Memorandum TO: UVM Non-Union Faculty and Staff Members

advertisement

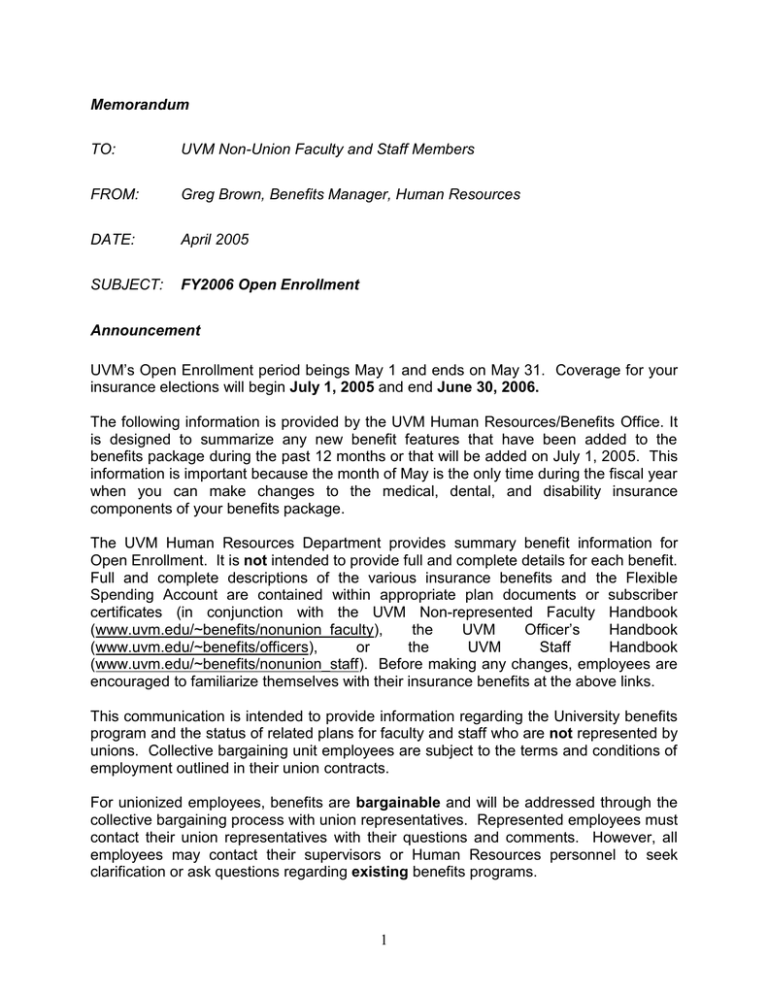

Memorandum TO: UVM Non-Union Faculty and Staff Members FROM: Greg Brown, Benefits Manager, Human Resources DATE: April 2005 SUBJECT: FY2006 Open Enrollment Announcement UVM’s Open Enrollment period beings May 1 and ends on May 31. Coverage for your insurance elections will begin July 1, 2005 and end June 30, 2006. The following information is provided by the UVM Human Resources/Benefits Office. It is designed to summarize any new benefit features that have been added to the benefits package during the past 12 months or that will be added on July 1, 2005. This information is important because the month of May is the only time during the fiscal year when you can make changes to the medical, dental, and disability insurance components of your benefits package. The UVM Human Resources Department provides summary benefit information for Open Enrollment. It is not intended to provide full and complete details for each benefit. Full and complete descriptions of the various insurance benefits and the Flexible Spending Account are contained within appropriate plan documents or subscriber certificates (in conjunction with the UVM Non-represented Faculty Handbook (www.uvm.edu/~benefits/nonunion_faculty), the UVM Officer’s Handbook (www.uvm.edu/~benefits/officers), or the UVM Staff Handbook (www.uvm.edu/~benefits/nonunion_staff). Before making any changes, employees are encouraged to familiarize themselves with their insurance benefits at the above links. This communication is intended to provide information regarding the University benefits program and the status of related plans for faculty and staff who are not represented by unions. Collective bargaining unit employees are subject to the terms and conditions of employment outlined in their union contracts. For unionized employees, benefits are bargainable and will be addressed through the collective bargaining process with union representatives. Represented employees must contact their union representatives with their questions and comments. However, all employees may contact their supervisors or Human Resources personnel to seek clarification or ask questions regarding existing benefits programs. 1 Contents May is Open Enrollment Month at UVM What Do I Need to Do? Changes for July 1, 2005 – June 30, 2006 Medical Insurance Coverage Waiver of Medical Insurance Dental Insurance Coverage Disability Insurance Coverage Group Life Insurance Flexible Spending Accounts Questions and Answers May is Open Enrollment Month at UVM The following describes the Open Enrollment for coverage beginning July 1, 2005 and ending June 30, 2006. Take time now to review the benefits you receive as a non-represented University of Vermont faculty or staff member. During the month of May 2005, you may choose to do the following: enroll for the first time in medical or dental insurance plans change or update your insurance coverage (i.e., changes within plans, switch plans) waive coverage If you missed a 30-day deadline to add a dependent to your medical, dental, or life insurance coverage during the year, you may add all eligible dependents at this time. The new changes will be effective July 1, 2005. You will continue to designate your cultural holiday in November for the following year. 2 What Do I Need To Do? 1. Learn about the valuable benefits available to you as a non-represented UVM staff or faculty member (www.uvm.edu/~benefits?Page=benefits_start.html). 2. Check what benefits you're enrolled in currently. Consult your Employee Benefits Statement (https://aisweb.uvm.edu/pls/owa_prod/hrs_web.P_HRS_Login) or your paycheck. 3. Don't miss the Benefits Fair (www.uvm.edu/~benefits/?Page=openenroll/05_fair.html) on April 27 and 28. This is your chance to talk with the benefits experts, ask questions, and win prizes! 4. Review the available plans (www.uvm.edu/~benefits?Page=benefits_start.html). All benefits plans and coverage will remain the same for FY 2006. 5. Choose the plan that works best for you. If you are satisfied with your current provider, coverage will continue without any action on your part. 6. If you wish to switch your plan provider, enroll in the plan of your choice before May 31. Changes Effective July 1, 2005 Life Insurance and Long-Term Disability Insurance No changes. UVM Retirement Savings Plan Beginning January 1, 2002, contribution limits to the retirement plan were simplified. Participants may contribute to the plan a dollar amount up to 100% of their compensation minus their benefit costs (e.g., FICA and Medicare taxes, health and dental deductions, etc.) to a limit of $14,000 in calendar year 2005. This will increase by $1,000 per calendar year until it reaches $15,000 in 2006. The overall employer-employee combined limit per calendar year is $42,000 for 2005, not to exceed 100% of their compensation minus their benefit costs. Participants aged 50 and over on December 31, 2005, may contribute an additional $4,000 to the plan in calendar year 2005, and increase their contribution by $1000 each calendar year until reaching $5,000 in 2006. Medical and Dental Insurance There are no changes to the medical and dental plans. 3 Medical and dental insurance premiums are changing. The University extended a request for competitive bids on the health plans this year. As a result, we were able to negotiate very favorable renewal rates for all plans. While the expectation had been for increases of approximately 15%, actual increases are as follows: Blue Cross Blue Shield Vermont Health Partnership Blue Cross Blue Shield Freedom Plan MVP Delta Dental 3% 9% 12.5% 7% Faculty and staff members’ premium payments will increase accordingly effective July 1, 2005. The Schedule of Monthly Premium Costs (www.uvm.edu/~benefits/forms/fy06_premiums.pdf) reflects these premium increases. Medical Insurance Coverage As an employee of the University of Vermont, you have three choices: Blue Cross Blue Shield – See “Blue Cross/Blue Shield Plan” below for information. MVP Health Plan – See “MVP Health Plan” below for information. Waiver – The waiver of medical coverage will remain at $750 but will be reimbursed over the fiscal year (July 1, 2005 to June 30, 2006). Click here for information. If you wish to change coverage, the Open Enrollment period is the only time during the year when you can switch plans. If you are currently waiving coverage, you may continue to waive coverage for another year or enroll in one of the medical plans. For detailed information, please click on the above links. Premium Payment Full-time Employees: All non-represented employees will be charged a percentage of the premium cost based on their base salary as of January 1, 2005 according to the following table: 4 Base Salary as of 1/1/05 Employee % of Cost $15,000 and less $15,001 to $20,000 $20,001 to $30,000 $30,001 to $40,000 $40,001 to $50,000 $50,001 to $60,000 $60,001 to $70,000 $70,001 to $80,000 $80,001 to $90,000 $90,001 to $100,000 $100,001 to $110,000 $110,001 to $120,000 $120,001 to $130,000 $130,001 to $140,000 $140,001 to $150,000 Over $150,001 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 27% 28% 29% 30% The salary will be the employee’s base salary as of January 1 of each year and will not be affected by salary changes during the year. To determine premium payments for medical school faculty, base salary will be defined to include the combined salary paid under the common paymaster. Employees with 9, 10 or 11-month appointments will pay their share of annual premiums over the term of their appointment. For example, a 9-month employee will pay for their 12-month coverage over their 9-month term (18 paychecks.) Part-time employees are eligible to participate and receive UVM contributions if their full-time equivalency is at least 50%, and they have been employed for at least four consecutive semesters if faculty, or one year if staff. Premiums are based on the employee’s full-time equivalency. For example, an employee who works 60% FTE pays 40% of the cost of coverage. Part-time employees who are at least 50% FTE but do not meet the length of service requirement may enroll, if they pay the full cost of coverage. Blue Cross/Blue Shield Plan The Blue Cross/Blue Shield Plan provides two different plans depending on whether you live in the network service area or outside of Vermont. If you live in Vermont or Western New Hampshire, you must be enrolled in the Vermont Health Partnership (VHP). This plan requires the selection of a primary care physician. BCBS has eliminated the referral system. You may visit any network specialist as long as none of the following 16 specific procedures are being performed: 1. Plastic or cosmetic surgery (for example, abdominoplasty, lipectomy, blepharoplasty, breast reconstruction, otoplasty, 5 panniculectomy, rhinoplasty or septorhinoplasty) 2. Dental surgery (oral surgery, trauma, orthognaltic surgery) 3. Chiropractic care after initial 12 visits in a calendar year 4. Radiology special procedures (MRI, MRA, MRS, PET scans) 5. UPPP/somnoplasty 6. Continuous Passive Motion (CPM) equipment 7. Durable Medical Equipment with a purchase price over $1,000 8. Orthotics/prosthetics 9. Polysomnography (sleep studies) 10. Chondrocyte transplants 11. Home infusion therapy 12. Private duty nursing 13. Transplants 14. TENS units/neuromuscular stimulators 15. Rehabilitation (cardiac/pulmonary/inpatient rehabilitation facility) 16. Services by any out-of-network provider You pay $10 when you see your primary care physician (PCP) and $20 when you use a specialist. Emergency hospital care has a $50 co-pay per visit that is waived if followed by hospitalization. There is a co-pay of $250 for each hospitalization with a maximum of three co-pays per family per plan year. This co-pay is for an entire course of treatment; if one is readmitted to the same hospital for the same diagnosis or treatment after a discharge within 21 days, there is no additional co-pay. Out-patient surgical benefits have a co-pay of $100 and ambulance services have co-pay of $50. With prior BCBS approval, you may choose to go to an out-of-network doctor or hospital. However, with this choice you will incur a $500 per person deductible ($1,000 family maximum), after which you will be reimbursed 70% of expenses. You will pay 30% until you have met a $2,500 out-of-pocket maximum ($5,000 family out-of-pocket maximum) after which you will be reimbursed 100%. If you live outside the network area, you are eligible for the Vermont Freedom Plan (VFP) which does not require selection of a PCP. As long as you use a provider who participates in a local Blue Cross/Blue Shield Plan, in/out-patient services are reimbursed at 90% of reasonable and customary charges after an individual deductible of $100 ($300 per family) has been met. Hospital admissions and surgery require prior authorization and are payable at 90% of reasonable and customary charges after an individual deductible of $100 ($300 per family) has been met. The out-of-pocket annual maximum is $1,100 per person plus prescription drug co-payments and the plan pays 100% thereafter. One advantage of the Blue Cross Plan is that you can go to any physician or acute care short-term general hospital worldwide. However, the plan will pay only reasonable and customary charges. If the provider does not participate in the local Blue Cross/Blue Shield plan and the charges are above reasonable and customary, you must pay the difference. 6 Mental health and substance abuse benefits under both the VHP and the VFP must be pre-certified by Magellan Behavioral Health. Out-patient care for VHP has a co-pay of $20. For VFP, you will be reimbursed at 90% of reasonable and customary charges after an individual deductible of $100 ($300 per family) has been met. For services preapproved by Magellan or UVM’s Employee Assistance Program (EAP), benefits are payable at the same rate (co-pay of $20) as PCP referrals under the medical portion of the plan. Prescription drug coverage is provided through a network of retail pharmacies managed by RESTAT. Under VHP and VFP, after you have met the $100 deductible, you will pay $5 per generic prescription, $20 per preferred brand prescription or $40 per nonpreferred brand ($5/20/40). A voluntary mail order prescription drug plan is available for maintenance drugs through IPS. After you have met the $100 deductible you may purchase a 90-day supply at a cost equal to two co-pays, (i.e., $10/40/80). See the complete BCBS preferred prescription drug list at www.bcbsvt.com/pages/RxCenter/preferreddrugs.htm. Claims for prescriptions through network pharmacies or IPS mail order are automatically filed with Blue Cross at the time of purchase. You must submit non-network claims directly to Blue Cross for processing. MVP Health Plan MVP’s Vermont CO-PLAN 15 is an alternative to Blue Cross Blue Shield. Under this plan, a PCP must be selected for health care. Office visits such as well-baby, periodic physicals, OB/GYN, laboratory and testing services, out-patient surgery, mental health, physical therapy, chiropractic, etc. have a co-pay of $15 per visit. Emergency hospital care has a $50 co-pay per visit in-area that is waived if followed by hospitalization and no charge for out-of-area emergency hospital care. There is a co-pay of $240 for each hospitalization. Out-patient surgery has a co-pay of 20% or $100 whichever is less. Prescriptions are covered by a $100 deductible and a $5/20/40 formulary drug card program. If covered under the formulary and you have met the $100 deductible, you will pay $5 per generic prescription, $20 per preferred brand prescription or $40 per nonpreferred brand. If it is not covered under the formulary, you must pay the entire cost of the prescription. See the complete MVP prescription drug list online at www.mvphealthcare.com/rx/HCalphadruglist3_23_05.pdf. One feature of MVP that may be attractive to parents with college-age students is Expanded College Student Coverage which provides up to $2,500 annually for out-ofarea care including doctors’ visits, lab work, physical therapy, and emergencies. With MVP, you may not seek care from providers who are not MVP-participating physicians. You are not free to choose your specialty care. Specialist services are covered only if they are first authorized by MVP and your PCP. 7 Vist www.mvphealthcare.com for more information about the MVP’s Vermont CO-PLAN 15. Waiver of Medical Coverage UVM offers an annual $750 payment in lieu of medical coverage. available to: This option is An employee who certifies that they and, if applicable, their dependents are covered by non-UVM medical insurance. The waiver option is available to full-time employees only. A full-time employee is defined by UVM as anyone who is employed at 75% full-time equivalency (FTE) or more on a 12-month basis, or 100% on a 9, 10 or 11-month basis. This option is not available to an employee whose spouse also works at UVM nor is it available to an employee formerly retired from UVM with post-retirement benefits. Further, it is not available if you waive coverage for your eligible dependents but not yourself. The waiver of $750 is subject to tax withholding and payments are spread throughout the year. These payments can be converted to pre-tax dollars through a Flexible Spending Account. If you lose your non-UVM medical insurance by an event outside your control, you are eligible to enroll in a UVM medical plan within 30 days of the date of the event. If you waived coverage for yourself and your dependents, and your spouse loses employment, or if you lose coverage because of divorce or your spouse’s death, you may enroll in the UVM plan within 30 days of the date of the event. You may not come back into a UVM plan simply because your spouse’s employer increases premiums or decreases coverage until the next Open Enrollment period. If you waived coverage from July 1, 2004 to June 30, 2005, you will be deemed to have waived it for the period July 1, 2005 through June 30, 2006 also unless you elect coverage under one of the medical plan options. Dental Insurance Coverage The University offers two dental plans, the Base Plan and the High Option Plan, through Northeast Delta Dental. Full-time employees are eligible for coverage after a six-month waiting period. For the Base Plan, UVM will pay the premium for full-time employees and dependents. For the High Option Plan, the employee pays the difference between the premium cost for the Base and High Option Plans. 8 Dental coverage for part-time employees is optional after one year of service for staff and four consecutive semesters for faculty. For the Base Plan, UVM will contribute a percent equal to the employee’s FTE. For the High Option Plan, in addition to their share of the Base Plan premium, the employee pays the difference between the premium cost for the Base and High Option Plans. If you currently have dental insurance coverage, no action is necessary. However if you previously waived coverage, you may enroll during this Open Enrollment period. Coverage will be effective on July 1, 2005. The features of the Base and High Option Plans follow: Coverage A (Preventive) Coverage B (Minor Restorative) Coverage C (Major Restorative) Deductible/Person/Calendar Year Deductible/Family/Calendar Year Deductible Applied to Coverage A Maximum/Person/Calendar Year Coverage D (Orthodontics) Lifetime Maximum/Person Base High Option 100% 80% 50% $25 $75 100% 80% 60% $25 $75 Base High Option Yes $750 50% $500 No $1,500 50% $1,000 Employee Monthly Cost for Optional Plan: Employee Only Employee and Spouse Employee and Child(ren) Employee and Family $ 6.29/month $12.54 $13.14 $19.32 Please note: The high option maximum per person coverage of $1500 runs through the calendar year, not the fiscal year. For further information about dental coverage, visit www.deltadental.com. 9 Disability Insurance Coverage The Standard/TIAA Long-term Disability Plan provides long-term disability coverage. Eligibility for disability insurance coverage requires that you have completed at least one year of service and that you are employed 75% FTE on a 12-month basis, or 100% FTE on a 9 or 10-month basis. If you do not enroll within 31 days of your eligibility date, you must provide proof of insurability to enroll at a later date. If you are currently enrolled, you may increase, decrease, premiums from after-tax to pre-tax dollars or vice versa. effective July 1, 2005 if you are actively at work on July 1. waived coverage, you must provide proof of insurability Enrollment. cancel or change your These changes will be If you have previously to enroll during Open You may also request a change in coverage due to a special life event, i.e., a marital status change, addition or loss of a dependent, or your spouse’s loss of coverage or termination of full-time employment. You may only request a change in income benefit if you apply within 31 days of the special life event. To determine the amount of your disability coverage, review your pay stub or your Employee Benefits Statement (https://aisweb.uvm.edu/pls/owa_prod/hrs_web.P_HRS_Login). It will indicate whether you have 60% or 70% coverage. If there is no deduction for disability insurance on your pay stub, you are not covered. Group Life Insurance UVM offers you the opportunity to purchase up to seven times your UVM salary in life insurance for yourself, one-half the amount of your coverage for your spouse, and $10,000 for each covered child. You may increase your coverage if you haven’t already elected the maximum as long as you provide proof of good health to TIAA/Standard. A change in life insurance coverage can be made at any time during the year. Flexible Spending Account There will be no changes to the calendar year 2005 Flexible Spending Account program. Enrollment for the 2006 Flexible Spending year will be in November. 10 Questions and Answers What if I’m happy with the status of my current benefits? Do nothing if you’d like to maintain your current benefits. How can I tell which insurance coverage I’ve elected? Look at your pay stub or your Employee Benefits Statement. You will see a deduction on your pay stub for all coverage that requires a premium. For example, the long-term disability coverage will indicate whether you are covered at 60% or 70% of your UVM base salary. If you see no life insurance deduction and your FTE is 75% or more, you are covered for $6,000. What if I don’t change my benefits now? Can I make changes later in the year? The open enrollment restriction applies only to medical and dental insurance. Changes in retirement plan contributions can be made any time during the year. In addition, if you want to increase the amount of your life insurance or if you have not enrolled in the long-term disability insurance plan, you may do so any time as long as you provide proof to the insurer that you are insurable. However, this is a good time to review all your benefits to be sure you are taking advantage of everything that may be beneficial to you and your family. Where can I find a description of the various benefit plans? Check the UVM Benefits website at www.uvm.edu/~benefits. What’s the most important thing to remember? If you need to make changes to your medical and dental insurance, be sure to complete the necessary paperwork during the Open Enrollment period from May 1, 2005 through May 31, 2005. Visit www.uvm.edu/~benefits for information about: - Benefits plans - Benefits eligibility - Medical and dental premiums - Employee Benefits Statement - UVM Benefits Fair April 27 & 28 - Total compensation 11