ROMANIA WEEKLY UPDATE The World Bank Office, Romania

advertisement

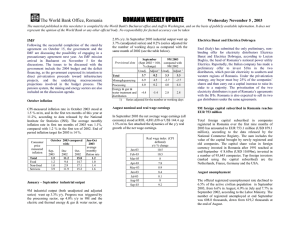

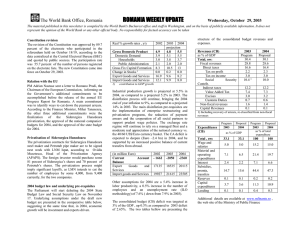

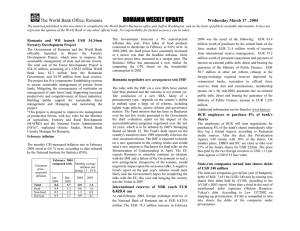

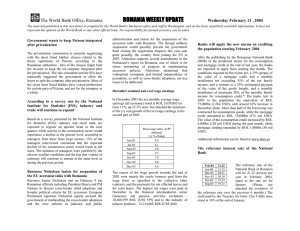

The World Bank Office, Romania ROMANIA WEEKLY UPDATE Wednesday January 19 , 2004 The material published in this newsletter is compiled by the World Bank's Bucharest office and staff in Washington, and on the basis of publicly available information. It does not represent the opinion of the World Bank or any other official body. No responsibility for factual accuracy can be taken October balance of payments and NBR reserves Romania's current account deficit widened to EUR 2,108 mn in the first ten months of 2003, up by 74.2% over the same period of 2002. The trade deficit (goods only, in fob terms) went up by 35.7%, to EUR 2,965mn. On the financing side, FDI went up 23.2% in 10m of 2003. 10m 10m y/y % 2002 2003 change Current Account, (net, -1210 -2108 74.2 in mn Euros) , o.w: 1 GNFS -2115 -2939 39.0 Goods -2184 -2965 35.7 Income -466 -514 10.3 Current transfers 1371 1345 -1.9 Capital & Financial 1507 2365 Account, ow: Foreign direct 880 1084 23.2 investment (FDI) Net errors and -297 -257 omissions 1) Goods and Non Financial Services Medium- and long-term external debt stood at EUR 15,542mn at end-October 2003. Public and publicly guaranteed external debt represented 64.2% (up from 62.8% at end-2002). At end-December 2003, foreign exchange reserves of the National Bank stood at EUR 6,399.3mn, down by EUR 228mn over the previous month. In terms of months of GNFS imports, the liquid foreign reserves slightly dropped to 3.5, down from 3.7 at the end of November and 3.6 at the end of last year, according to public sources. Additional information can be found at www.bnro.ro 2003 FDI estimates ARIS, the Romanian Foreign Investment Agency, estimates that FDI might have increased by 30-40% in 2003 to reach US$ 1.5bn, or 2.6% of the 2003 projected GDP . The optimism of ARIS relies on the data reported at end Oct-2003, which indicate a 23.2% increase of FDI y/y in Euro terms. The ARIS projection does not included the BCR privatization proceeds (estimated at US$ 222mn) which would be received in January 2004, after the signing of the privatization documents with IFC and EBRD, nor the proceeds to be yielded by the energy sector privatization deals, which are estimated at some US$ 0.5bn for Petrom and a similar amount for the electricity and natural gas retailers. Privatization proceeds worth US$ 300mn in 2003 In 2003, the Authority for Privatization and Management of State Shareholdings (APAPS) signed sale-purchase contracts for 309 companies, with a combined share capital worth some 14,000 bn ROL (US$ 300mn). Out of the privatized companies, 51 were large and very large, with a precarious financial and economic situation, and 258 were small and medium-sized companies. NBR adjusts the currency basket The National Bank of Romania (NBR) has decided to raise the weight of the Euro in the currency basket used to monitor the ROL depreciation from 60% to 75%, to better reflect the country's foreign trade orientation toward the EU. Privatization of Petrom, Distrigaz, Electrica Banat and Electrica Dobrogea might be delayed The deadlines for the privatization of Petrom oil company and the two natural gas retailers, Distrigaz Sud and Distrigaz Nord, might be slightly delayed, according to the Romanian media, primarily due to unclear ownership rights over some of the assets of the companies, uncovered in the process of due diligence. * Letters of interest for Distrigaz Sud and Distrigaz Nord, the natural gas distributors, have been submitted by Gazprom of Russia, Gaz de France, Ruhrgas of Germany, Enel of Italy and Wintershall of Germany. * A slippage of the deadline was also indicated for the privatization of electricity distributors Electrica Banat and Electrica Dobrogea, initially planned to be sold by the end of last year. November nominal and real wage earnings In November 2003 the net monthly average wage earnings (all economy) stood at ROL 5,037,861 (or Euro 126), up 1.6% m/m. See attached the dynamics of the y/y real growth of the net wage earnings. Jun-03 Jul-03 Aug-03 Sep-03 Oct-03 Nov-03 Real wage index (CPI deflated) y/y % change 8.4 8.1 8.0 9.2 7.9 9.0 Note: The data for October in our previous Newsletter have been corrected from 9.1% to 7.9%, according to NIS data. The reference interest rate of the National Bank The reference rate of the National Bank of Romania will be 21.25 percent per year in January 2004. (Please see attached the evolution of the reference rate over the previous 4 months.) The yield paid by the Treasury for latest 12m Tbills issue stood at 17.9% at the end of December. Jan-04 Dec-03 Nov-03 Oct-03 Sep-03 21.25 20.41 20.19 19.25 19.11 2003 yearend inflation The preliminary monthly inflation for December 2003 was announced at 1.2%, bringing the yearend CPI inflation at some 14.1%, exceeding only marginally the 14% official target. For 2004 the central bank announced a 9% target for the yearend inflation.