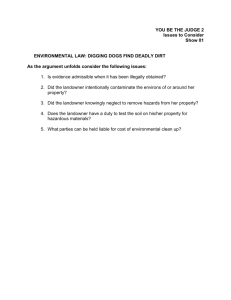

Reporting to Landowners in Illinois Abstract

advertisement

Abstract Reporting to Landowners in Illinois Although Cash Rent arrangements are becoming more prevalent as a farm ground rental arrangement, Crop Share agreements are still popular. It is also a common practice for farm producers to pay for the landowner’s share of expenses related to the crop in the Crop Share arrangement. Quicken can be used to track these expenses and report to the landowner. In order to do this with Quicken, the production field owned by the particular landowner must be identified. To do this, a Class identifying the field must be created. It is convenient to use the FSA identification number. Quicken for Farm Producers was developed to provide instruction to Illinois farm producers desiring to computerize their farm records. The program is computer based through the use of a laptop lab which is portable to local extension offices. A 200 page manual is available on cd or hardcopy. Over 200 producers in Illinois have been trained through this program. The program has evolved from a single session program to a minimum of three session’s program. This format allows the producer to take their file home with them to input information and then later ask questions during lab time. A group file is also used which allows the producer to ask questions without providing personal financial details, if they so desire. Since moving to the multi-session format, impact evaluations indicate that implementation of Quicken into the farm operation has improved from 25% to 100% after attending the program. The manual is also available online in pdf format. In Illinois, it is important for producers to keep field level (individual landlord) information. This is done by using Quicken´s muliti-level reporting functions. Producers are encouraged to email the instructor with questions on using Quicken after the program. Introduction to Using Classes What is the purpose of using a class? Classes represent additional layers of detail. Think of the Accounts as being the first level. Under each account, such as a checking account, you record transactions. An example might be writing a check for a fertilizer expense. The account is the Checking Account. The category will be Fertilizer Expense. We can also use a subcategory of phosphorus. Level 3 Phosphorus Fertilizer Subcategory Level 2 Fertilizer Expense Category Level 1 Checking Account Account Suppose we want detail on analyzing the farm business by Enterprise. Let’s assume we want to see how we are doing with our commercial corn business. How much money are we making on corn? How are we going to do this? Here’s how. Level 1 Checking Account Account Level 2 Fertilizer Expense Category Level 3 Phosphorus Fertilizer Subcategory More Detail 1. Corn Enterprise Or 2. FSA 100 Or 3. FSA 100 - Corn Class Class By using the Class “Corn Enterprise” we can pull up every transaction pertaining to the Corn Enterprise. This allows us to do Enterprise Analysis. The same thing could be done by Field as well. In #1, the whole corn 2 enterprise can be analyzed. In #2, we can exam the field for enterprise analysis. In #3, the corn enterprise on the mentioned field is analyzed. This can be particularly useful in identifying expenses by landowner. By dividing the field for Enterprise Analysis, the field will not be able to be analyzed as a whole, but only by field enterprise. The Quicken Reporting System, although very good, will not allow you to do both whole field and field by enterprise analysis. By adding the two together using a spreadsheet, you could easily combine the field enterprise analyses into one field analysis. Handling Landowners This section is for producers that pay for inputs that will later be charged to the landowner. The easiest way to handle this is to say, “Don’t do that!” However, it is a common practice that will continue. Many also handle and sell grain for their landowner. This chapter will address such issues. There are several ways to handle this. 1. Charge all the expenses to yourself in the appropriate category and class. When you receive payment from the landowner; credit the account back using the same categories, subcategories, classes, and subclasses. In this, let’s assume the bill for FSA 103 should be paid 50% by the landowner, but you paid it already and now have received payment. 3 Next, we will receive payment from the landowner for the landowner’s portion. Here are the recorded transactions.. 4 Here is the report showing the total expenses and reimbursements. 5 2. Another way….Set-up a new category named “Farm Revolving Funds”. From this category, money will be exchanged. At the end of the business cycle, this account should be zeroed out. We have discussed setting up categories earlier. This method will be more tedious to input, but might be easier to track all transactions. When creating a profit and loss report, simply uncheck the “Farm Revolving Funds” category. Example: Next, we will pay the following invoice in full and collect payment from Landowner Joe for half of the bill. When recording the transaction, use the Split Transaction button. Half of the bill is charged to the Farm Revolving Funds category using Landlord Joe as a class. 6 Next, record the payment from the landowner The Red arrow shows your payment. The Blue arrow shows the landowner share Below the Blue arrow is the payment from the landowner. 7 Grain Marketing and Landowners For a farmer who markets grain for the landowner and the grain is stored at an elevator, do not inventory the grain within your own file. If you mix your grain with your landowner’s grain in the same bin, simply do not count the estimated portion of the landowner. Again, keep a separate file if needed. For the full instructions on using Quicken for Farm Producers: http://www.farmdoc.uiuc.edu/manage/quicken/quicken.html United States Department of Agriculture • Local Extension Councils Cooperating University of Illinois Extension provides equal opportunities in programs and employment 8