SALES TAXES AND ELECTRONIC COMMERCE

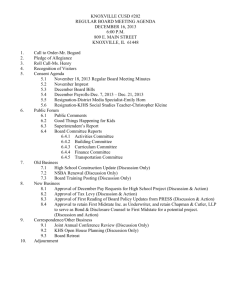

advertisement

SALES TAXES AND ELECTRONIC COMMERCE William F. Fox, Director Center for Business and Economic Research The University of Tennessee June 1999 ROLE OF STATE AND LOCAL GOVERNMENTS Provide the Public Services that • Enhance Quality of Life • Are the Backbone of a Productive Economy W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 SHARE OF SERVICES S&L Federal 100 Percent 80 60 40 20 0 K-12 Educ Higher Ed W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 Police/Fire Highways ROLE OF SALES TAXES IN STATE AND LOCAL FINANCE Imposed in 45 States Plus D.C. 6,600 Local Governments W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 SHARE OF TAX REVENUES Other 19.2% Property 30.4% Corp. Income 4.6% Income 21.3% Sales 24.5% W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 IS THE SALES TAX A CONSUMPTION TAX? Intent is to Tax Consumption Nonetheless, Sales Tax Base Differs from Consumption • Much Consumption is Exempt – Most services – Some Goods • Many Business Purchases are Taxable W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 SALES TAX BASE DIFFERS WIDELY (Sales Tax Base as a Share of Personal Income, 1997) Greater than 50% 40% to 50% Less than 40% W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 No sales tax IS THE SALES TAX A CONSUMPTION TAX? Intent is to Tax Consumption Nonetheless, Sales Tax Base Differs from Consumption • Much Consumption is Exempt – Most services – Some Goods • Many Business Purchases are Taxable Must be Destination Based--Use Tax W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 TAX BASE HAS NARROWED OVER TIME (Sales Tax Base as a Percent of Personal Income) 60 50 Percent 40 30 20 10 0 1979 W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 1997 TAX BASE HAS NARROWED OVER TIME Services Grow Faster than Goods W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 PERSONAL CONSUMTPION EXPENDITURES, 1979 and 1998 Total Expenditure Durable Goods Autos Other Durables Nondurable Goods Food and Beverage Other Nondurables Services 1979 Percent 100 13.4 5.9 2.4 39.1 20.3 18.8 47.4 W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 1998 Percent 100 12.3 4.8 2.4 28.6 14.0 14.6 59.1 TAX BASE HAS NARROWED OVER TIME Services Grow Faster than Goods Legislated Business Exemptions W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 TAX BASE HAS NARROWED OVER TIME Services Grow Faster than Goods Legislated Business Exemptions Other Legislated Exemptions W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 TAX BASE HAS NARROWED OVER TIME Services Grow Faster than Goods Legislated Business Exemptions Other Legislated Exemptions Remote Purchases • Cross Border Shopping • Mail Order Shopping • Electronic Commerce W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 STATE RESPONSE--RAISE RATES 6.0 Median Rate 5.0 4.0 3.0 2.0 1.0 0.0 1970 1980 W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 1990 STATE SALES TAX COLLECTIONS AS A PERCENT OF GDP Percent 2 1 0 1972 1977 1982 1987 1992 1993 1994 1995 1996 1997 POTENTIALLY TAXABLE E-COMMERCE EVENTS Tangible Goods and Services Sold over the Internet Digitized Services Sold Over the Internet Access to the Internet W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 GOALS IN DESIGNING TAX STRUCTURES Neutrality • Tax Functionally Equivalent the Same • Destination Basis W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 GOALS IN DESIGNING TAX STRUCTURES Neutrality • Tax Functionally Equivalent the Same • Destination Basis Equity • Vertical--Difficult with the Sales Tax • Horizontal--Broad Tax Base W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 GOALS IN DESIGNING TAX STRUCTURES Appropriate Revenue Growth Path W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 GOALS IN DESIGNING TAX STRUCTURES Appropriate Revenue Growth Path Ease of Administration and Compliance • E-Commerce Presents Some Problems • Simplification by States Should be Required W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 GOALS IN DESIGNING TAX STRUCTURES Neutrality Equity Revenue Growth Administrative and Compliance Ease W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 SOME OPTIONS TO TAXING REMOTE COMMERCE Reduce State and Local Spending Growth Raise Sales Tax Rates More Federal Finance of State and Local Government W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 FEDERAL TRANSFERS AS A PERCENT OF GENERAL REVENUE 25 Percent 20 15 10 5 0 70 72 74 76 78 80 82 84 W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999 86 88 90 92 94 96 SOME OPTIONS TO TAXING REMOTE COMMERCE Reduce State and Local Spending Growth Raise Sales Tax Rates More Federal Finance of State and Local Government Alternative Own-Source Revenues • Personal Income Tax • Business Taxes • Property Taxes W.F. Fox, Center for Business and Economic Research, UT Knoxville, June 1999