Credit and Credit Reports

advertisement

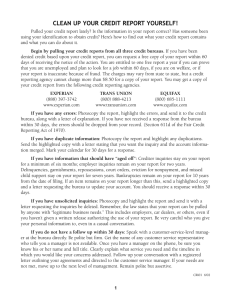

Credit and Credit Reports Presented by Nancy Adelson Senior Loan Originator, Spectrum Mortgage NSCC Real Estate Program Coordinator For NSCC Investment Club February 1, 2011 Benefits of Credit Convenient Buy homes, cars, major purchases Start and/or expand business Display good credit history Increase future borrowing power Disadvantage of Credit Buy more than able to afford or pay back Incur costly finance charges or higher rates Debtor’s security/collateral may be repossessed Creditor may use legal action to collect Generate poor credit history Closes door to future borrowing Key Words Defined Credit: The right to pay later for products and services purchased today Finance Charge: The extra cost for credit Creditor: The party who sells the goods or services on credit or lends money Debtor: The party who buys the goods or services on credit or borrows money Secured/Installment Loan: Creditors own rights to debtor’s asset (collateral) if debtor doesn’t pay Unsecured/Revolving Loan: No collateral provided Key Words Defined Continued Delinquent Payment: Payment received by creditor 30 days or more past due date Credit Reporting Agency/Bureau (CRA): Repository of credit information collected from credit grantors Credit Report: Provided by credit bureaus containing detailed information on credit history Credit Worthy: The likelihood of repaying loan & making payments on time Credit Score: Based on credit history providing a measure of credit worthiness FICO Scoring Credit scoring system developed by the Fair Isaac Company Used by 90% of US lenders & creditors FICO score range is 350 to 850 Consumers who are good credit risks have higher credit scores 1:1,300 US citizens have credit scores above 800 Five Factors of FICO Scoring Payment History: Paying debts in full and on time Outstanding Credit Card Balances: Marks ratio between outstanding balance & available credit Credit History: Length of time since opened accounts Type of Credit: Mix of installment and revolving accounts Inquiries: Credit inquiries within 12 months Fair Credit Reporting Act of 1970 Governs the collection, dissemination, and use of consumer credit information Protects consumers from fraudulent and inaccurate credit reporting agency reports Requires Credit Reporting Agencies (CRA) to remove past credit items in a reasonable time Offers more protection for the privacy of consumers Fair and Accurate Credit Transaction Act of 2003 Amended Fair Credit Reporting Act Allows consumers to obtain one free credit report every 12 months from each CRA Central web site for free annual credit reports: www.annualcreditreport.com Reduces identity theft by permitting the people to place alerts on their credit histories if identity theft is suspected Requires secure disposal of consumer information Credit Reports Produced by Credit Reporting Agencies (CRA) (aka Credit Bureaus) Shows individual’s credit history, personal information, employment, residence, credit inquiries and legal actions (liens, collections, bankruptcies, garnishments, judgments, etc.) Rates credit risk and payment history Information provided by creditors and public records Time limits on your record: inquiries, 2 years; late payments, foreclosure, collection accounts & Chapter 13 bankruptcy, 7 years; Chapter 7 bankruptcy, 10 years; unpaid liens, forever. Improve Your Credit Score Time heals bad credit Pay on time and payoff revolving debts Negotiate and pay off collections, judgments and liens Keep and use “old” revolving accounts Use 5 trade-lines – 3 revolving & 2 installment Regularly review and fix your credit reports from each Credit Reporting Agency (CRA) Don’t allow creditor inquiries Free Credit Reports Call 1-877-322-8228 Complete the Annual Credit Report Form & mail Annual Credit Report Request Service, PO Box 105281, Atlanta, GA 30348-5281 Go to https://www.annualcreditreport.com/cra/index.jsp First Steps to Repairing Your Credit Remember car dealers, landlords, creditors, lenders, insurers etc. check your credit reports To ensure proper correction, first contact the creditors and get documentation/proof Then contact all CRA’s with request and documentation Credit Reporting Agencies Contact Information Repair Your Credit Charge $15-$17 for each FICO Score Equifax -- 1-800-685-1111 http://www.equifax.com Experian -- 1-888-397-3742 http://www.experian.com TransUnion -- 1-800-916-8800 http://www.transunion.com Repair Your Credit Online Repair Your Credit by Letter Experian Trans Union Corp. Equifax Attn: NCAC Attn: Disputes Attn: Disputes P.O. Box 2002 P. O. Box 1000 P. O. Box 740241 Allen, Texas 75013 Chester, PA 19022 Atlanta, GA 30374 I dispute the accuracy of my credit file as revealed to me on [Give Date]. In accordance with Section 611 of the Fair Credit Reporting Act, I hereby request that you investigate the current status of the information I have disputed below. Credit Grantor:________ Account No.:_________ The disputed portion reads: _____ I maintain that:_____ Your Name and Your Address Your Social Security Number Your Signature and Date Read More and Learn More http://www.mtgprofessor.com/credit_issues.htm Conclusion Use credit wisely and reap the benefits Know your rights as consumers Be aware of finance charges and fine print in contracts Questions? Nancy Adelson nancyadelson@comcast.net