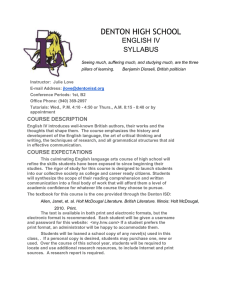

United States Economics Instructor: Mail:

advertisement

United States Economics Instructor: Telephone: Web Page: Tutorials: Richard Bragg E-Mail: rbragg@dentonisd.org (940)369-1099 Conference Period: 5 th AB http://www.dentonisd.org/5222062105452570/site/default.asp M-Th 4:10-4:30 pm. Friday : 8:15 – 8:45 am. COURSE DESCRIPTION: United States Economics is a one-semester course which helps the students’ understand events and conditions in the economy. The study of economics deals with how society addresses the allocation of scarce resources. The course addresses that economics decisions involve making trade-offs that will include both costs and benefits. The theoretical content will cover all the basic economics principles and practices such as supply and demand, inflation, employment, resource management, government spending, economic stability-instability. This course provides opportunities to use analytical skills based on knowledge gained within the course. The course also provides a practical approach to address the “personal finance” requirements recently required by the Texas Education Agency. The goal of the personal finance component is to prepare students to make informed decisions about spending, savings, investments, credit, and other matters concerning financial success. Grading Policy Grades will be in one of two categories: Major Summative Assessments and Minor Summative Assessments. Major grades will consist of test, projects, essays, and presentations. There will be a minimum of three major grades per nine weeks, with a least one major grade per unit. Minor grades will consist of Quizzes, developmental activities, homework. Major Summative: 70 % of final 9 weeks grade Minor Summative: 30 % of final 9 weeks grade Reassessment opportunities may be earned by meeting criteria included but limited to the following: Teachers may require that all late work tied to that assessment must be completed and demonstrate mastery in order to earn reassessment Teacher may require tutorials be attended in order to earn reassessment Teacher may require review materials be completed in order to earn reassessment Teachers will set a deadline for reassessments to be completed in a timely manner. As a general guideline the reassessment must be completed within one week of the primary assessment. Teachers will provide at least one opportunity for reassessment Students may only have one additional attempt at showing mastery Reassessment is worth full credit Teacher may require a “Request to Reassess” form be submitted Semester Exams will not qualify for reassessment. Possible Major and Minor Assessments and Formative Assignments MAJOR ASSESSMENTS: Teaching tools designed to evaluate understanding (including but not limited to the following): Unit Exams Evaluative Writing Projects Conceptual assignments Chapter Tests Seminars MINOR ASSESSMENTS: Teaching tools designed to check for understanding, addressing a smaller set of learning objectives as compared to the major assessments (including but not limited to the following): Quizzes Developments Writing Developmental Activities Homework Chapter Quizzes Seminars FORMATIVE ASSIGNMENTS: This developmental work is used to help students acquire a skill or knowledge. Formative assignments may be used for practice. This practice is “designed to provide direction for improvement and / or adjustment of teaching.” (including but not limited to the following): Homework Classroom Activities Key Concept Terms Graphic Organizers Notes from Flipped Lessons Developmental Activities Seminar Preparation Disciplinary Action Actions that impede the learning process such as: not completing assignments, not participating in class, chronically turning in late work, etc. may be met with disciplinary measures. Students will have due dates and deadlines. Teachers and the Assistant Principles will be involved in the disciplinary measures that include, but are not limited to: Detention Saturday School ISSC Loss of Parking Permit Loss of Dismissal Period Classroom Expectations: It is my goal to provide a classroom culture that invites analytical thinking, encourages creativity, and demands academic success. Students should be punctual, prepared, and an active participant in order to receive the maximum benefit of this educational learning experience. Classroom Management: All school rules and policies will be observed throughout this course. Also, the students will be responsible for arriving on time, being prepared, participating in class, and maintaining their work area. GHS policy requires name badges to be worn and students to dress within dress code. Food, drink and gum are not permitted within the GHS classroom. Minor infractions will be handled through verbal conference, parent contact, or teacher detention. Frequent or major infractions will be referred to the office. Curriculum and Textbook: Textbook: Economics Networks ( McGraw Hill) Texas Essential Knowledge and Skills: http://www.tea.state.tx.us/ssc/teks_and_taas/teks/teksecon.htm Classroom Topic Outline: Fundamental Economic Concepts What is Economics? Economic Systems and Decision Making Business Organizations Microeconomics Demand Supply Prices and Decision Making Market Structures Macroeconomics: Institutions Employment, Labor, and Wages Sources of Government Revenue Government Spending Money and Banking Financial Markets Macroeconomics: Policies Economic Performance Economic Instability The Fed and Monetary Policy Achieving Economic Stability International and Global Economics International Trade Comparative Economic Systems Developing Countries Global Economic Challenges Personal Finance: Understanding interest, avoiding and eliminating credit card debt Understanding the rights and responsibilities of renting or buying a home Managing money to make the transition from renting a home to ownership Starting a small business Being a prudent investor in the stock market and using other investment options Beginning a savings program and planning for retirement Bankruptcy The types of bank accounts available to consumers and the benefits of maintaining a bank account Balancing a check book The types of loans available to consumers and becoming a low-risk borrower Understanding insurance Charitable giving Guyer High School . . . Where the Tradition Begins and Excellence Continues “Knowledge, Integrity, Courage”