Lecture Notes for Chapter 14 and 15

advertisement

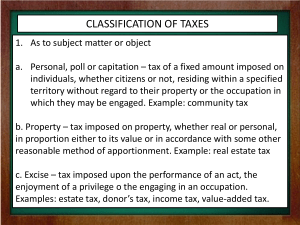

Lecture Notes for Chapter 14 and 15 Chapter 14-Taxes and Government Spending As citizens of the United States we authorize the G____________________, through our elected O__________________and through the C____________________to raise money in the form of T__________________. A T__________is a required P__________________to a local, state or national government. Taxes give the government the F__________________it needs to operate. The C________________ specifically limits certain kinds of T______________. First, the P__________________of a tax must be for the “Common D______________________ and general W_______________________.” A tax cannot bring in M_____________for individual I_______________. F_________________taxes must be the same in every S____________________. Congress cannot tax church S_______________ because that would violate the freedom of R_______________and separation of C________________and S_______________. Taxes are not charged on E__________________goods leaving the country, and taxes must be imposed on the states according to their P_____________________. Types of Taxes: Property tax: Tax on the V_____________of homes. This is the basis for how public S_______________are funded. Corporate tax: Based on the V____________________of a company’s P_______________. Proportional tax: A T________where the P_______________of income paid in taxes is the S____________for all I_____________levels. ( Rich and P_______________pay the same.) Progressive tax: A t___________where the P____________of income paid in taxes increases as I_______________ increases. (This is our federal income tax system in the US) Example: A person who earns $12,000 would be taxed at 20%, but if he makes $60,000 his tax rate I_____________to 60%. Regressive tax: A tax where the P_____________of income paid in taxes decreases as I___________________increases. Example: Sales tax is considered a R_________________tax because H_____________income households spend a L______________proportion of their income in sales tax than low income households. Withholding: A method of taking out T_____________from an individual’s paycheck B______________he or she gets it. This is also called P_______ as you G_________ taxation. The G_________________believes that it is E_________________for us to pay taxes in every P_____________than to make a large payment at the end of the Y______________. A tax R_____________is the form used to file I________________ taxes. Our T_____________income is our G___________income minus any E_________________ and deductions. An E_________________ is a fixed amount based on ourselves, our S______________, and any D__________________. A deduction is a variable amount that can be S________________from taxes owed. For example: M_____________expenses, charitable D____________, work-related E___________________. FICA: Federal I________________ Contribution Act. This funds Social S_______________ and M___________________. Social Security: Insurance for the E___________ and R_____________ as well as survivors and those with D___________________. Medicare: A N__________________health C______________program that helps pay for H____________coverage for those 65 years and older and also for people with certain D_____________________. Medicaid: I__________________program for L_______ income families, those with D__________________, and E_____________people in N________________homes. Other Types of taxes: Tariff: Tax imposed on I_____________goods. Tariffs are often added into the C________of the good when we B_____________it. Excise tax: T___________placed on the S________or production of a good. Examples: There are excise taxes on G___________________, alcoholic B______________, telephone services, cable T___________ and motor O____________. Estate tax: Placed on the total value of P________________ or money of someone who has D____________. It is paid out of the person’s E______________before the heirs can receive their S______________. An estate can include P_______________, jewelry, furniture, paintings, cars, and life insurance. Gift tax: A tax on M_____________or property that a L____________person gives to someone. This was imposed to keep people from avoiding estate taxes. State Taxes: We are taxed on our I_______________, P_________________, and goods and S________________. State taxes help fund public safety, E_____________________, highways, transportation, welfare, arts, recreation, and S______________ of public officials. Chapter 15-Fiscal Policy Fiscal Policy refers to the F_________________government’s use of T___________and spending to keep the E_____________stable. The fiscal year is a _______month time period used for B____________ and record keeping. The F__________government’s F___________ year is October 1st to September 30th. The Federal B_________________is a written document that tells the amount of M____________the government E____________to receive that year and H_________it will be S_______________. A budget surplus occurs when the R___________exceeds S___________________. A budget D_____________is when the government S___________more than it T____________in. The national D___________is all of the money the F__________government owes to all bond holders. Every year there is a D_____________and the government B_______________from investors. These I____________are people who have B______________Treasury B_____________, bills, or other notes. What is the difference between deficit and debt? The D_____________is the amount of money the government owes and the D_____________is the amount of money the G_______________owes minus any revenue. Expansionary Policy: Any P_____________that the G________________uses to encourage economic G_________. This happens when taxes are L__________and the government S____________more money. A contractionary policy R____________ economic growth. This happens when tax rates are H___________ and government spending is L________________. (This is one reason people say the economy is better during a war. The government spends more on defense, more people have jobs, and taxes are generally lower.) To control fiscal policy the government uses a powerful tool called the multiplier effect. The idea is that for every O________ dollar spent; this creates M_______than O________dollar of economic activity. So in other words the effects of the fiscal policy are M__________________. Example: To prevent a recession the government spends an extra 700 billion dollars to stimulate the economy and hope that increases GDP and production of goods and S_______________ by another 700 billion.