Mergers & Acquisitions-GOs

advertisement

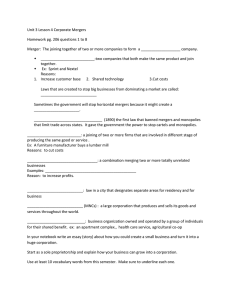

Mergers & Acquisitions-GOs Anticompetitive effects of mergers Effect on businesses of anticompetitive mergers Implications of Global Mergers Merger Acquisition Company Company A X Company Company C X Company B Company Y Diversification of trade and service activities Achieving optimum size of business Enhance profitability Widening Customer base Economies of scale Pooling resources Dynamic efficiency Escaping Gestation Period Merger Horizontal Vertical Backward Integration Conglomerate Forward Integration Most likely to raise competition concerns Reduction in Number of Players Concentration of Economic Power Growth of monopoly power/ Dominance Factors for Anti-competitive effects’ Assessment: Homogeneity/ Heterogeneity of products/services Co-ordinated Effects : Ability/ Inability to coordinate pricing/output decisions Unilateral Effects: Ability/ Inability to raise prices post transaction Ease of entry/ expansion in the Relevant Market Whether either party is a potential failing enterprise Likely Pro-competitive effects of the Merger No reduction in Number of players Efficiency enhancing- Unlikely to result in competitive injury. Likely to produce injurious effects where either party is dominant in the relevant market: 1. Market Foreclosure 2. Facilitating co-ordinated behaviour in upstream/downstream markets Most unlikely to result in any competitive injury. Potential Competition concerns: 1. “Deep Pockets”Theory. 2. Entrenchment 3. Reciprocity 4. Bundling and Portfolio Effects 5. Multiple Market Strategies • MERGERS EXEMPT FROM NOTIFICATION • Negligible Impact - Where mergers Are Between Small Enterprises- Small Mergers Not Subject to Review and Approval • SMALL MERGERS SUBJECT TO NOTIFICATION • No effect on market unless mergers cause AAEC Anti-Competitive merger have a lasting and permanent change than anticompetitive agreements Horizontal Mergers may have an intent of reducing direct competitors and, hence, competition Price Increase- Increased market power may result in price increase of product or services. Before Merger Control was applicable in U.S. U.S. Standard Oil Co. sought to restrict competition by consolidating refineries throughout the U.S. Into a mammoth enterprise. Prosecuted and divided into several distinct companies in 1911. Competitors provide competitive restraint. Horizontal merger leads to elimination of competitors and concentration of market power in a few hands Deustche Borse/NYSE Euronext- Within the exchange traded derivative market, the of the two major competitors would enjoy 90% market share. Declared incompatible. Primary fear is that where the vertically integrated entity has market power, it may foreclose the market or a source of supply to its competitors. GE/Honeywell- Vertical foreclosure concerns arose since- among others- Honeywell was the sole supplier to Rolls Royce Multi-National Mergers can bring efficiencies and investment in an economy Global mergers will also bring in new technologies to an economy Multi-National mergers can also take away profits to a foreign country Ownership of the acquired enterprise will flow out of the country Perceived National Symbols may be considered as valuable by foreign owners KK SHARMA LAW OFFICES, NEW DELHI CONTACT +91-11-26491137 E: globalhq@kkslawoffices.com kksharma@kkslawffices.com