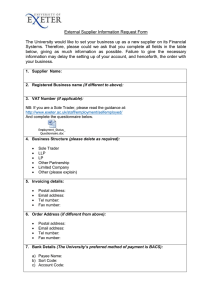

ICAEW Accredited Products Scheme Personal & Partnership Tax [Company Name]

advertisement

![ICAEW Accredited Products Scheme Personal & Partnership Tax [Company Name]](http://s2.studylib.net/store/data/015571590_1-e5f921af4a3799b4fa506cccd22486e3-768x994.png)