Person-to-Person Financing for Development: Governing the Intermediaries Kevin E. Davis

advertisement

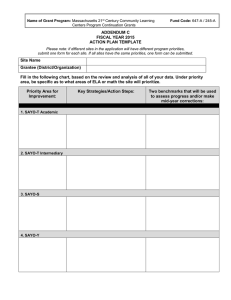

Person-to-Person Financing for Development: Governing the Intermediaries Kevin E. Davis NYU School of Law Anna Gelpern American University Washington College of Law The Privatization of Development Assistance NYU School of Law December 4-5, 2009 Alternative business models - Charity Funder Home country Intermediary Host country Intermediary Recipient - Charity for social enterprise Funder Home country Intermediary Host country firm – Investment funds Funder Home country Intermediary Host country Intermediary Recipient Funder Home country Intermediary Host country Intermediary Recipient Screen shot Funder Home country Intermediary Host country Intermediary Recipient The future Funder Home country Intermediary Host country Intermediary Bank? Mutual fund? Recipient Potential problems Credit risk Funder Home country Intermediary Host country Intermediary Recipient Potential problems Credit risk Funder Home country Intermediary Currency risk Host country Intermediary Recipient Potential problems Credit risk Funder Home country Intermediary Host country Intermediary Recipient Regulatory concerns: Currency risk •Uninformed funders •Uninformed recipients •Home country foreign policy interests •Host country institutional development •Host country development •Systemic risk Existing regulatory framework Regulation of charities Must be nonprofits Must be organized under US law. Restrictions on non-charitable activities and on risky investments* *Not applicable to “program-related investments.” Administered by IRS and state attorneys general Regulation of financial institutions For investment companies: Disclosure, semi-annual reporting, conflict of interest regulation For banks: Chartering rules, activities restrictions, minimum capital requirements, supervision, and deposit insurance Robust cross-border co-operation Private ordering Examples: CGAP Microfinance Consensus Guidelines: Good Practice Guidelines for Funders of Microfinance CGAP Microfinance Investment Vehicles Disclosure Guidelines for Reporting on Performance Indicators (2007) Recommendations Motivating insights Many of these transactions ought to be regulated like financial products. Regulation of international finance should be integrated. Regulatory framework should accommodate interests of both home states and host states. No single state-sponsored regime will be capable of accommodating diverse needs of parties to these transactions. Specific recommendations 1. Reform charities laws to permit international regulatory competition 2. Apply securities law to all actors that promise financial returns, regardless of charitable status or level of returns. 3. Enhance monitoring. 4. Promote regulation by host states. 5. Promote private ordering as a supplement to legal regulation.