Worst-Case Bounds on R&D and Pricing Distortions:

advertisement

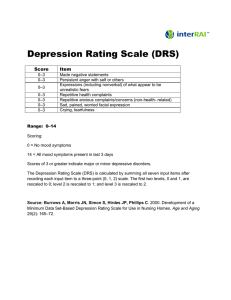

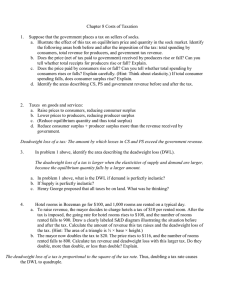

Worst-Case Bounds on R&D and Pricing Distortions: Theory and Disturbing Conclusions if Consumer Values Follow the World Income Distribution Michael Kremer Harvard University Christopher Snyder Dartmouth College Introduction Theory paper investigating basic (textbook) micro questions regarding rents and distortions on unregulated markets Distortions • How large can distortions possibly be on an unregulated market? • What is source of more distortion? o Intensive margin (supra-competitive pricing, leading to Harberger triangle) o Extensive margin (distorted investment incentives) Worst-case scenarios • How bad can distortion be on a given market? • Worst case among class of markets based on properties of demand curve Key object is monopoly surplus-extraction ratio 𝝆∗ • Look at which demand shapes are lucrative and which not Plan Surplus extraction ratio 𝜌∗ → max.deadweight loss → policy implications ↑ Suite of results characterizing Calibrations • Consider generic demand curves based on world income distribution • Resemble worst case (STRZ). Another reason to worry about income distribution? Basic Ideas 1 𝐴 1/2 𝐵 𝐶 1/2 1 𝑄(𝑝) Figure 1: Numerical example Basic Ideas 𝑝 1 1/2 1/2 1 𝑄(𝑝) Figure 2: STRZ demand curve Literature Vaccines versus Drugs • Spin off paper from Kremer & Snyder (2015) • Zipf distribution of disease risk limits ability to extract rent with vaccine • Risk resolves when drug sold, leading to possible bias against vaccines • Ideal laboratory for general ideas here, plus calibrations and empirical tests Equal revenue (STRZ) demand • Maleug & Snyder (2006) bounding profitability of price discrimination • Hartline & Roughgarden (2009) compare worst case from auction mechanisms • Brooks (2013) optimality of proposed auction mechanism • Bergemann, Brooks & Morris (2014) general welfare results for price discrimination Rent extraction and efficiency • Makowski & Ostroy (1995, 2001) Shape of demand curves • Anderson & Renault (2003); Johnson & Myatt (2006); Garber, Jones & Romer (2006); Weyl & Fabinger (2013); Fabinger & Weyl (2015) Innovation incentives • Dosi (1988); Freeman (1994); Acemolu & Linn (2004); Weyl & Tirole (2012); Budish, Roin, & Williams (2013) Model Consumer side • Demand 𝑄(𝑝) nonincreasing, left-cont. • Covers discrete, mixed cases • Inverse demand 𝑃(𝑞) • Choke price 𝑝0 • Max. conceivable valuation 𝑝max Producer side • Start with monopoly case • Unit production cost 𝑐 • To enter, need fixed R&D 𝑘 • Entry decision indicator 𝐸 Ex post surplus Ex ante surplus • Profit Π 𝑝 = 𝑃𝑆 𝑝 − 𝑘 • Welfare 𝑊 𝑝 = 𝑇𝑆 𝑝 − 𝑘 𝑝0 • Consumer surplus 𝐶𝑆 𝑝 = 𝑝 𝑄 𝑥 𝑑𝑥 • Producer surplus 𝑃𝑆 𝑝 = 𝑝 − 𝑐 𝑄(𝑝) • Total surplus 𝑇𝑆 𝑝 = 𝐶𝑆 𝑝 + 𝑃𝑆(𝑝) Asterisks • One asterisk indicates equilibrium o 𝑝∗ = argmax 𝑃𝑆 𝑝 o Π ∗ = Π(𝑝∗ ) • Two asterisks indicate first best o 𝑝∗∗ = 𝑐 o 𝑊 ∗∗ = 𝑊(𝑐) o 𝐸 ∗∗ = 1 if 𝑊 ∗∗ > 1 Deadweight loss • Static o Just intensive = pricing margin o Conditional on entry o 𝑆𝐷𝑊𝐿 𝑝 = 𝑇𝑆 ∗∗ − 𝑇𝑆(𝑝) • Dynamic o Extensive and intensive margins o 𝐷𝑊𝐿∗ = 𝐸 ∗∗ 𝑊 ∗∗ − 𝐸 ∗ 𝑊 ∗ Model Bounding Deadweight Loss Theorem 1. In a monopoly market, the total surplus that cannot be extracted by a firm provides a tight upper bound on the level of deadweight loss, i.e., sup 𝐷𝑊𝐿∗ = 𝑇𝑆 ∗∗ − 𝑃𝑆 ∗ 𝑘≥0 Definition. Surplus-extraction ratio 𝜌∗ = 𝑃𝑆 ∗ 𝑇𝑆 ∗∗ . Theorem 2. In a monopoly market, one minus the surplus-extraction ratio provides a tight upper bound on the relative deadweight loss, i.e., sup 𝑘≥0 𝐷𝑊𝐿∗ 𝑇𝑆 ∗∗ = 1 − 𝜌∗ . Theorem 3. The social loss from banning price discrimination is tightly bounded above by 𝐷𝑊𝐿∗ , as is the social gain from subsidy policies. General Oligopoly Models Assumption 1. 𝑃𝑆 ∗ = 𝑃𝑆(1). Assumption 2. 𝑃𝑆(1) ≥ 𝑃𝑆(𝑛). Assumption 3. 𝑃𝑆 ∗ (𝑛) ≥ 𝑘𝑖 for all the 𝑖 = 1, … , 𝑛 actual entrants. Theorem 4. Consider any model of competition 𝐶 satisfying preceding assumptions and any number of potential entrants 𝑁 ≥ 1. The upper bound on relative deadweight loss is weakly higher than under monopoly: sup 𝑘𝑖 ≥0|𝑖=1,…,𝑁 𝐷𝑊𝐿∗ (𝐶, 𝑁) ≥ 1 − 𝜌∗ , ∗∗ 𝑇𝑆 where 𝐷𝑊𝐿∗ (𝐶, 𝑁) is the deadweight loss in model 𝐶 with 𝑁 firms and 𝜌∗ is the monopoly surplus-extraction ratio. Characterizing 𝝆∗ Rescaled demand • Rescaled consumer value 𝑥= 𝑝−𝑐 . 𝑝max −𝑐 • Rescaled demand Φ 𝑥 =Φ 𝑝−𝑐 𝑝max −𝑐 = 𝑄(𝑝) . 𝑞 ∗∗ • Think of in distributional terms, with 𝑥 a random variable and Φ 𝑥 the survivor Function. Lemmas 1-2. The surplus-extraction ratio satisfies 𝜌∗ = max 𝑥Φ 𝑥 1 0 Φ 𝑥 𝑑𝑥 = 𝑅𝐸𝐶 ∗ . 𝜇 STRZ Demand STRZ demand Φ 𝑥, 𝜇 = min 𝐴(𝜇) ,1 𝑥 where 𝐴(𝜇) satisfies 𝜇 = 𝐴(𝜇) 1 − ln 𝐴(𝜇) . • Equal revenue, unit-elastic, etc. • Symmetrically truncated Zipf distribution • Capped at 1 to be rescaled demand, constant 𝐴(𝜇) set so mean value is 𝜇. Proposition 2. The STRZ demand curve is the unique (almost everywhere) minimizer of producer surplus among rescaled demands whose mean rescaled value is at least 𝜇. STRZ Demand Decomposition Zipf similarity 𝑍= 1−𝜌∗ 1−𝜌(𝜇) Decomposition 𝜌∗ = 1 − 𝑍 1 − 𝜌(𝜇) • Worse potential for DWL with o Zipf-similar distributions o Low mean rescaled values (i.e., low mean to peak consumer values) Static Inefficiency Proposition 3. Consider a market with STRZ rescaled demand Φ 𝑥, 𝜇 . There exists a monopoly equilibrium in this market in which static deadweight loss as a proportion of total surplus 𝑆𝐷𝑊𝐿∗ 𝑇𝑆 ∗∗ = 1 − 𝜌(𝜇), strictly greater than in any other market with a rescaled demand that is not almost everywhere identical but with the same mean rescaled value 𝜇. Proposition 4. In a given market, 𝑆𝐷𝑊𝐿∗ 𝑇𝑆 ∗∗ is bounded above by 𝑍 1 − 𝜌(𝜇) . Static deadweight loss is vanishingly small in the limit as 𝑍 ↓ 0 or 𝜇 ↑ 1. Implies that static distortion can approach dynamic distortion but only in one equilibrium of one special case. Specific Distributions Discrete Proposition 5. Consider a set of markets in which the distribution of consumer values 𝑋 has 𝑇 discrete types. Then 1 𝑇 is a tight lower bound on 𝜌∗ . Example. Consider market with two types which have a Zipf distribution. Then 𝐴 𝐴 𝜌∗ = 𝐴+𝐵+𝐶 = 2𝐴+𝐵 , which converges to ½ in limit 𝜇 =𝐴+𝐵+𝐶 →0 Specific Distributions Beta Specific Distributions Means, medians, modes Theorem 5. Letting 𝜇 be the mean and 𝑚 the median of the distribution of rescaled consumer values, the monopoly surplus-extraction ratio has the following lower bound: 1 𝑚 𝜇 𝜌∗ ≥ 2 . Proof: 𝜌∗ = 𝑥 ∗ Φ (𝑥 ∗ ) 𝜇 ≥ 𝑚Φ 𝑚 𝜇 = 𝑚/2𝜇 because can always set price at median of distribution. Proposition 7. Assume 𝑋 is a unimodal random variable for which max(𝑚 − 𝑋, 0) weakly first order stochastic dominates max(𝑋 − 𝑚, 0). Proof: This is a general condition for the mean, median, mode inequality from Dharmadhikari and Joag-dev (1988). Proposition 8. Assume 𝑋 is unimodal. Then 1 𝜌∗ ≥ 2 1 − 𝜎 0.6 𝜇 . Proof: Corollary 4 of Basu and DasGupta (1997) states 𝜇 − 𝑚 /𝜎 ≤ 0.6. Specific Distributions General demand curvature Definition. Demand function Φ is 𝑐-concave if and only if Φ′′ 𝑋 Φ𝑋 Φ′𝑋 2 ≤ 1 − 𝑐. Proposition 10. Suppose rescaled demand Φ is twice continuously differentiable. If Φ is 𝑐-concave for 𝑐 > −1, then 𝜌∗ ≥ 1 1/𝑐 1+𝑐 1 𝑒 𝑐≠0 𝑐 = 0. The reverse inequality holds if Φ is 𝑐-convex for 𝑐 > −1. Proof: Use Proposition 5 of Anderson and Renault (2003). World Income Calibration Figure 12: World income distribution from Pinkovsky and Sala-i-Martin (2009) Figure 13: Calibrated producer surplus using 2006 data