Final Class Study Guide

advertisement

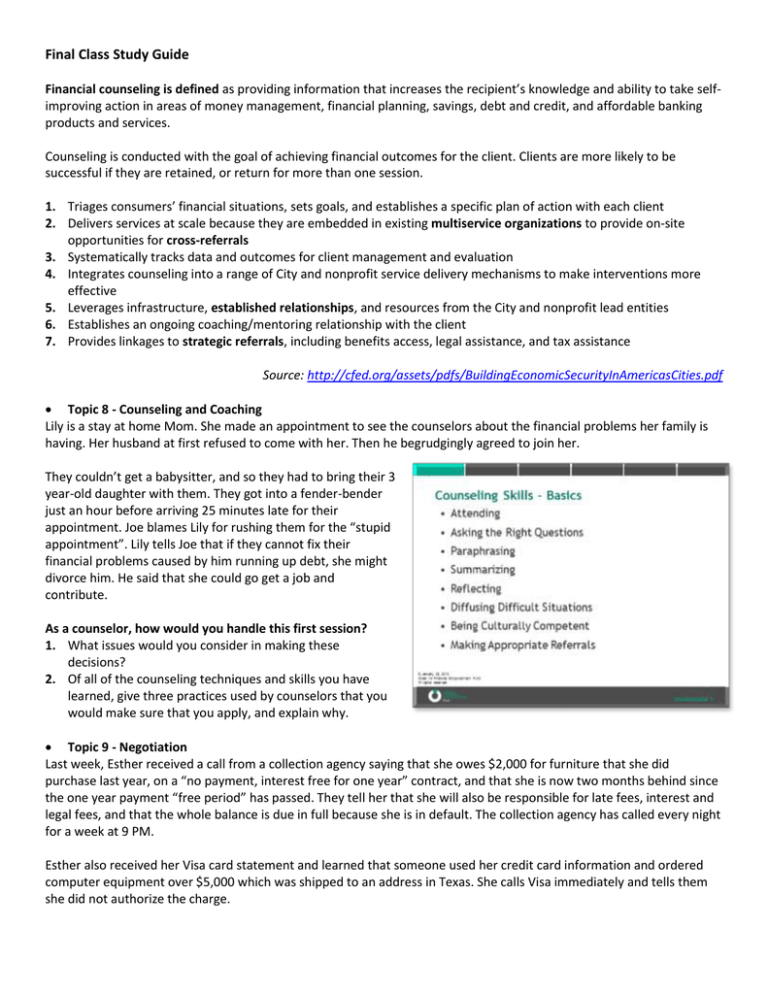

Final Class Study Guide Financial counseling is defined as providing information that increases the recipient’s knowledge and ability to take selfimproving action in areas of money management, financial planning, savings, debt and credit, and affordable banking products and services. Counseling is conducted with the goal of achieving financial outcomes for the client. Clients are more likely to be successful if they are retained, or return for more than one session. 1. Triages consumers’ financial situations, sets goals, and establishes a specific plan of action with each client 2. Delivers services at scale because they are embedded in existing multiservice organizations to provide on-site opportunities for cross-referrals 3. Systematically tracks data and outcomes for client management and evaluation 4. Integrates counseling into a range of City and nonprofit service delivery mechanisms to make interventions more effective 5. Leverages infrastructure, established relationships, and resources from the City and nonprofit lead entities 6. Establishes an ongoing coaching/mentoring relationship with the client 7. Provides linkages to strategic referrals, including benefits access, legal assistance, and tax assistance Source: http://cfed.org/assets/pdfs/BuildingEconomicSecurityInAmericasCities.pdf Topic 8 - Counseling and Coaching Lily is a stay at home Mom. She made an appointment to see the counselors about the financial problems her family is having. Her husband at first refused to come with her. Then he begrudgingly agreed to join her. They couldn’t get a babysitter, and so they had to bring their 3 year-old daughter with them. They got into a fender-bender just an hour before arriving 25 minutes late for their appointment. Joe blames Lily for rushing them for the “stupid appointment”. Lily tells Joe that if they cannot fix their financial problems caused by him running up debt, she might divorce him. He said that she could go get a job and contribute. As a counselor, how would you handle this first session? 1. What issues would you consider in making these decisions? 2. Of all of the counseling techniques and skills you have learned, give three practices used by counselors that you would make sure that you apply, and explain why. Topic 9 - Negotiation Last week, Esther received a call from a collection agency saying that she owes $2,000 for furniture that she did purchase last year, on a “no payment, interest free for one year” contract, and that she is now two months behind since the one year payment “free period” has passed. They tell her that she will also be responsible for late fees, interest and legal fees, and that the whole balance is due in full because she is in default. The collection agency has called every night for a week at 9 PM. Esther also received her Visa card statement and learned that someone used her credit card information and ordered computer equipment over $5,000 which was shipped to an address in Texas. She calls Visa immediately and tells them she did not authorize the charge. The following month, the charge is still on her Visa card statement. She calls again, and the credit card company said they did an investigation, and that she will have to pay the charge. She refuses to pay the charge. The card company tells her this will have a negative effect on her credit if she does not pay. Explain the step by step guidance you would give Ray and Esther to help them be proactive. You must also arm them to handle the creditor’s tactics. 1. Based on the consumer protection regulations you learned in class what advice would you give them to handle a really aggressive third party collector on the contract that’s past due? 2. Of the negotiation tactics you learned, choose three that you think are the most important negotiation tactics you would want them to be aware of, explain (a) what they are; (b) how they work, and (c) why the particular tactics you chose are important in their situation, i.e. for handling overdue credit cards, and for the unauthorized charge that the collector is calling about. Topics 1, 2, 10, 11 and 12 (Investments, Homeownership, Insurance & Debt) Esther and Ray are married and have 2 children, ages 3 and 15. Ray is 43 years old, and works for a printing company. Esther is a stay at home mom and does occasional graphic design work at home. Ray was just given a 35% pay cut because his company is not doing well. Three months after Ray had the pay cut the company is doing better and restores Ray’s full salary. He pools money with his co-workers to buy a Mega Millions lottery ticket. The group wins, and Ralph’s share is $270,000 after taxes. He wants to pay off all his debt, buy a house, go on vacation, buy a new TV, put some money away for his children’s education and for retirement. He is also worried now because Esther has been ill, and it looks like it will be a chronic (ongoing) problem. The prognosis doesn’t look good. Ray and Esther are both back in your office, asking for guidance. 1. What should you focus on when discussing their desire to buy a home? Why? 2. What should they do considering Esther’s health issues? Why? 3. What kinds of investments, savings or other vehicles should they consider when planning for the children and retirement? 4. Should they pay all their debts in full? Why? Expenses Rent Electric & gas Cell phones (2) Food Other groceries-toiletries, paper goods, etc. Total credit card minimum payments Cable Internet Clothing, shoes (annualized) Dry cleaning Car insurance premium Health insurance premium Miscellaneous- gas, pocket money, etc. Total Monthly Expenses: $ 4,447.00 $1450 $115 $189 $800 $200 $650 $109 $69 $100 $25 $75 $265 $300