Slide

7-1

Chapter

7

Fraud, Internal

Control, and Cash

Financial Accounting,

Seventh Edition

Slide

7-2

Study Objectives

Slide

7-3

1.

Define fraud and internal control.

2.

Identify the principles of internal control.

3.

Explain the applications of internal control principles to

cash receipts.

4.

Explain the applications of internal control principles to

cash disbursements.

5.

Describe the operation of a petty cash fund.

6.

Indicate the control features of a bank account.

7.

Prepare a bank reconciliation.

8.

Explain the reporting of cash.

Fraud, Internal Control, and Cash

Fraud and

Internal

Control

Fraud

The SarbanesOxley Act

Internal control

Principles of

internal control

activities

Limitations

Slide

7-4

Cash Receipts

Controls

Over-thecounter

receipts

Mail receipts

Cash

Disbursement

Controls

Voucher

system

controls

Petty cash

fund controls

Control

Features: Use

of a Bank

Making

deposits

Writing checks

Bank

statements

Reconciling

the bank

account

Electronic

funds transfer

(EFT) system

Reporting

Cash

Cash

equivalents

Restricted

cash

Compensating

balances

Fraud and Internal Control

Fraud

Dishonest act by an employee that results in personal

benefit to the employee at a cost to the employer.

Illustration 7-1

Why does

fraud occur?

Slide

7-5

SO 1 Define fraud and internal control.

Slide

7-6

Fraud and Internal Control

The Sarbanes-Oxley Act

Companies must

develop principles of control over financial reporting.

continually verify that controls are working.

Independent auditors must attest to the adequacy

of internal control.

SOX created the Public Company Accounting Oversight

Board (PCAOB).

Slide

7-7

SO 1 Define fraud and internal control.

Fraud and Internal Control

Internal Control

Methods and measures adopted to:

1.

Safeguard assets.

2. Enhance accuracy and reliability of accounting

records.

3. Increase efficiency of operations, and

4. Ensure compliance with laws and regulations.

Under the Sarbanes-Oxley Act, all publicly traded U.S. corporations

are required to maintain an adequate system of internal control.

Slide

7-8

SO 1 Define fraud and internal control.

Fraud and Internal Control

Internal Control

Internal control systems have five primary components

1. A control environment

2. Risk assessment

3. Control activities

4. Information and communication

5. Monitoring

Slide

7-9

SO 1 Define fraud and internal control.

Fraud and Internal Control

Principles of Internal Control Activities

Measures vary with

management’s assessment of the risks faced.

size and nature of the company.

Six principles of controls activities:

Slide

7-10

Establishment of responsibility

Segregation of duties

Documentation procedures

Physical controls

Independent internal verification

Human resource controls

SO 2 Identify the principles of internal control.

Fraud and Internal Control

Principles of Internal Control Activities

ESTABLISHMENT OF RESPONSIBILITY

Control is most effective when only one person is responsible

for a given task.

SEGREGATON OF DUTIES

Related duties, including physical custody and record

keeping, should be assigned to different individuals.

DOCUMENTATION PROCEDURES

Companies should use prenumbered documents for all

documents should be accounted for.

Slide

7-11

SO 2 Identify the principles of internal control.

Fraud and Internal Control

Slide

7-12

SO 2

Fraud and Internal Control

Slide

7-13

SO 2 Identify the principles of internal control.

Fraud and Internal Control

Slide

7-14

SO 2

Fraud and Internal Control

Principles of Internal Control Activities

PHYSICAL CONTROLS

Slide

7-15

Illustration 7-2

SO 2 Identify the principles of internal control.

Fraud and Internal Control

Principles of Internal Control Activities

INDEPENDENT INTERNAL

VERIFICATION

Illustration 7-3

1. Verify records

periodically or on a

surprise basis.

2. Records verified by an

employee who is

independent.

3. Discrepancies reported

to management.

Slide

7-16

SO 2 Identify the principles of internal control.

Fraud and Internal Control

Principles of Internal Control Activities

HUMAN RESOURCE CONTROLS

1. Bond employees.

2. Rotate employees’ duties

and require vacations.

3. Conduct background checks.

Slide

7-17

SO 2 Identify the principles of internal control.

Fraud

and

Internal

Control

Slide

7-18

SO 2

Fraud and Internal Control

Slide

7-19

SO 2

Fraud and Internal Control

Slide

7-20

SO 2

Slide

7-21

Fraud and Internal Control

Limitations of Internal Control

Costs should not exceed benefit.

Human element.

Size of the business.

Slide

7-22

SO 2 Identify the principles of internal control.

Cash Receipts Controls

Over-the-Counter Receipts

Slide

7-23

Illustration 7-4

Establishment of

Responsibility

Only designated

personnel are

authorized to handle

cash receipts

(cashiers)

Documentation

Procedures

Use remittance

advice (mail

receipts), cash

register tapes, and

deposit slips

Independent Internal

Verification

Supervisors count cash

receipts daily;

treasurer compares

total receipts to bank

deposits daily

Segregation of Duties

Different individuals

receive cash, record

cash receipts, and hold

the cash

Physical Controls

Store cash in safes

and bank vaults; limit

access to storage

areas; use cash

registers

Human Resource

Controls

Bond personnel who

handle cash; require

employees to take

vacations; deposit all

cash in bank daily

SO 3 Explain the applications of internal control principles to cash receipts.

Cash Receipts Controls

Cash consists of coins, currency, checks, money orders,

and money on hand or on deposit in a bank.

Cash receipts come from:

cash sales

collections on account from customers

receipt of interest, rent, and dividends

investments by owners

bank loans

proceeds from the sale of noncurrent assets

Slide

7-24

SO 3 Explain the applications of internal control principles to cash receipts.

Over-theCounter

Receipts

Illustration 7-5

Slide

7-25

SO 3 Explain the applications of internal control principles to cash receipts.

Cash Receipts Controls

Mail Receipts

Mail receipts should be opened by two people, a list

prepared, and each check endorsed.

Copy of the list, along with the checks and remittance

advices, sent to cashier’s department.

Cashier adds the checks to the over-the-counter

receipts and prepares a daily cash summary and makes

the daily bank deposit.

Copy of list sent to treasurer’s office for comparison

with total shown on daily cash summary.

Slide

7-26

SO 3 Explain the applications of internal control principles to cash receipts.

Cash Receipts Controls

Review Question

Permitting only designated personnel to handle cash

receipts is an application of the principle of:

a. segregation of duties.

b. establishment of responsibility.

c. independent check.

d. Human resource controls.

Slide

7-27

SO 3 Explain the applications of internal control principles to cash receipts.

Cash Disbursement Controls

Generally, internal control over cash disbursements

is more effective when companies pay by check,

rather than by cash.

Applications:

Voucher system

Petty cash fund

Slide

7-28

SO 4 Explain the applications of internal

control principles to cash disbursements.

Cash Disbursement Controls

Illustration 7-6

Establishment of

Responsibility

Only designated

personnel are

authorized to sign

checks (treasurer) and

approve vendors

Segregation of Duties

Different individuals

approve and make

payments; check

signers do not record

disbursements

Slide

7-29

Documentation

Procedures

Use prenumbered

checks; checks must

have an approved

invoice; require

employees to use

corporate credit cards

for reimbursable

expenses

Physical Controls

Store blank checks in

safes, with limited

access; print check

amounts by machine in

indelible ink

Independent Internal

Verification

Compare checks to

invoices; reconcile bank

statement monthly

Human Resource

Controls

Bond personnel

who handle cash;

require employees

to take vacations;

conduct background

checks

Cash Disbursement Controls

Review Question

The use of prenumbered checks in disbursing cash is

an application of the principle of:

a. establishment of responsibility.

b. segregation of duties.

c. physical, mechanical, and electronic controls.

d. documentation procedures.

Slide

7-30

SO 4 Explain the applications of internal

control principles to cash disbursements.

Cash Disbursement Controls

Voucher System Controls

Voucher System

Network of approvals, by authorized

individuals, to ensure all disbursements by

check are proper.

A voucher is an authorization form prepared

for each expenditure.

Slide

7-31

SO 4 Explain the applications of internal

control principles to cash disbursements.

Cash Disbursement Controls

Petty Cash Fund Controls

Petty Cash Fund - Used to pay small amounts.

Involves:

1. establishing the fund,

2. making payments from the fund, and

3. replenishing the fund.

Slide

7-32

SO 5 Describe the operation of a petty cash fund.

Cash Disbursement Controls

Illustration: If Laird Company decides to establish a $100

fund on March 1, the journal entry is:

Mar. 1

Petty cash

Cash

Slide

7-33

100

100

SO 5 Describe the operation of a petty cash fund.

Cash Disbursement Controls

Illustration: Assume that on March 15 Laird’s petty cash

custodian requests a check for $87. The fund contains $13

cash and petty cash receipts for postage $44, freight-out $38,

and miscellaneous expenses $5. The general journal entry to

record the check is:

Mar. 15

Postage expense

44

Freight-out

38

Miscellaneous expense

Cash

Slide

7-34

5

87

SO 5 Describe the operation of a petty cash fund.

Cash Disbursement Controls

Illustration: Occasionally, the company may need to recognize

a cash shortage or overage. Assume that Laird’s petty cash

custodian has only $12 in cash in the fund plus the receipts as

listed. The request for reimbursement would, therefore, be for

$88, and Laird would make the following entry:

Mar. 15

Postage expense

44

Freight-out

38

Miscellaneous expense

5

Cash over and short

1

Cash

Slide

7-35

88

SO 5 Describe the operation of a petty cash fund.

Control Features: Use of a Bank

Contributes to good internal control over cash.

Minimizes the amount of currency on hand.

Creates a double record of bank transactions.

Bank reconciliation.

Slide

7-36

SO 6 Indicate the control features of a bank account.

Control Features: Use of a Bank

Making Bank Deposits

Authorized employee

should make deposit.

Front Side

Slide

7-37

Illustration 7-8

Bank Code

Numbers

Reverse Side

SO 6 Indicate the control features of a bank account.

Control Features: Use of a Bank

Writing Checks

Written order signed by depositor directing bank to pay

a specified sum of money to a designated recipient.

Illustration 7-9

Maker

Payee

Payer

Slide

7-38

SO 6 Indicate the control features of a bank account.

Control Features: Use of a Bank

Bank Statements

Illustration 7-10

Debit Memorandum

Bank service charge

NSF (not sufficient

funds)

Credit Memorandum

Collect notes

receivable.

Interest earned.

Slide

7-39

SO 6 Indicate the control features of a bank account.

Control Features: Use of a Bank

Review Question

The control features of a bank account do not include:

a. having bank auditors verify the correctness of the

bank balance per books.

b. minimizing the amount of cash that must be kept on

hand.

c. providing a double record of all bank transactions.

d. safeguarding cash by using a bank as a depository.

Slide

7-40

SO 6 Indicate the control features of a bank account.

Control Features: Use of a Bank

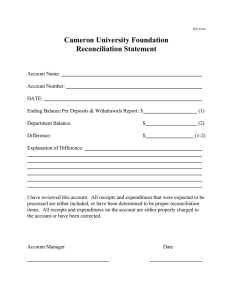

Reconciling the Bank Account

Reconcile balance per books and balance per bank to

their adjusted (corrected) cash balances.

Reconciling Items:

1. Deposits in transit.

2. Outstanding checks.

3. Errors.

4. Bank memoranda.

Slide

7-41

SO 7 Prepare a bank reconciliation.

Control Features: Use of a Bank

Reconciliation Procedures

Illustration 7-11

+ Deposit in Transit

+ Notes collected by bank

-

-

NSF (bounced) checks

-

Check printing or other

service charges

Outstanding Checks

+- Bank Errors

+- Company Errors

CORRECT BALANCE

Slide

7-42

CORRECT BALANCE

SO 7 Prepare a bank reconciliation.

Control Features: Use of a Bank

Illustration: The bank statement for Laird Company (Illustration

7-12), shows a balance per bank of $15,907.45 on April 30, 2011.

On this date the balance of cash per books is $11,589.45. Using

the four reconciliation steps, Laird determines the following

reconciling items.

Slide

7-43

Control Features: Use of a Bank

Illustration: a) Prepare a bank reconciliation at April 30.

Cash balance per bank statement

Add:

$15,907.45

Deposit in transit

2,201.40

Less:

Outstanding checks

Adjusted cash balance per bank

(5,904.00)

$12,204.85

Cash balance per books

$11,589.45

Add:

Error in recording check no. 443

Collection of notes + interest - fee

Less:

NSF check

Bank service charge

Adjusted cash balance per books

Slide

7-44

Illustration 7-12

36.00

1,035.00

(425.60)

(30.00)

$12,204.85

SO 7 Prepare a bank reconciliation.

Control Features: Use of a Bank

The company records each reconciling item used to determine

the adjusted cash balance per books.

Collection of Note Receivable: Assuming interest of $50 has

not been accrued and collection fee is charged to

Miscellaneous Expense, the entry is:

Apr. 30

Cash

Miscellaneous expense

Slide

7-45

1,035.00

15.00

Notes receivable

1,000.00

Interest revenue

50.00

SO 7 Prepare a bank reconciliation.

Control Features: Use of a Bank

Book Error: The cash disbursements journal shows that

check no. 443 was a payment on account to Andrea Company,

a supplier. The correcting entry is:

Apr. 30

Cash

Accounts payable

Slide

7-46

36.00

36.00

SO 7 Prepare a bank reconciliation.

Control Features: Use of a Bank

NSF Check: As indicated earlier, an NSF check becomes an

account receivable to the depositor. The entry is:

Apr. 30

Accounts receivable

425.60

Cash

425.60

Bank Service Charges: Depositors debit check printing

charges (DM) and other bank service charges (SC) to

Miscellaneous Expense. The entry is:

Apr. 30

Miscellaneous expense

Cash

Slide

7-47

30.00

30.00

SO 7 Prepare a bank reconciliation.

Control Features: Use of a Bank

Review Question

The reconciling item in a bank reconciliation that will

result in an adjusting entry by the depositor is:

a. outstanding checks.

b. deposit in transit.

c. a bank error.

d. bank service charges.

Slide

7-48

SO 7 Prepare a bank reconciliation.

Control Features: Use of a Bank

Electronic Funds Transfers (EFT) System

Disbursement systems that uses wire,

telephone, or computers to transfer cash

balances between locations.

EFT transfers normally result in better

internal control since no cash or checks are

handled by company employees.

Slide

7-49

SO 7 Prepare a bank reconciliation.

Reporting Cash

Cash consists of coins, currency (paper money), checks,

money orders, and money on hand or on deposit in a bank

or similar depository.

Illustration 7-14

Cash equivalents

Restricted cash

Compensating balances

Slide

7-50

SO 8 Explain the reporting of cash.

Reporting Cash

Review Question

Which of the following statements correctly

describes the reporting of cash?

a. Cash cannot be combined with cash equivalents.

b. Restricted cash funds may be combined with

Cash.

c. Cash is listed first in the current assets section.

d. Restricted cash funds cannot be reported as a

current asset.

Slide

7-51

SO 8 Explain the reporting of cash.

Protecting Yourself from Identity Theft

Identity thieves determine your identity by going through your

mail or trash, stealing your credit cards, redirecting mail through

change of address forms, or acquiring personal information you

share on unsecured sites. In a recent year, more than 7 million

people were victims of identity theft.

During a single computer-virus outbreak, called the “Hearse,”

thieves stole 90,000 pieces of personal data.

The average identity-theft victim spends 600 hours clearing up

his or her finances and financial and other records to recover

from the crime.

Slide

7-52

Protecting Yourself from Identity Theft

Victims incur an average of $1,400 in out-of-pocket expenses.

Consumers have $1.7 trillion worth of assets with online brokerage

firms. Many of the largest identity theft losses have been the

result of thieves completely cleaning out online brokerage

accounts.

The Federal Trade Commission reports identify theft is the No. 1

fraud complaint among consumers. Phoenix and Las Vegas top the

list for identity theft per capita.

Slide

7-53

Slide

7-54

Do you feel it is safe to store personal financial data (such

as Social Security numbers and bank and credit account

numbers) on your computer?

YES: I have anti-virus software that will detect and stop

any intruder.

NO: Even the best anti-virus software does not detect

every kind of intruder.

Slide

7-55

Copyright

“Copyright © 2010 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

in Section 117 of the 1976 United States Copyright Act without

the express written permission of the copyright owner is

unlawful. Request for further information should be addressed

to the Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the

use of these programs or from the use of the information

contained herein.”

Slide

7-56