Figure 1. Increases in Health Insurance Premiums Percent

advertisement

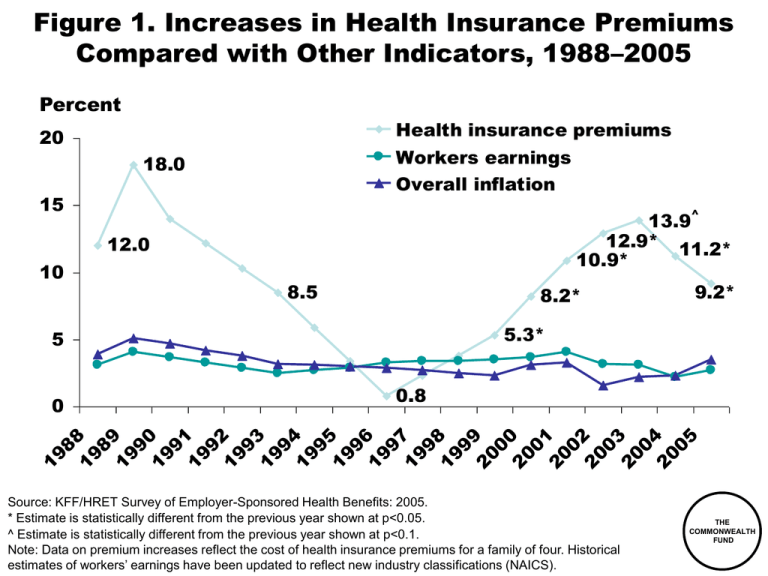

Figure 1. Increases in Health Insurance Premiums Compared with Other Indicators, 1988–2005 Percent Health insurance premiums 20 Workers earnings Overall inflation 18.0 15 ^ 13.9 12.9* 11.2* 10.9* 12.0 10 8.5 5.3* 5 Source: KFF/HRET Survey of Employer-Sponsored Health Benefits: 2005. * Estimate is statistically different from the previous year shown at p<0.05. ^ Estimate is statistically different from the previous year shown at p<0.1. Note: Data on premium increases reflect the cost of health insurance premiums for a family of four. Historical estimates of workers’ earnings have been updated to reflect new industry classifications (NAICS). 05 20 04 20 03 20 02 20 01 20 00 20 99 19 19 97 19 96 19 95 19 94 19 93 19 92 19 91 19 90 19 89 19 88 98 0.8 0 19 9.2* 8.2* THE COMMONWEALTH FUND Figure 2. Deductibles Rise Sharply, Especially in Small Firms, Over 2000–2005* PPO in-network and out-of-network deductibles $900 2000 $750 676 $600 510 469 383 $450 $300 2005 254 210 319 157 $150 $0 In-network Out-of-network Small firms (3–199 employees) In-network Out-of-network Large firms (200+ employees) * Out-of-network deductibles are for 2000 and 2004. Source: J. Gabel and J. Pickreign, Risky Business: When Mom and Pop Buy Health Insurance for Their Employees (Commonwealth Fund, Apr. 2004); KFF/HRET Employer Health Benefits 2005 Annual Survey. THE COMMONWEALTH FUND Figure 3. Percent of Firms Offering Health Benefits Declined Over 2000–2005 Percent of firms offering health benefits 75 69 68 66 66 63 2002 2003 2004 60 50 25 0 2000 2001 2005 THE COMMONWEALTH FUND Source: KFF/HRET Employer Health Benefits 2005 Annual Survey. Figure 4. 47 Million Uninsured in 2005; Increasing Steadily Since 2000 Number of uninsured, in millions 56 60 40 33 31 33 35 35 41 39 40 40 42 43 44 40 40 41 44 45 46 47 20 0 1987 1990 1993 1996 1999* 2002 2005 *1999–2003 estimates reflect the results of follow-up verification questions and implementation of Census 2000-based population controls. Note: Projected estimates for 2006–2013 are for nonelderly uninsured based on T. Gilmer and R. Kronick, “It’s the Premiums, Stupid: Projections of the Uninsured Through 2013,” Health Affairs Web Exclusive, Apr. 5, 2005. Source: U.S. Census Bureau, March CPS Surveys 1988 to 2005. 2008 2011 2013 Projected THE COMMONWEALTH FUND Figure 5. Americans Spend More Out-of-Pocket on Health Care Expenses National health expenditures per capita (US$) 6000 United States 5000 4000 3000 Netherlands 2000 1000 Germany Canada Australia France OECD Median Japana New Zealand 0 0 100 200 300 400 500 600 700 800 900 Out-of-pocket health care spending per capita (US$) a 2002 Note: Adjusted for differences in the cost of living, 2003. Source: B.K. Frogner and G.F. Anderson, Multinational Comparisons of Health Systems Data, 2005, The Commonwealth Fund, April 2006. THE COMMONWEALTH FUND Figure 6. Americans Are Spending More Out-of-Pocket for Health Care Dollars spent per capita (in 2004 dollars) 900 $788 $774 800 700 600 500 400 $667 $577 $583 300 200 100 19 7 19 0 7 19 1 7 19 2 7 19 3 7 19 4 7 19 5 7 19 6 7 19 7 7 19 8 7 19 9 8 19 0 8 19 1 8 19 2 8 19 3 8 19 4 8 19 5 8 19 6 8 19 7 8 19 8 8 19 9 9 19 0 9 19 1 9 19 2 9 19 3 9 19 4 9 19 5 9 19 6 9 19 7 9 19 8 9 20 9 0 20 0 0 20 1 0 20 2 0 20 3 04 0 Source: C. Smith et al., “National Health Spending in 2004: Recent Slowdown Led by Prescription Drug Spending,” Health Affairs 25, no. 1 (Jan./Feb. 2006); Centers for Medicare and Medicaid Services, National Health Expenditures Data; http://www.cms.hhs.gov/NationalHealthExpendData/downloads/tables.pdf THE COMMONWEALTH FUND Figure 7. Adults with Individual Coverage Are More Likely to Spend $5,000 or More Annually on Personal Out-of-Pocket Expenses Percent of adults ages 19–64 insured all year with private insurance Annual out-of-pocket costs $5,000 or more 75 Annual out-of-pocket costs $1,000–$4,999 50 25 41 31 30 4 3 27 27 Total ESI 8 33 0 Individual THE ESI = employer-sponsored insurance. COMMONWEALTH FUND Source: S.R. Collins, J.L. Kriss et al., Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families, The Commonwealth Fund, Sept. 2006. Figure 8. Adults with Higher Deductibles Are More Likely to Spend $1,000 or More on Personal Out-of-Pocket Expenses Percent of adults ages 19–64 insured all year with private insurance Annual out-of-pocket costs $5,000 or more 100 Annual out-of-pocket costs $1,000–$4,999 75 50 25 55 31 4 40 27 2 27 25 Total <$500 13 5 35 42 0 $500–$999 $1,000+ Annual deductible Source: S.R. Collins, J.L. Kriss et al., Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families, The Commonwealth Fund, Sept. 2006. THE COMMONWEALTH FUND Figure 9. One-Quarter of Adults Spent 10 Percent or More of Their Household Income Annually on Family Out-of-Pocket Expenses and Premiums Percent of adults ages 19–64 insured all year with private insurance 100 Spent 5% or more of income on out-of-pocket costs Spent 10% or more of income on out-of-pocket costs 75 50 65 40 43 38 25 25 24 0 Total ESI Individual THE ESI = employer-sponsored insurance. COMMONWEALTH FUND Source: S.R. Collins, J.L. Kriss et al., Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families, The Commonwealth Fund, Sept. 2006. Figure 10. Adults with Higher Deductibles Are More Likely to Spend a Greater Share of Household Income on Family Out-of-Pocket Expenses and Premiums Percent of adults ages 19–64 insured all year with private insurance 100 Spent 5% or more of income on out-of-pocket costs Spent 10% or more of income on out-of-pocket costs 67 75 55 50 25 40 36 25 36 43 22 0 Total <$500 $500–$999 $1,000+ Annual deductible Source: S.R. Collins, J.L. Kriss et al., Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families, The Commonwealth Fund, Sept. 2006. THE COMMONWEALTH FUND Figure 11. Low-Income Households at Most Risk for Spending Greater Shares of Income on Family Out-of-Pocket Expenses and Premiums Percent of adults ages 19–64 insured all year with private insurance Spent 5% or more of income on out-of-pocket costs Spent 10% or more of income on out-of-pocket costs 75 61 57 50 25 42 40 40 37 25 30 21 18 0 Total <$20,000 $20,000– $39,999 $40,000– $59,999 $60,000+ Annual income Source: S.R. Collins, J.L. Kriss et al., Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families, The Commonwealth Fund, Sept. 2006. THE COMMONWEALTH FUND Figure 12. Adults with High Deductibles Are More Likely to Avoid Needed Health Care Because of Cost Percent of adults ages 19–64 insured all year with private insurance 75 <$500 $500–$999 $1,000+ 44 50 25 16 22 27 8 12 19 11 17 26 12 19 24 25 31 0 Did not fill a Did not see Skipped Had medical Any of the four prescription specialist when recommended problem, did not access needed test, treatment, see doctor or problems or follow-up clinic Source: S.R. Collins, J.L. Kriss et al., Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families, The Commonwealth Fund, Sept. 2006. THE COMMONWEALTH FUND Figure 13. Cost-Sharing Reduces Use of Both Essential and Less Essential Drugs and Increases Risk of Adverse Events Percent reduction in drugs per day Elderly Low Income 22 25 10 Elderly 140 120 20 15 Percent increase in incidence per 10,000 14 15 100 Low Income 117 97 78 80 9 43 60 40 5 20 0 0 Essential Less Essential Adverse Events Source: R. Tamblyn et al., “Adverse Events Associated with Prescription Drug Cost-Sharing Among Poor and Elderly Persons,” JAMA, Jan. 24/31, 2001 285(4):421–29. ED Visits THE COMMONWEALTH FUND Figure 14. Adults with High Deductibles Have Problems Paying Medical Bills or Are Paying Off Medical Debt Percent of adults ages 19–64 insured all year with private insurance 75 <$500 $500–$999 $1,000+ 50 25 14 27 23 20 8 9 5 6 13 17 31 17 35 41 23 0 Not able to pay Contacted by Had to change Medical bills/ Any medical bill medical bills collection way of life to debt being paid problem or agency* pay medical off over time outstanding bills debt * Includes only those individuals who had a bill sent THE to a collection agency when they were unable to pay it. COMMONWEALTH FUND Source: S.R. Collins, J.L. Kriss et al., Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families, The Commonwealth Fund, Sept. 2006. Figure 15. Increased Health Care Costs Have Reduced Savings Has increased spending on health care expenses in the past year caused you to do any of the following? Among those with health insurance coverage who had increases in health care costs in the last year (n=731) (percentage saying yes) Decrease your contributions to other savings 45% 34% Have difficulty paying for other bills Use up all or most of your savings 29% Decrease your contributions to a retirement plan, such as a 401(k), 403(b) or 457 plan, or an IRA 26% Have difficulty paying for basic necessities, like food, heat, and housing Borrow money 24% 18% THE COMMONWEALTH FUND Source: EBRI Health Confidence Survey, 2005. Figure 16. Few Insured People Are Currently Covered by High-Deductible Health Plans (HDHP) or Consumer-Directed Health Plans (CDHP) with a Savings Account CDHP 1% HDHP 9% Comprehensive 89% Note: Comprehensive = plan w/ no deductible or <$1000 (ind), <$2000 (fam); HDHP = plan w/ deductible $1000+ (ind), $2000+ (fam), no account; CDHP = plan w/ deductible $1000+ (ind), $2000+ (fam), w/ account. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 17. FEHBP HDHP/HSA Plans Enroll 7,500 Out of 9 Million Covered Lives Percent 10 6.4 5 0.1 0 Percent of FEHBP plans that are HDHP/HSAs Percent of FEHBP enrollees that are in HDHP/HSAs Note: As of March 2005. Source: Government Accountability Office, Federal Employees Health Benefits Program First-Year Experience with High-Deductible Health Plans and Health Savings Accounts, Washington, DC: GAO, Jan. 2006; OPM, http://www.opm.gov/insure/handbook/FEHBhandbook.pdf THE COMMONWEALTH FUND Figure 18. Enrollees Who Chose HDHPs from the Federal Employees Health Benefits Program Are More Likely to Earn Higher Incomes Percent of FEHBP enrollees with incomes > $75,000 75 50 43 23 25 0 HDHP All FEHBP plans Source: Government Accountability Office, Federal Employees Health Benefits Program First-Year Experience with High-Deductible Health Plans and Health Savings Accounts, Washington, DC: GAO, Jan. 2006. THE COMMONWEALTH FUND Figure 19. Age Distribution of HDHP and Other FEHBP Enrollees Percent FEHBP enrollees HDHP enrollees 35 All FEHBP enrollees 30 25 20 15 10 5 0 <23 23–34 35–44 45–54 55–64 65–74 75–99 Source: Government Accountability Office, Federal Employees Health Benefits Program First-Year Experience with High-Deductible Health Plans and Health Savings Accounts, Washington, DC: GAO, Jan. 2006. >99 THE COMMONWEALTH FUND Figure 20. Less than Half of Those Enrolled in Employer-Based High-Deductible Health Plans Had a Choice Percent of adults with employer-based coverage who were offered a choice of health plans 75 58 50 47 45 CDHP (n=134) HDHP (n=334) 25 0 Traditional (n=1016) • CDHP and HDHP owners are less likely to have a choice of plans from their employer • When they have a choice, the savings account is the leading reason for choosing CDHP, while premium cost is the most frequent reason for choosing HDHP. Traditional plans are chosen for low out-ofpocket costs. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 21. Enrollees of HDHP/CDHPs Are Less Satisfied with Their Coverage Percent Comprehensive 75 HDHP CDHP 63 50 33* 42* 25 39* 28 32 29* 26* 8 0 Extremely or very satisfied Somewhat satisfied Not satisfied * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 22. Enrollees of HDHP/CDHPs Are Less Satisfied with Out-of-Pocket Costs Percent Comprehensive HDHP CDHP 75 50 25 57* 54* 42 36 12* 18* 31 28* 21 0 Extremely or very Somewhat satisfied satisfied Not satisfied * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 23. Enrollees of HDHP/CDHPs Are Less Likely to Stay with Their Current Health Plan If They Had the Opportunity to Change Percent of adults 21–64 75 Comprehensive 61 HDHP CDHP 46* 50 30* 37* 28 33* 33* 21 25 11 0 Extremely or very Somewhat likely to likely to stay stay Not likely to stay * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 24. Enrollees of HDHP/CDHPs Are Less Likely to Recommend Their Plan to a Friend or Coworker Percent of adults 21–64 Comprehensive 75 50 25 HDHP CDHP 51 34* 22* 26 34* 31 43* 35* 24 0 Extremely or very likely Somewhat likely Not likely * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 25. Employers’ Contributions Lower for Workers in HSA-Qualified HDHPs; Employees’ Premiums and Deductibles Higher Dollars 4000 3000 Deductible contribution Premium contribution 2000 $1,779 1000 1348 0 $3,413 $2,823 553 3413 $933 323 431 610 HSAqualified HDHP All plans^ Worker contribution 2270 HSAqualified HDHP All plans^ Employer contribution “All plans” refers to all conventional HMOs, PPOs, and POS plans in the survey, not just HDHP/HRA or HSA-qualified HDHPs. Source: Calculated based on G. Claxton et al., “What High Deductible Health Plans Look Like: Findings from a National Survey of Employers, 2005,” Health Affairs Web Exclusive, Sept., 14, 2005; J. Gabel et al., “Health Benefits in 2005: Premium Increases Slow Down, Coverage Continues to Erode,” Health Affairs, Sept./Oct. 2004. ^ THE COMMONWEALTH FUND Figure 26. Enrollees of HDHP/CDHPs Spend Higher Percent of Income on Out-of-Pocket Medical Expenses and Premiums Percent of adults 21–64 spending > 5% of income 100 10%+ of income 92* 5–9% of income 80 66 60 42* 40 20 0 3 r eh p m Co s en 12 9 ive 29* 13* HP D H 53* 31* 9* HP D C Total 17 23* 13 4 r eh p m Co s en ive 35* 18* HP D H 58* 38* 44* 34 (n = 90) 26* 25 12* HP D C (n = 61) 33* 10 r eh p m Co Health problem s en ive HP D H 21 HP D C <$50,000 Annual income * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 27. Enrollees of HDHP/CDHPs Are More Likely to Delay or Avoid Getting Health Care When Sick Due to Cost Percent of adults 21–64 75 Comprehensive HDHP CDHP 48* 40* 50 31* 25 35* 31* (n = 61) (n = 90) 21 17 42* 26 0 Total Health Problem <$50,000 Annual Income * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 28. Enrollees of HDHP/CDHPs Are More Likely To Skip Doses to Make Medications Last Percent of adults 21–64 with prescriptions in last 12 months Comprehensive 60 35* 40 20 HDHP 26* 15 20 CDHP 32 29 (n = 85) 20 21 28 (n = 50) 0 Total Health Problem** <$50,000 Annual Income * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. ** Health problem defined as fair or poor health or one of eight chronic health conditions. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 29. Enrollees of HDHP/CDHPs Are More Likely to Not Fill a Prescription Due to Cost Percent of adults 21–64 75 Comprehensive HDHP CDHP 50 25 26* 16 33* 20 21 26 (n = 90) 27 32 25 (n = 61) 0 Total Health Problem <$50,000 Annual Income * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 30. Most Insured Do Not Have Quality and Cost Information to Make Informed Choices Comprehensive HDHP/CDHP 14% 16% 14 15 Doctors 16 12 Hospitals 15 12 Doctors 42 54 Hospitals 25 45 Doctors 15 36 (n = 76) Hospitals 14 32 (n = 76) Health plan provides information on quality of care provided by: Doctors Hospitals Health plan provides information on cost of care provided by: Of those whose plans provide info on quality, how many tried to use it for: Of those whose plans provide info on cost, how many tried to use it for: Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. THE COMMONWEALTH FUND Figure 31. Cost Conscious Decision-Making, by Insurance Source Percent of adults 21–64 who received health care in last 12 months 49 Checked whether plan would cover care 60* 43 Talked to doctor about treatment options & costs 55* Asked doctor to recommend less costly prescription drugs 27 44* 23 Checked price of service Comprehensive 32* HDHP/CDHP 14 Checked quality rating of doctor or hospital 19 0 25 50 * Difference between HDHP/CDHP and Comprehensive is statistically significant at p < 0.05 or better. Source: P. Fronstin, S.R. Collins, Early Experience with High-Deductible and Consumer-Driven Health Plans: Findings From the EBRI/Commonwealth Fund Consumerism in Health Care Survey, EBRI Issue Brief, Dec. 2005. 75 THE COMMONWEALTH FUND Figure 32. HSAs Won’t Solve the Cost Problem: Most Costs Are Concentrated in the Very Sick Distribution of health expenditures for the U.S. population, by magnitude of expenditure, 1997 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Expenditure threshold (1997 dollars) 1% 5% 10% 50% U.S. Population 27% $27,914 55% $7,995 69% $4,115 97% $351 Health Expenditures Source: A.C. Monheit, “Persistence in Health Expenditures in the Short Run: Prevalence and Consequences,” Medical Care 41, supplement 7 (2003):III53–III64. THE COMMONWEALTH FUND Figure 33. Uninsured Rates High Among Adults with Low and Moderate Incomes, 2001–2005 Percent of adults ages 19–64 75 Insured now, time uninsured in past year Uninsured now 49 50 16 25 28 24 26 9 9 9 52 53 15 16 28 33 37 37 15 17 18 0 35 11 41 13 11 17 24 28 16 18 13 9 7 9 6 7 9 4 4 3 2 7 3 2001 2003 2005 2001 2003 2005 2001 2003 2005 2001 2003 2005 2001 2003 2005 Total Low income Moderate income Middle income High income Note: Income refers to annual income. In 2001 and 2003, low income is <$20,000, moderate income is $20,000– $34,999, middle income is $35,000–$59,999, and high income is $60,000 or more. In 2005, low income is <$20,000, moderate income is $20,000–$39,999, middle income is $40,000–$59,999, and high income is $60,000 or more. Source: S.R. Collins et al., Gaps in Health Insurance Coverage: An All-American Problem—Findings from the Commonwealth Fund Biennial Health Insurance Survey, The Commonwealth Fund, Apr. 2006. THE COMMONWEALTH FUND Figure 34. Distribution of Uninsured Young Adults 19–29 by Poverty Status, 2004 200% FPL or more 31% Less than 100% FPL 40% 100%– 199% FPL 29% Source: S.R. Collins, C. Schoen, J.L. Kriss et al., Rite of Passage? Why Young Adults Become Uninsured and How New Policies Can Help, The Commonwealth Fund, updated May 2006. THE COMMONWEALTH FUND Figure 35. HSAs Won’t Solve the Uninsured Problem: Income Tax Distribution of Uninsured 5% (27% tax bracket) 1% (30%–39% tax bracket) 23% (15% tax bracket) 55% (0% tax bracket) 16% (10% tax bracket) Source: S.A. Glied, The Effect of Health Savings Accounts on Health Insurance Coverage, The Commonwealth Fund, Apr. 2005. THE COMMONWEALTH FUND Figure 36. Individual Market Is Not an Affordable Option for Many People Adults ages 19–64 with individual coverage or who thought about or tried to buy it in past three years who: Total Health problem No health problem <200% poverty 200%+ poverty 34% 48% 24% 43% 29% Found it very difficult or impossible to find affordable coverage 58 71 48 72 50 Were turned down or charged a higher price because of a pre-existing condition 21 33 12 26 18 Never bought a plan 89 92 86 93 86 Found it very difficult or impossible to find coverage they needed Source: S.R. Collins, J.L. Kriss et al., Squeezed: Why Rising Exposure to Health Care Costs Threatens the Health and Financial Well-Being of American Families, The Commonwealth Fund, Sept. 2006. THE COMMONWEALTH FUND Figure 37. Lacking Health Insurance for Any Period Undermines Quality and Efficiency Percent of adults ages 19–64 with at least one chronic condition* Uninsured now 75 59 Insured now, time uninsured in past year Insured all year 58 50 35 27 18 25 16 0 Skipped doses or did not fill Visited ER, hospital, or both for prescription for chronic condition chronic condition because of cost * Hypertension, high blood pressure, or stroke; heart attack or heart disease; diabetes; asthma, emphysema, or lung disease. Source: S.R. Collins et al., Gaps in Health Insurance Coverage: An All-American Problem— Findings from the Commonwealth Fund Biennial Health Insurance Survey, The Commonwealth Fund, Apr. 2006. THE COMMONWEALTH FUND Figure 38. Adults Without Insurance Have More Problems With Lab Tests and Records Percent of adults ages 19–64 reporting the following problems in past two years: Insured all year 75 Uninsured during the year 50 25 15 23 10 19 19 30 26 41 0 Test results or Duplicate tests Never received Any lab test/ records not ordered lab/diagnostic test record problem available at time of results or delay in appointment receiving abnormal results Source: S.R. Collins et al., Gaps in Health Insurance Coverage: An All-American Problem— Findings from the Commonwealth Fund Biennial Health Insurance Survey, The Commonwealth Fund, Apr. 2006. THE COMMONWEALTH FUND