SMALL BUSINESS

MANAGEMENT

Chapter 12

Tax Management

Race #1

Race #2

Race #3

Advisers and Small Business

As entrepreneurs are engaged in

planning and starting their business, they

will often seek out assistance from more

experienced entrepreneurs or mentors

Copyright © 2014 McGraw-Hill Ryerson.

All rights reserved.

Advisers and Small Business

Use of Advisers

Entrepreneur will usually use outside

advisers such as accountants, bankers,

lawyers, advertising agencies, and market

researchers on an as-needed basis

These advisers, who are separate from the

more formal board of advisers, can also

become an important part of the organization

and thus will need to be managed just like

any other permanent part of the new venture

Copyright © 2014 McGraw-Hill Ryerson.

All rights reserved.

Advisers and Small Business

Use of Advisers (cont.)

Mentors

Often the first stage in formal advice is

the use of a mentor

Mentors can be used on an ad hoc basis

or formally assist the entrepreneur in

running the company on an ongoing basis

Board of Advisers

Some entrepreneurs will form a board of

board of advisers occasionally referred to

as a board of directors

Copyright © 2014 McGraw-Hill Ryerson.

All rights reserved.

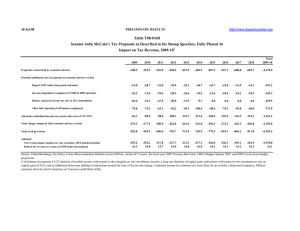

Taxation and Small Business

History of Taxation

1917 temporary tax

Average Canadian pays 52% of income to

tax

Table 13-3 10% increase needs $100,00

sales

Income Taxes

complexity of principles and frequency

of legislative changes

1. What books and records must be

kept for a business?

Any person carrying on a business must

keep books of accounts and records which

provide the ability to calculate taxes

payable.

Source documents include

invoices for purchases and sales, deposit

slips, cheques, and contracts

For purposes of income tax, many books of

accounts, records, and source documents have

to be retained for a minimum of six years

General Tax Management Principles

Ten fundamental areas

1. Continual tax planning

2. Tax Deferral

Use the tax money during deferral period

Tax laws may change which may reduce tax

liability

3. Income Splitting

through the year requirements

Progressive tax system

4. Marginal Tax Rates

Income and expenses ie 30% = 30 cents on

each dollar

Race #2

General Tax Management Principles (cont.)

5. Deductibles

accounting and legal expenses

Not tax prep or incorporation

Advertising

Canadian Media

business entertaining

automobile expenses

interest expense

Shareholder loan strategy

Repairs - deducted

Improvements - depreciated

office expenses

General Tax Management Principles (cont)

6. Government Tax-Related Programs

Special Tax Rate Deductions

Small Business Deduction (SBD)

Manufacturing and Processing Deduction

12% on 1st $300,000, 22% after

On income not included in sbd

Investment Tax Credit

Deferral Programs

deferred profit sharing – deduct now pay tax later

when paid out

registered retirement savings plan

bonus deferral

General Tax Management Principles

6. Government Tax-Related

Programs (cont.)

Accelerated Capital Cost Allowance

Small Business Financing Programs

7. The Incorporation Question

corporation vs. proprietorship vs.

partnership

General Tax Management Principles (cont)

8. The Remuneration Question

9. Transferring the Business:

Capital Gains

compensation salary or dividend

capital gains and family members

(Chapter 15)

10. Goods and Service Tax (GST)

and Provincial Sales Tax (PST)

Race # 3

Appendices

A. Federal and Provincial Tax Rates

for Individuals

B. Tax Reference Tables