Henry Simons and the Chicago School of Economics Douglas Irwin Dartmouth College

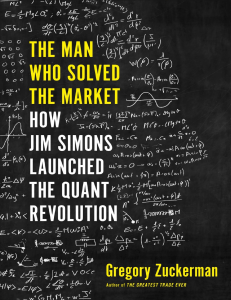

advertisement

Henry Simons and the Chicago School of Economics Douglas Irwin Dartmouth College • “the Crown Prince of that hypothetical kingdom, the Chicago School of Economics” – George Stigler Simons most famous for Positive Program for Laissez Faire 1. Promote competitive (not free) markets 2. Monetary stability through rules 3. Tax policy to reduce inequality 4. Free trade 5. Limit advertising Problems of the 1930s Simons says • Competitive markets – Suspicious of concentrated power, want decentralization – Aggressive antitrust policy, eliminate monopolies – Oppose government restrictions on competition • Monetary stability – 100% money – Price-level rule • Main point: if you can ensure economic stability through sound monetary policy, the competitive market system will work well • Point comes from 1930s, but message resonates beyond 1930s Friedman’s 1967 Simons lecture Stigler’s 1958 Simons Lecture Stigler • Early research questions: – Extent and Basis of Monopoly (AER, 1942) • “the major factor in the decline of competition has been governmental support of monopoly” – “The Case against Big Business” Fortune (1955) – Favored Sherman Antitrust Act and merger restrictions – Questioned benefits of public regulation • 1961: “I believe the increasing public hostility toward both big business and big unions is not justified by any increases in their power. The amount of power possessed by a big business or a big union is usually very small, so that even with the worst will in the world . . . do only a very modest amount of damage to the community.” • “I find his monetary theory sophisticated and modern, but his policy recommendations unacceptable.” – Milton Friedman (1967) • “I am no longer a faithful follower, although I am still an admirer, of Frank Knight and Henry Simons” – George Stigler (1985)