-day free fall in market history – Newsweek said, “It felt like the end of the world, after two generations of assurances that it couldn’t possibly happen” – The crash was almost twice as severe as the infamous stock market crash of 1929 – “It was God tapping us on the shoulder”, one billionaire investor said, “a warning to us to get our act together”. But virtually nobody had predicted it! 29 Wars, Earthquakes, Forest Fires & Financial Panics Each of these disasters erupted from its own particular setting. How are they related? In each case, it appears that the organization of the system – the web of international relations, the fabric of the forest or the earth’s crust or the network of linked expectations and trading perspectives of investors – made it possible for a small shock to trigger a response out of all proportion to itself. It is as if these systems were poised on some knife-edge of instability, merely waiting to be set-off 30 Wars, Earthquakes, Forest Fires & Financial Panics The key to a unified understanding lies in the subtle and powerful concept of the critical state, an idea that appears to be central to the scientific understanding of many processes in which the notion of history plays a fundamental role For centuries, physicists have sought to capture the fundamental laws of the universe in timeless and unchanging equations, often with great success But the paradox is this: if the laws of physics are so simple, why is the world itself so complex? 31 Wars, Earthquakes, Forest Fires & Financial Panics In the 1970s and 1980s, scientists discovered at least part of the answer – chaos The molecules inside a balloon move according to the law of chaos. Give just one molecule a nudge and soon every molecule inside the balloon will be affected. But chaos cannot explain the upheavals that we often witness – For example, chaos would suggest that a butterfly flapping its wings in Brazil might, weeks later, lead to a thunderstorm in Europe – But if the butterfly were inside a balloon, then it could never affect the air outside of the balloon. The air inside the balloon would be in a state of equilibrium 32 Wars, Earthquakes, Forest Fires & Financial Panics For the air inside the balloon, the past and the future are essentially the same; the idea of history has no meaning In contrast, the air in the earth’s atmosphere is very much out of equilibrium. It is constantly stirred and agitated and energized by the sun. The result is the rich and ever unfolding history of the weather and climate. When out of equilibrium, there is such a thing as history Upheavals occur when systems are out of equilibrium The key idea is the notion of the critical state, a special kind of organization characterized by a 33 Wars, Earthquakes, Forest Fires & Financial Panics This is the first landmark discovery in the emerging science of non-equilibrium physics, which is also referred to as complexity theory When things are out of equilibrium, they tend to be complex – Complexity usually involves a string of historical accidents » The structure of a snowflake or a food web However, since there are no fundamental equations for things in which history matters, how can we understand them? 34 Understanding through Games “All great deeds and all great thoughts have ridiculous beginnings” wrote Albert Camus, a French philosopher 1987 – Per Bak, Chao Tang & Kurt Weisenfeld begin to play a sandpile game in their lab at the Brookhaven National Laboratory. They are trying to understand dis-equilbrium. In the process, they discover the critical state In the sandpile game, a grain of sand is dropped onto a pile. As each grain of sand is dropped, the pile becomes steeper and it is more likely that the next grain of sand will cause the side of the pile to slide Sand would then slide downhill to a flatter 35 The Sandpile Game To speed up their work, Bak et al developed a computer game to drop imaginary grains of sand for them. A java version of the sandpile game is found here: http://www.cmth.bnl.gov/~maslov/Sandpi le.htm The first simple question they hoped to answer was, “What is the typical size of an avalanche?” – After observing millions of avalanches in thousands of sandpiles, the answer: there was no “typical” avalanche. Some involved a single grain of sand; some involved the entire side of the sandpile. – But an amazing result became obvious. As the size of the 36 The Sandpile Game The reason is due to the “fingers of instability” that run through the sandpile. When a new grain of sand is dropped, its effects are totally unknown. – It might affect only one or two grains nearest to it. – However, if it falls on a very unstable area, it may cause a chain reaction that causes much of the sandpile to slide. 37 And Earthquakes . . . After analyzing both US and international seismic data, researchers found a similar pattern As the magnitude of the earthquake doubled, it became four times as rare Thus everyday there are a large number of very small earthquakes. Occassionally, a very large earthquake will occur. But when an earthquake begins, it is impossible to predict how large it will become – it depends on the fingers of instability in its immediate 38 And Forest Fires Later, researchers discovered a very similar pattern with respect to forest fires. There are a very large number of small fires but few large fires. The actual ratio is as area doubles, fires become 2.48 times as rare 39 And Forest Fires Another insight also came from studying forest fires. – The longer the period of stability, the greater the instability that built up in the system – Greenspan has often spoken about this with respect to financial markets. The longer the period of stability, the greater the instability that exists in the financial sector. 40 And Financial Markets In 1998, Gene Stanley of Boston U led a group studying the price history of the S&P 500. They studied prices recorded every 15 seconds over 13 years – a total of 4.5 million data points Stanley et al found that price changes became 16 times as unlikely every time the size of the change doubled This implies that there is no such thing as a “typical” fluctuation and so there is no reason to think that 41