Chapter 12 – Single Investment Risk Analysis

advertisement

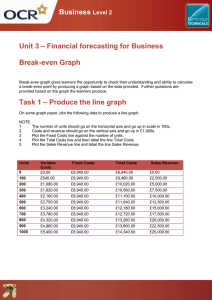

Chapter 12 – Single Investment Risk Analysis Reasons for looking at risk from a single project prospective lack comprehensive knowledge of the rest of the firm of other projects - since they arrive one at a time evaluation may be based on success/ failure of the project may be helpful in finding ways to reduce the risk of the project basis for understanding contribution to company and shareholder risk Sensitivity Analysis What can go wrong -- important variable Run what-ifs allowing the variables to change -for example break-even Look at possible outcomes Does not require assigning probabilities to variables Sensitivity Analysis One typical sensitivity analysis is the earnings break-even point. In this you typically allow sales to vary until you identify the minimum level of sales necessary to earn a profit of zero (break-even). Other variables such as net operating income can be used. Sensitivity Analysis Another more advanced and useful sensitivity analysis is the net present value break-even point. Allow sales to vary the first year and grow at different rates over time until you identify the minimum level of sales and growth rate necessary to earn a net present value of zero (break-even). Other variables such as interest rates, and expenses can be varied to generated meaningful sensitivity numbers for management. Methods Based on Probability Simulation Simple Simulation Build a model and change the important variables Monte Carlo Simulation Build model, assign probabilities, and let the computer generate the output from the probabilities Disadvantages include expense, difficulty in separating out nondiversifiable risk, lack of a clear decision rule Methods Based on Probability Decision Trees Useful in identifying embedded options Closer to reality in that there is significant correlation between the beginning years and later years Parallels nicely with strategic planning Methods Based on Probability Developing Probability Estimates History Experiments Test markets Pilot production facilities Judgment of knowledgeable people Managing Risk Trading variable for fixed costs Make inside -- high fixed cost Buy outside -- high variable cost Measure with the net present value breakeven Good to find the crossover point in sales where one is favored over the other Managing Risk Pricing Strategy Lower price -- increased demand -- higher break-even Might pick off the innovator customers first with a higher price and reduce as competition enters Might reduce price before competition enters -contestable market theory in economics Simulation and sensitivity analysis are useful in conjunction with a net present value break-even Target costing goes along with this Managing Risk Other methods Sequential investing More analysis -- Extent of the Analysis Cost in time and money -- Cost < Benefit rule applies Financial Leverage Others to assume the risk -- Covered later in financing section Trading fixed financing cost for variable Diversification Project Selection Under Risk Judgement Required return adjustment Certainty equivalents Payback period requirement Risk Analysis of International Investments Project risk Same process as for domestic projects except that more sources of uncertainty are involved Projects may not correlate between countries due to different economies -- Chapter 13 Political risk Dependent on the country Can be measured or estimated Exchange rate risk Value of the cash flows back to the parent company