Asymmetric Information It’s Impact on the Financial Markets Econ 102

advertisement

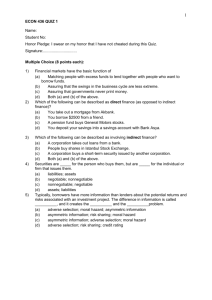

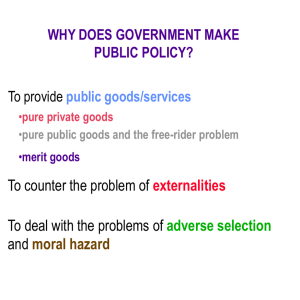

Asymmetric Information It’s Impact on the Financial Markets Econ 102 What is the Problem? • In economics and contract theory, information asymmetry deals with the study of decisions in transactions where one party has more or better information than the other. This creates an imbalance of power in transactions which can sometimes cause the transactions to go awry. Examples of asymmetric information • Seller usually has better information: used-car salespeople, mortgage brokers and loan originators, stockbrokers, Realtors, real estate agents, and life insurance transactions. • Buyer usually has better information: estate sales as specified in a last will and testament, or sales of old art pieces without prior professional assessment of their value. This situation was first described by Kenneth J. Arrow in an article on health care in 1963.[2] Classifying the problems • Examples of this problem are adverse selection and moral hazard. Most commonly, information asymmetries are studied in the context of principal-agent problems. Adverse Selection • the ignorant party lacks information while negotiating an agreed understanding of or contract to the transaction • An example of adverse selection is when people who are high risk are more likely to buy insurance, because the insurance company cannot effectively discriminate against them Moral Hazard • moral hazard the ignorant party lacks information about performance of the agreedupon transaction or lacks the ability to retaliate for a breach of the agreement • An example of moral hazard is when people are more likely to behave recklessly after becoming insured, either because the insurer cannot observe this behavior or cannot effectively retaliate against it, for example by failing to renew the insurance. Principal-Agent • principal hires an agent, such as the problem that the two may not have the same interests, while the principal is, presumably, hiring the agent to pursue the interests of the former Empirical Studies • Lazear (1996) saw productivity rising by 44% (and wages by 10%) in a change from salary to piece rates, with a half of the productivity gain due to worker selection effects. • Fernie and Metcalf (1996) find that top British jockeys perform significantly better when offered percentage of prize money for winning races compared to being on fixed retainers. Empirical Studies • Kahn and Sherer (1990) find that better evaluations of white-collar office workers were achieved by those employees who had a steeper relation between evaluations and pay. • Nikkinen and Sahlström (2004) find empirical evidence that agency theory can be used, at least to some extent, to explain financial audit fees internationally. Readings • Moral hazard: (MBN) Ch. 20 Mortgage Meltdown • Principal/Agent: MBN Ch. 22 Is your Banker Heading to Vegas? • Barron: Ch. 21 Asymmetric Information