Econ 351: Intermediate Empirical Economics February 2013

advertisement

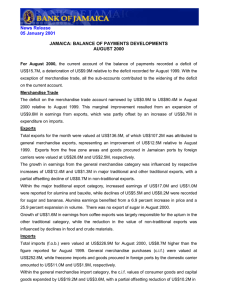

Econ 351: Intermediate Empirical Economics WS #2: Exercises and Issues for Discussion on the Balance of Payments February 2013 1. Table 1 shows the balance of payments for India in millions of US dollars. (i) In the upper panel of the table, calculate trade balance; net nonfactor services; net income; net private transfers; current account balance; balance on capital account; net foreign direct investment; net loans; overall balance; and monetary movements. (The relevant rows are highlighted in yellow). (ii) In the lower panel, calculate the ratio to GDP for the following items: current account, trade balance, net non-factor services, net private transfers, net transfers, net income, and net FDI, and portfolio investment (the relevant rows are highlighted in yellow). What conclusions can be drawn from the evolution of the current account and the trade balance, and what accounts for the deviations between these two balances? (iii) In the lower panel under memorandum items, calculate the import coverage of gross reserves (the relevant row is highlighted in yellow). 2. How is the balance of payments affected if (a) an estimated €20 million in exports have not been reported, and (b) if there is an estimated unreported capital outflow of €20 million? 3. From the data on export and import values and unit values provided in Table 2: (i) Calculate the following: annual percent changes in the value, volume, and prices of merchandise exports and merchandise imports (the relevant columns are highlighted in yellow). (ii) What were the main factors driving exports and import values—prices or volume? (iii) Calculate the terms of trade index and the changes in the terms of trade. 4. How does the existence of unrecorded trade affect the analysis of the balance of payments? 5. Tables 3 and 4 provide data on the structure of merchandise exports and imports. Calculate the share of each category in total exports and imports. Comment on the evolution of the structure of merchandise trade. 1 6. Tables 5 and 6 show the direction of trade for imports and exports. Calculate the share of each partner country in total exports and imports. Comment on the evolution of the direction of trade. 7. Review Table 1 on the capital account. Under memorandum items, calculate total debt-creating flows and non-debt creating flows, in both nominal terms and in share of total financial inflows. (Assume that portfolio investment is non-debt creating). 8. In Table 8, calculate the various indicators of debt and debt service burden, and relate the change in the debt burden to flows in the capital account in Table 1. 9. Based on the balance of payments table, discuss the nature and sources of imbalances in the external accounts, and how this affects the debt position. 2