CHAPTER 2 Payroll Accounting 2013 Bernard J. Bieg and Judith A. Toland

advertisement

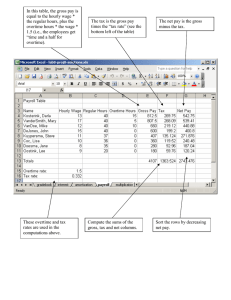

Payroll Accounting 2013 Bernard J. Bieg and Judith A. Toland CHAPTER 2 CHAPTER 2 COMPUTING WAGES & SALARIES Developed by Lisa Swallow, CPA CMA MS Learning Objectives • Explain the major provisions of the Fair Labor • • • • Standards Act Define hours worked Describe the main types of records used to collect payroll data Calculate regular and overtime pay Identify distinctive compensation plans Fair Labor Standards Act • Enterprise coverage includes all employees if • Two or more work in interstate commerce and • $500,000 or more annual gross sales or produce goods for interstate commerce Plus many nonprofits (schools, etc.) regardless of annual sales volume or • • Individual employee coverage • Employee whose company may not meet enterprise coverage, but in fringe occupation • For example: drive for fleet that transports goods, with annual revenues equal to $225,000 Federal Wage & Hour Law provides for both these types of coverage. Note: Many family businesses are exempt! LO-1 Employee & Employer Defined • An employer is an individual who “acts directly/indirectly in the interest of an employer” in relation to an employee • An individual is an employee if he/she performs services in a covered employment Common-law relationship • IRS test based on behavioral control, financial control or relationship between two parties • • Specific rules apply to employees of corporations, domestic employees, partners in partnerships and statutory employees • Independent contractor defined by “ABC test” LO-1 FLSA & Domestics • Domestic help includes nannies, gardeners, chauffeurs, etc. • Casual baby sitter and companions for aged/infirmed not covered • These employees must earn minimum wage and overtime if they • • Work 8 hours/week or more or Earn at least $1,000 in a calendar year • Live-in domestics need not be paid overtime LO-1 What is Minimum Wage? • Includes all rates of pay including, but not limited to • Commissions • Nondiscretionary bonuses and severance pay • On-call or differential pay • Discretionary bonus (one which is not agreed upon or promised before hand) is not included in an employee’s regular rate of pay • Other types of compensation not included in regular rate of pay include Gifts made as a reward for service • Payments for a bona fide profit-sharing plan • Vacation, holiday, sick day or jury duty pay • Vehicle, tool or uniform allowances • LO-1 Minimum Wage vs. “Living Wage” • Current minimum wage is $7.25/hour • Proposal to increase wage rate in series of steps to $9.50 per hour proposed by Obama Administration • Certain exceptions to minimum wages • “Living wage” refers to local ordinances that vary between cities • • • • Law that attempts to keep low-wage workers’ wages on track with cost of living 100+ cities have local laws requiring employers that do business with the government to pay a calculated living wage Some states now include private industry Washington minimum wage is $9.19/hour LO-1 Tipped Employees “Tipped employee” regularly average more than $30/month in tips • Minimum tipped wages is $2.13/hour, therefore tip credit = $5.12/hour – but may be calculated differently based upon state law • Employee must make $7.25/hour when combining tips/wages ($7.25 x 40 = $290 minimum weekly gross) • Tip credit remains the same for overtime pay calculation purposes • • Examples of tips received for 40-hour workweek *40 hours x $2.13/hour = $85.20 #1. Reported tips = $43 • Is $85.20 (40 x $2.13 minimum tipped wage) + $43 > $290 - (No - so employer must pay additional wages of $290 - $43 = $247) • #2. Reported tips = $1,189 • Is $85.20 + $1,189 > $290 - (Yes – so employer pays $85.20 wages) • Note: states’ tip credit percentages may differ from federal law LO-1 Overtime Provisions & Exceptions • Workweek established by corporate policy • Must be seven consecutive 24-hour periods • For example 12:01 a.m. Saturday - 11:59 p.m. Friday • Some states require daily overtime (OT) over 8 hours (if state plan is more generous than FLSA, state law is followed) • FLSA sets OT pay at 1.5 times regular pay • Employer can require employees to work overtime • Exceptions to the above are as follows Hospital employee, overtime for 80+ hours in 14 days or over 8 hours in a day (whichever is greatest) • Retail or service industry employees earning commission (special rules) • Employee receiving remedial education • LO-1 Compensatory Time Off • In specific situations, employers may grant employees compensatory time (called ‘comp time’) off in lieu of overtime Employee in public safety or emergency response can accumulate 320 hours x 1.5 = 480 hours comp time • Employee whose work doesn’t include activities from exception in bullet above can accumulate 160 hours x 1.5 = 240 hours compensatory time instead of OT • • Employee must be paid out comp time when employment terminated LO-1 Exempt vs. Nonexempt Employees “Exempt” means exempt from some, or all, of FLSA provisions • White-collar workers as outlined in Figure 2-2 (p. 2-10) are exempt Executives, administrators, professionals • Business owners, highly compensated employees • Computer professionals and creative professionals • Outside salespeople • • Test of exemption means employee must meet ‘primary duty’ requirements listed in Figure 2-2 • • Employee must be paid on salary basis at least $455/week Blue collar workers are always entitled to overtime pay – includes police officers, EMTs, firefighters, paramedics and LPNs Note: Putting someone on salary doesn’t mean he/she is exempt!! LO-1 Equal Pay Act • Men and women performing equal work must receive equal pay • Applies to any employer with workers subject to minimum pay provisions • Wage differentials allowed only if based on a seniority system, merit system or factor other than sex • If found to have differential pay, must raise the lower rate to equal the higher rate LO-1 Child Labor Restrictions • Nonfarm occupations • Employees age 16 and 17 may work unlimited number of hours each week in nonhazardous jobs • 14- and 15-year olds are limited to employment in retail and food/gas service very specific conditions as to hours/employment conditions • Agricultural occupations • Under age 12 employment is generally prohibited • Kids age 10 and 11 may work as hand harvest laborers outside school hours only between 6/1 and 10/15 • Subject to many strict limitations • Employer needs to have Certificate of Age on file Violations of child-labor provisions can result in serious fines LO-1 What the FLSA Does Not Cover • Employers are not required to • • • • • • Pay extra for weekend/holiday work Pay for holidays, vacation or severance Limit number of hours of work for persons 16 years of age or over Give holidays off Grant vacation time Grant sick leave LO-1 Problem 2-1 A and 2-2A Determining Employee’s Work Time • Principal activities require exertion, and are required by the employer and for the employer’s benefit • • • • • • • • • Prep at work station is principal activity and in some situations changing in/out of protective gear may be part of workday Travel (when part of principal workday) is compensable Idle time and wait time (waiting to provide employer’s service) Rest periods under 20 minutes are principal activities (can’t make employee “check out”) Meal periods are not compensable time unless employee must perform some tasks while eating – generally 30 minutes or longer Work at home is principal activity for nonexempt employees Sleep time is principal activity if required to be on duty < 24 hours Training sessions (with certain caveats) Waiting for doctor’s appointment on site LO-2 Noncompensable Activities • Preliminary and postliminary activities • Portal-to-Portal Act defines these activities • Need not be counted unless customary or contractual • For example checking in/out of plant • Absences due to illness • Tardiness may result in “docked” time, based upon system in place • Must be paid for fractional parts of an hour – different courts issued diverse rulings on smallest increments of time LO-2 Problem 2 – 7A Records Used for Timekeeping • FLSA requires certain time and pay records be kept • • Time sheets indicate arrival/departure time of employee Computerized time/attendance recording systems • • • • • Card-generated systems use computerized time cards Badge systems employ badges in conjunction with electronic time clocks Cardless and badgeless sytems require that an employee use their PIN number to process timekeeping PC-based system allows employee to clock in via computer Next generation technology includes touch-screen kiosks, web-based, biometrics and IVR (interactive voice response) LO-3 Computing Wages/Salaries Most common pay periods are as follows • Biweekly (26) - 80 hours each pay period • Semi-monthly (24) - different hours each pay period • Monthly (12)- different hours each pay period • Weekly (52) - 40 hours each pay period Employer may have different pay periods for different groups within same company! LO-4 Calculating Overtime Pay There are two methods • Most common method Calculate gross pay (40 hours x employee’s regular rate) • OT rate then calculated by multiplying 1.5 x employee’s regular rate x hours in excess of 40 • • Other method Calculate gross pay (all hours worked x employee’s regular rate) • Then calculate an overtime premium (hours in excess of 40 x overtime premium rate*) • • Hourly rate x ½ = *overtime premium rate These methods result in same total gross pay! LO-4 Overtime Premium Facts: hourly rate of $18.50 Joe worked 49 hours, calculate his gross pay 40 x 18.50 = 740 9 x 18.50 x 1.5 = 249.75 740 + 249.75 = 989.75 OT Premium 49 x 18.50 = 906.50 9 x 9.25 ( 18.50 x .5) = 83.25 906.50+83.25 = 989.75 Calculating Overtime – Different Rates for Different Jobs Employer may calculate overtime in one of three ways: Pay overtime at higher rate Calculate total earnings for all jobs, divide by total hours and apply overtime premium based on that weighted average Use overtime rate for job performed after 40th hour LO-4 Steps to Follow When Converting Period Wage Rates to Hourly Rates • • • • • Used to calculate pay for salaried and nonexempt employees Annualize salary Calculate regular weekly gross Calculate hourly pay Calculate overtime (OT) rate - (1.5 x hourly rate) Add OT pay to regular gross LO-4 Example #1 Calculating Gross Paycheck FACTS: Salary quoted to nonexempt employee is $1,500/month - paid weekly – 43 hours in one pay period • $1,500 x 12 = $18,000 annual • $18,000/52 = $346.15 weekly gross • $346.15/40 = $8.65 regular rate • $8.65 x 1.5 = $12.98 OT rate • $346.15 + ($12.98 x 3) = $385.09 gross LO-4 Example #2 Calculating Gross Paycheck FACTS: Salary quoted to nonexempt employee is $2,000/month – paid semimonthly – 4 hours OT in one pay period • $2,000 x 12 = $24,000 annual • $24,000/24 = $1,000 semimonthly gross • $24,000/52 = $461.54 regular rate • $461.54/40 = $11.54 regular rate • $11.54 x 1.5 = $17.31 OT rate • $1,000 + ($17.31 x 4) = $1,069.24 gross LO-4 Example #3 Calculating Gross Paycheck FACTS: Salary quoted to nonexempt employee is $2,000/month for 38 hour work week - paid semimonthly. Two rates in addition to semimonthly gross (regular pay between 38-40 hours/week; 1.5 after 40 hours). Of 16 hours of OT in one pay period only 12 over 40. • $2,000 x 12 = $24,000 annual • $24,000/24 = $1,000 semimonthly gross • $24,000/52 = $461.54 weekly rate • $461.54/38 = $12.15 regular rate • $12.15 x 1.5 = $18.23 OT rate • $1,000 + ($12.15 x 4) + ($18.23 x 12) = $1,267.36 gross LO-4 Example #4 Calculating Gross Paycheck FACTS: Salary quoted to nonexempt employee is $1,600/month for 35 hour work week -paid semimonthly. OT is calculated as regular hourly pay between 35-40 hours/week; 1.5 after 40 hours. Of 16 hours of OT in one pay period, 6 hours are over 40 hours weekly. $1,600 x 12 = $19,200 annual gross $19,200/24 = $800 semimonthly gross $19,200/52 = $369.23 weekly rate $369.23/35 = $10.55 regular rate $10.55 x 1.5 = $15.83 OT rate • $800 + ($10.55 x 10) + ($15.83 x 6) = $1,000.48 gross • • • • • LO-4 Problem 2 – 4A, 2 – 6A, 2 – 8A Problem 2 – 12A, 2 – 15A, 2 -16A Example #5 Calculating Gross Paycheck FACTS: Salary quoted nonexempt employee is $2,200/month paid biweekly - 11.5 hours OT in one pay period • $2,200 x 12 = $26,400 annual • $26,400/26 = $1,015.38 each biweekly pay period • $26,400/52 = $507.69 weekly rate • $507.69/40 = $12.69 regular rate • $12.69 x 1.5 = $19.04 OT rate • $1,015.38 + ($19.04 x 11.5) = $1,234.34 gross LO-4 Salaried Nonexempt Employees Fluctuating Workweek • Employee and employer may forge an agreement that a fluctuating schedule on a fixed salary is acceptable • • • • • Overtime is calculated by dividing normal salary by total hours worked Then an extra .5 overtime premium is paid for all hours worked over 40 or Can divide fixed salary by 40 hours – gives different pay rate each week Then an extra .5 overtime premium is paid for all hours worked over 40 • Alternative – BELO Plan • Appropriate for very irregular work schedule • Deductions cannot be made for non-disciplinary absences • Guaranteed compensation cannot be for more than 60 hours • Calculate salary as wage rate multiplied by maximum number of hours and then add 50% for overtime LO-5 Piece Rate • FLSA requires piecework earners to get paid for nonproductive time • Must equal minimum wage with OT calculated one of two ways Method A • Units produced x unit piece rate = regular earnings • Regular earnings/total hours = hourly rate • Hourly rate x 1/2 = OT premium • Regular earnings + (OT premium x OT hours) = gross pay or Method B • (Units produced in 40 hours x piece rate) + [(Units produced in OT) x (1.5 x piece rate)] Note: two methods don’t give same results!! LO-5 Example #1 Calculating Piece Rate Gross Pay FACTS: 4,812 units inspected in a 47.25 hour week (600 of those units produced in extra hours). Employee is paid .12 per unit. Calculate gross pay using both methods. Method A • 4,812 x .12 = $577.44 regular piece rate earnings • 577.44/47.25 hours = $12.22 hourly rate • $12.22 x .5 = $6.11 OT premium • $577.44 + ($6.11 x 7.25 hrs.) = $621.74 gross Method B • (4,212 x .12) + [600 x (.12)(1.5)] = $613.44 gross LO-5 Example #2 Calculating Piece Rate Gross Pay FACTS: Inspection rate = $.08/unit. An EE inspected 6,897 units in 43.5 hours. She inspected 423 of these in overtime. Calculate using both methods. Method A • (6,897 units x .08) = $551.76 regular piece rate earnings • $551.76/43.5 hours = $12.68 hourly rate • $12.68 x .5 = $6.34 OT premium • $551.76 + ($6.34 x 3.5 hours) = $573.95 gross Method B • (6,474 x .08) + [423 x (.08)(1.5)] = $568.68 gross LO-5 Special Incentive Plans • Special incentive plans are modifications of piece-rate plans • Used to entice workers to produce more • Computation of payroll is based on differing rates for differing quantities of production • Example of incentive plan • • • .18/unit for units inspected up to 2,000 units/week .24/unit for units inspected between 2,001-3,500 units/week .36/unit for units inspected over 3,500 units/week LO-5 Commissions • Commission can be used in many combinations – is a stated percentage of revenue paid for each transaction • • With base salary or stand alone As long as minimum wage provisions are met Exceptions are outside salespeople who are exempt from FLSA • FACTS: Sam sold $40,000 of product. His quota is $31,500. He gets 2% in excess of quota. His annual base salary is $30,000. He gets paid biweekly; calculate his total gross pay. • • • $30,000/26 = $1,153.85 base earnings ($40,000 - $31,500) x .02 = $170 commission $1,153.85 + $170.00 = $1,323.85 gross LO-5 Nondiscretionary Bonuses • Bonuses that are part of employees’ wage rates must be included for period covered by bonus Those known in advance or set up as incentives must be added to wages for week • Then divided by total hours worked to get regular pay • OT calculated based upon this rate FACTS: Jamil earns $13.50/hour and also earned a safety performance bonus of $85.00. He worked 44 hours this week, his gross pay would be: • • • • • $13.50 x 44 hours = $594.00 + $85.00 = $679.00 $679.00/44 hours = $15.43 regular rate $15.43 x .5 = $7.72 x 4 hours = $30.88 $679.00 + $30.88 = $709.88 LO-5 Profit-Sharing Plans • Profit-sharing plans are ones in which an employee shares in corporate profits – receives his/her share in the form of • • • • Cash payment Profits paid into retirement or savings account Profits distributed as stock These payments must meet standards established by Department of Labor LO-5 Problem 2 – 17A, 2 – 18A, 2 – 21A