MGT 4451 Name: Spring 2009

advertisement

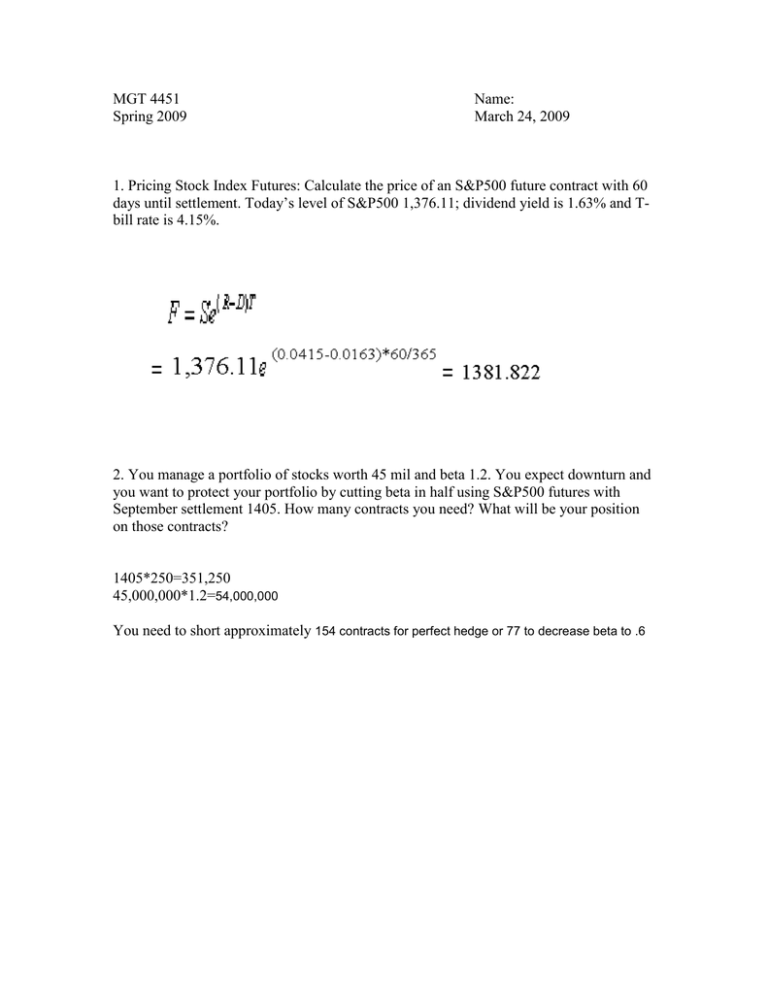

MGT 4451 Spring 2009 Name: March 24, 2009 1. Pricing Stock Index Futures: Calculate the price of an S&P500 future contract with 60 days until settlement. Today’s level of S&P500 1,376.11; dividend yield is 1.63% and Tbill rate is 4.15%. 2. You manage a portfolio of stocks worth 45 mil and beta 1.2. You expect downturn and you want to protect your portfolio by cutting beta in half using S&P500 futures with September settlement 1405. How many contracts you need? What will be your position on those contracts? 1405*250=351,250 45,000,000*1.2=54,000,000 You need to short approximately 154 contracts for perfect hedge or 77 to decrease beta to .6