公司理財研討 MA0A0204王詩婷 MA0A0205許睿烜 497A0009 陳欣妤

advertisement

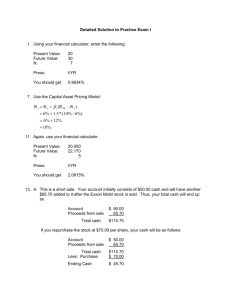

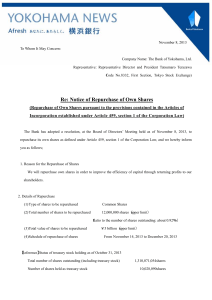

公司理財研討 MA0A0204王詩婷 MA0A0205許睿烜 497A0009 陳欣妤 Traditional Pecking Order 傳統的融資順位 The traditional pecking-order theory predicts that investors’ concerns about being informationally disadvantaged relative to managers will lead managers to prefer internal equity to debt financing, and debt financing to external equity financing. 傳統的融資順位理論預測是指投資者擔心資訊若對 管理人員產生不利時將會導致管理人員傾向於內部 權益的債務融資,和外部權益的債務融資。 Notably, when large firms engage in substantial investments, they tend to rely on debt financing. However, they do not appear to exhaust their cash reserves before undertaking debt. Therefore, managers do not behave in strict accordance with the predictions of pecking-order theory. 特別是,當大型企業從事巨額投資時他們往往會 依賴於債務融資。然而,在承擔債務之前,他們 似乎並未耗盡他們的現金準備金。因此經理人的 行為應嚴格遵照融資順位理論預測。 The FEI survey reports little support for the asymmetric-information basis underlying traditional pecking-order theory. To be sure, CFOs are reluctant to issue equity when they believe that their firms’ stocks are undervalued. FEI調查報告顯示在資訊不對稱的基礎上,傳統的 融資順位理論大多不支持。可以肯定的是,CFO 認為當公司的股價被低估時就不願意發行股票。 6.3 BEHAVIORAL APV 行為APV The behavioral approach to capital structure involves the same general framework as the traditional approach but incorporates the impact of biases. In the traditional approach, managers make financing and investment decisions by maximizing adjusted present value (APV), the sum of net present value (NPV) and the value of associated financing side effects. 資本結構的行為方式包括傳統方法的一般框架但包 含偏差的影響。在傳統的方法,管理者制定融資與 投資決策是按調整現值最大化(APV),淨現值的總額 (NPV) 及相關的融資副作用的價值。 Traditional financing side effects include tax shields and the flotation costs associated. However, financing side effects can also include terms that reflect perceived market mispricing. 傳統的融資副作用包括稅盾和相關發行成本。 然而,融資副作用也可能包括市場定價錯誤。 Perception of Overvalued Equity: New Issues 對股權高估的看法:新發行 The first chief executive of the biotechnology firm Amgen quipped that managers should issue new equity whenever markets are receptive, whether or not they need to finance projects at the time. Hypothetically, suppose that Amgen could issue $1 billion worth of stock, with flotation costs amounting to $30 million. 生物技術公司Amgen的執行長諷刺說,融資方案 無論是否需要時間,只要市場願意接受,管理人員 就應該發行新的股權。可以想像,假設Amgen公 司可能發行價值10億美元的股票,則發行成本總額 為三千萬美元。 Suppose that it has no projects to fund at the time, but judges that the intrinsic value of the equity is only $750 million. In this case, the APV associated with the new issue would be $220 million (=$1 billion - $750 million - $30 million). 假設對這項方案沒有提供資金,而股權的內在價值 只有7.5億美元。在這種情況下,APV與新發行將 會是2.2億美元(=10億-7.5億-3000萬)。 Perception of Undervalued Equity: Repurchases 對股權低估的看法:回購 Financial executives who perceive the equity of their firms to be underpriced can repurchase shares. For example, imagine that Amgen’s market value is underpriced by 25 percent. Then if Amgen spends $1 billion in cash to repurchase shares, it receives $1.25 billion in value. The APV associated with the decision is $250 million and represents a wealth transfer from shareholders who tender their shares to shareholders who retain their shares. 財務主管認為公司被低估的股權可以再買回。例如, 想像一下,Amgen公司的市價被低估了25%。然後如 果Amgen公司花費10億美元的現金回購股票,則 它接收的價值是12.5億美元。與APV有關聯的決策是 $ 2.5億美元表示財富移轉是來自股東,股東提供他們 自己的股票也保留自己的股份。 The results from the FEI survey indicate that 75 percent of firms make the decision about repurchase policy after having determined their investment plans. Many financial executives are willing to reduce repurchases in order to fund new projects. Moreover, only about 25 percent believe that there are negative consequences attached to a reduction in repurchase activity. 從FEI調查結果指出有75%的企業做出回購政策的 決定後在去確定自己的投資計劃。許多財務主管 也都願意為新的方案提供資金而減少回購。此外, 大約只有25%的受訪者認為在回購行動中,會減 少負面後果。 In the traditional approach, market timing is not a traditional factor underlying the decision either to issue or repurchase shares. In practice financial executives come to learn that market timing is an important consideration in their decisions about capital structure. 在傳統的方法,市場時機在決定發行或者回購 股票是不是一個傳統因素。在實施資本結構決 策時,財務主管來學習市場時機是一個重要的 考慮因素。 Underraction 反應不足 In some instances, managers actually announce that they are repurchasing shares because they believe that their firms are undervalued. The evidence supports the idea that managers who repurchase shares are sending the market a clear signal. The average market response to the announcement of an open market repurchase is 3.5 percent. 在某些情況下,實際上經理人相信他們的公司被 低估,經理人宣佈購回股票。市場證據指出,購 回股票的經理人帶來一個明確的訊息。公開市場 宣布購回平均為3.5%。 Notably, investors appear to underreact to repurchases, in that stock prices drift upward when firms repurchase shares. This drift effect comprises the flip side to the drift effect associated with new issues. (As was mentioned in Chapter 5, the market appears slow to adjust to new issues: The stocks of firms with new issues underperform for several years after the offering.) 值得注意的是,當公司購回股份,該股票價格向上飄移 時,投資者在購回時反應不足。這種飄移效應,包括漂 移效應與另一面新問題。 (正如在第五章中提到的,市場將出現緩慢調整新的問 題:公司發行股票幾年後,低於市場表現的新問題。) As to long-run performance, the stocks of firms who repurchase and have high book-to-market equity earn abnormal returns of 45.3 percent over four years. When averaged over all firms, the average abnormal return after the initial announcement is 12.1 percent. 至於長期的表現,公司的股票購回,四年並有高 的帳面價值與市價比,多賺取45.3%的異常報酬。 當所有企業平均,最初發佈的平均異常報酬率是 12.1%。 Behavioral Pitfalls 行為陷阱 In 2003, the firm AutoNation was the largest seller of used and new cars in the United States. In June 2003 AutoNation held more than $200 million in cash. Its CFO at the time was Craig Monaghan. 在2003年,該公司AutoNation為美國最大的新 車賣方。在2003年6月AutoNation的發行超過20 億美元。當時的首席財務長Craig Monaghan。 Suppose that Monaghan correctly judged that AutoNation’s stock was undervalued. What action could Monaghan take to exploit this situation, buy low or sell high? In this case, he would buy low, meaning that AutoNation would engage in a share repurchase. 假設Monaghan判斷正確,AutoNation的股票被 低估。Monaghan在這種情況下能採取什麼行動, 買低賣高嗎?在這種情況下,他會買低,這意味 著,AutoNation的從事股票購回。 Although AutoNation could use some of its cash to repurchase shares, should it? The answer depends on the opportunity cost of that cash. At issue is how else that cash could be spent. What projects might not get funded if AutoNation uses cash to repurchase shares? 雖然AutoNation可能使用部分現金來購回股票, 應該嗎?答案取決於這些現金的機會成本。目 前的問題是怎麼使用這些現金。AutoNation如 果使用現金購回股票,哪些專案計畫可能得不 到資金? Between January 2002 and June 2003, AutoNation implemented an $836 million stock repurchase program and repurchase 20 percent of its out standing shares. Notably the firm makes its decisions about repurchasing shares in conjunction with its operational goal of earning a 15 percent return on its investments. In this respect, the repurchasing decision to exploit market mispricing is treated like an investment project in respect to opportunity costs. 在2002 年 1 月到 2003 年 6 月,AutoNation實現 83.6億美元股票購回計劃和購回20%的流通在外股數。 值得注意的是,該公司一併回購股票的決定,其營運 目標為賺15%的投資收益。在這方面,購回的決定為 市場的錯誤定價,像投資計畫的機會成本。 Craig Monaghan states that when he was in business school, he learned the traditional approach to capital structure and capital budgeting. Notably, the traditional approach is premised on market efficiency. However, in practice Monaghan bases his capital structure decisions on market timing, as he describes here: Craig Monaghan指出,當他在商業學校的時候,他 學到了傳統的資本結構和資本預算的方法。值得注 意的是,市場效率的前提是傳統的做法。然而,在 實際上,Monagha資本結構決定是立足於市場的時 間,他的描述: Right now we can move from acquisitions to share repurchases to spending on infrastructure. So if we see an opportunity to spend $100 million on an auto dealership, we can do it. Or we can do a stock buyback if the stock goes down… 現在,我們可以從股票購回變成基本的建設支 出。因此,如果我們有一個機會,我們可以做 到這一點,在汽車經銷商投資10億美元。或 者假設股價下跌,我們可以做一個購回股票... My professors at Wharton will tell you that a stock buyback is a wash. But when companies buy back their stock, they are sending a message loud and clear that management and the board have a strong belief that the company has more value and a brighter future than the market is recognizing… 我在Wharton商學院的教授會告訴你,股票購回是 虛購。但是,當公司回購自己的股票,管理層和 董事會有一個堅定的信念,經理人發送響亮而明 確的消息,公司擁有比市場認知到更多的價值和 美好的未來... 6.4 FINANCIAL FLEXIBILITY AND PROJECT HURDLE RATES 財務彈性和計劃必要報酬率 Undervalued Equity: Cash-Poor Firms Reject Some Positive NPV Projects 低估股票:缺乏現金的公司拒絕正向的NPV計劃 Suppose that AutoNation had a project whose NPV managers perceived to be $100 million. Imagine that undertaking the project required that AutoNation raise external financing in the amount $150 million at a time when its managers perceived the market value of their equity to be one-third of the intrinsic value of their equity. 假設AutoNation(全美汽車租賃公司)有一個計劃,其NPV 經理認為是1億美元。想像該企業此計劃是必須的,當經 理認為其股票市場價值是其股票內在價值的三分之一,因 此AutoNation提高外部融資總額為1.5億美元。 Suppose further that AutoNation had no debt capacity and almost no cash. In this case, AntoNation's managers would perceive the intrinsic value of a $150 million equity issue to be $450 million, thereby resulting in a $300 million wealth transfer from old shareholders to new shareholders($300=$450-$150). 進一步地假設,AutoNation沒有負債能力和幾乎沒有現金。 在這種情況下,AutoNation經理認為其內在價值為1.5億美 元的股票發行4.5億美元,因此導致3億美元從舊股東轉移 到新股東($300=$450-$150)。 According to the FEI survey, the top factor that financial executives consider in their decision to issue new equity is dilution. In this example, the $300 million dilution cost outweighs the NPV of $100 million, leading the net effect on APV to be -$200 million. As a result, the managers of cash-poor AutoNation would be wise to avoid issuing equity and to reject the project. 根據FEI(國際財務執行官)調查顯示,財務主管考慮在他們決 定發行新股票的主要因素是稀釋。在這個例子中,這3億美元 稀釋成本超過NPV的1億美元,導致APV的淨效果為-2億美元。 因此,缺乏現金以避免發行股票並拒絕該計劃,AutoNation經 理是明智的。 Undervalued Equity for Cash-Limited Firms: Invest or Repurchase? 現金有限的公司低估股票:投資或購回? According to the FEI survey, the top factor that financial executives consider in their decisions about debt is financial flexibility. Inadequate financial flexibility means that the firm's managers might have to make their decisions about capital structure and investment jointly instead of separately. 根據FEI調查顯示,財務主管考慮決定關於債務的主要因素是 財務彈性。不適當的財務彈性是指公司的經理可能使他們的 決定關於資本結構和投資是一起的,不是單獨的。 Just as the traditional approach adjusts project hurdle rates using an after-tax weighted average cost of capital to reflect tax shields, the behavioral approach adjusts hurdle rates to reflect mispricing. 正如傳統方法調整項目的必要報酬率,使用稅後加權平均資 本成本來反映稅盾,行為方式調整必要報酬率以反映錯誤定 價。 In the traditional approach, a firm like AutoNation computes the NPV of its average project by discounting future expected cash flows at its cost of capital. If AutoNation's cost of capital is 15 percent, then it uses a hurdle rate of 15 percent to compute the NPV component of APV. 在傳統方法中,如AutoNation公司其NPV是以未來預期現金 流量的資金成本為貼現率折現。如果AutoNation資本成本為 15%,然後它的必要報酬率為15%去計算NPV中的APV。 As long as the firm has adequate cash or access to external capital markets, it can finance all projects that feature nonnegative perceived APV and can draw on cash holdings or debt capacity to repurchase shares. 只要公司有足夠的現金或獲得外部資本市場,它可以資金支 援所有計劃,認為非負數的APV和推斷出持有現金或債務能 力以購回股票。 A firm with limited cash and debt capacity might have to choose between repurchasing shares and financing investment projects. In this situation, managers should view a share repurchase as akin to an investment project. 有限的現金和債務能力公司可能會在購回股票和融資的投資計 劃兩者之間做選擇。在這種情況下,經理人應該查看購回股票 相似的投資計劃。 Suppose that AutoNation had limited cash, had no debt capacity, and is undervalued in the market. How would its managers choose between using the firm's cash to repurchase shares and using the firm's cash to finance a new project? The answer is that they base their choice on APV. 假設AutoNation有限的現金、沒有債務能力和在市場被低估。 管理者會如何選擇使用公司現金購回股票和利用公司現金投 資一個新的計劃呢?答案是他們會根據APV去做選擇。 Consider an example. Imagine that the firm's shares are undervalued by 25 percent. Suppose that the project requires an initial investment of $500 million and has an NPV of $100 million. Which decision would create more value for investors, spending $500 million to repurchase shares or spending $500 million to fund the project? 考慮例子。試想一下,公司股票被低估25%。假設該計劃 需要最初股資為5億美元和NPV為1億美元。這個決定會為 投資者創造更多的價值,花費5億美元以購回股票或花5億 美元投資計劃? The value received from the share repurchase is $625 million (=1.25 × $500 million), whereas the value received from the investment project is $600 million(=$500million+ $100million). Transaction costs aside, repurchasing creates more value. 從股票購回獲得的價值是6.25億美元(=1.25 × $5億美元), 而從股資計劃獲得的價值為6億美元(=$5億美元+$1億美元)。 除了交易成本,購回創造更多的價值。 The point of this example is that repurchasing increases the opportunity cost of the firm's investment projects. Two key variables determine the appropriate adjustment to project hurdle rate: the firm's financing constraints and the impact of the firm's repurchase activity on the price of its shares. 重點是這個例子是購回增加了公司投資計劃的機會成本。兩 個關鍵變量決定適當的調整項目的障礙率:該公司的融資約 束和公司購回活動其股票價格的影響。 suppose a firm has enough debt capacity to fund half the project with debt and uses its cash to fund the other half. In this case, the project will have a lower hurdle rate than if it is entirely financed with cash. 假設該公司有足夠的債務能力以資助債務計劃的一半和使 用其現金以資助其另一半。在這種情況下,該計劃如果它 是完全用現金融資將會有較低的必要報酬率。 Second, suppose that the firm's repurchasing activities cause its share price to rise dramatically. In this case, its managers might engage in limited repurchase activity, even if they only had mediocre projects available. Hence, the associated hurdle rate would be lower than if the repurchase activity had a lower impact on the market price. 第二,假設公司購回活動導致其股票大幅上升。在這種情 況下,經理人可能會從事有限的購回活動,即使他們只有 中等的計劃可利用。因此,必要報酬率將低於購回活動中 市場價格有較低的影響。