Antonio Guerrero (安東尼) MA0N0245

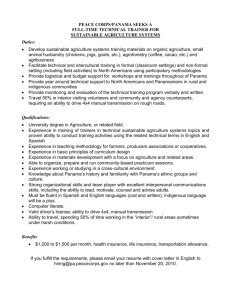

advertisement

Antonio Guerrero (安東尼) MA0N0245 Panama Stock Market General Structure The Panama Stock Exchange is the first organized market for public trading of securities in the Republic of Panama. As such, the Stock Exchange is a self-regulating securities market organization, authorized and supervised by the National Securities Commission of Panama (CNV). The stock exchange members, who each hold a Stock Exchange Seat, are corporations engaged in stock market operations as Brokerage houses. Each is duly authorized by the CNV, and hence subject to its regulation and oversight. In addition, the members that operate a Stock Exchange Seat have to be duly authorized by the BVP and agree to observe its rules as a self regulatory organization. Shareholders The Panama Stock Exchange is a publicly held corporation whose shares are traded on the BVP itself. In its character as an issuer, the BVP is subject to the same rules and regulations regarding disclosure, dissemination and the updating of relevant financial and corporate information due investors and shareholders as mandated by the CNV and the Stock Exchange itself. The BVP as a corporation that concentrates ultimate operational control in its shareholders, acting in the General Shareholders Meeting. At 31 December 2004 the BVP had 60 registered shareholders. Seatholders at the BVP held 43% of the shares of the BVP. The National Stock Products (Baisa), and the Panama Stock Exchange (BVP), are the two brokerage firms in the country. The first started to negotiate tariff quotas agreed by Panama and the World Trade Organization (WTO) in 1997 and agreed on the Free Trade Agreement (FTA) signed by the country in recent years. Cochez and Company, profits increased 60%. Cochez, currently has over 80 years in the market for building materials, finishes and hardware store in Panama. The company has a network of 16 branches throughout the country, has launched an aggressive expansion program and currently is building two branches. The most important market Cochez focuses on the capital, which represents 70% of its sales, the remaining 30% is generated by branches within the country and none of its customers generates more than 1% of sales. Its main competitors include companies in the group Comasa Melo, Doit Center, House Goli and Novey, although the latter since 1984 is under the administrative control of Cochez. By June 30 2011, the Company common shares Held 8.000 Issued and outstanding, Whose book value is $ 800,000, an Accumulated Surplus of $ 3.8 billion and earnings taxes amounted to $ 3.5 million. As for the results of operations, sales increased $ 8.5 million, compared to June 2010, from $ 68,800,000 to $ 77,300,000, reflecting a growth of 12%. The cost of sales, meanwhile, increased $ 6.9 million, up 12% compared to 2010, reaching $ 61.5 million. The operation of the company was favored by more than 100% in the other income line, which increased $ 2.3 million, primarily for services provided to related companies. Expenses Total operating expenses grew 19% from $ 12.9 million in June 2010 to $ 15.3 million to June this year. The operating efficiency of the company (general and administrative expenses from gross profit) was 0.97, while for June 2010 was 0.91. For 2011 the company expects that operations have a variation range between 10% and 15%. Regarding current assets loa, these showed an increase of $ 3.7 million, from $ 30.4 million on December 31, 2010 to $ 34.2 million to June this year thanks to the line of receivables, which rose $ 3, 9 million. Overall, total assets rose by $ 9.2 million, from $ 75 million to $ 84.2 million, primarily due to an increase of $ 2.5 million in inter-company accounts and $ 2.8 million in property, improvements , rolling equipment and furniture and equipment. Current liabilities remained unchanged, standing at $ 20.9 million. However, total liabilities recorded a final increase of $ 6 million due to the account payable to shareholders, which increased $ 5.8 million in the period of analysis. For capital, increased from $ 3.2 million in equity, which rose from $ 1.4 million to $ 4.6 million due to retained earnings, which rose from $ 618,032 to $ 3.8.