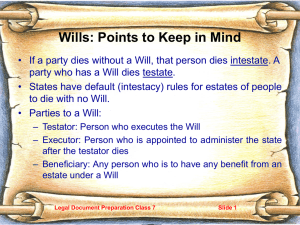

I. Introduction A. Terminology 1. Descentintestate entitlement of heirs at law (realty)

advertisement