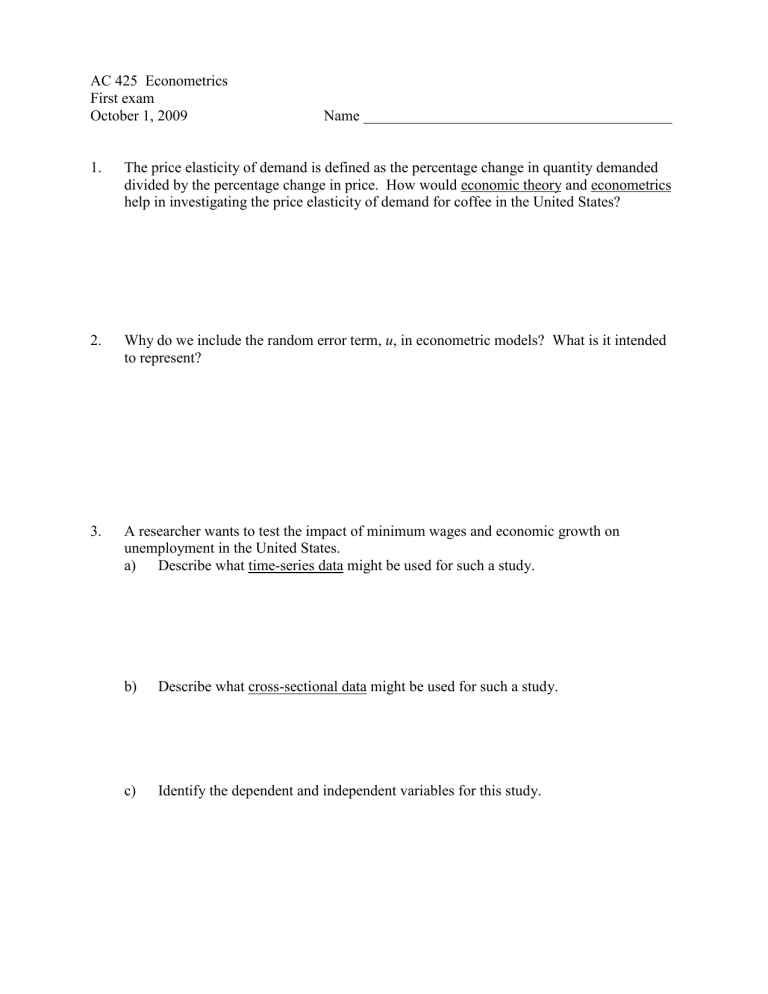

AC 425 Econometrics First exam October 1, 2009 Name _________________________________________

AC 425 Econometrics

First exam

October 1, 2009 Name _________________________________________

1.

The price elasticity of demand is defined as the percentage change in quantity demanded divided by the percentage change in price. How would economic theory and econometrics help in investigating the price elasticity of demand for coffee in the United States?

2.

Why do we include the random error term, u , in econometric models? What is it intended to represent?

3.

A researcher wants to test the impact of minimum wages and economic growth on unemployment in the United States. a) Describe what time-series data might be used for such a study. b) Describe what cross-sectional data might be used for such a study. c) Identify the dependent and independent variables for this study.

4.

Indicate whether each of the following is a discrete (D) or continuous (C) variable.

Variable D or C

Number of economics majors

Age

Inflation rate

5.

(This part of the exam is easier if you do it by hand, after printing out this page.) Draw a normal distribution for W~N(20,4). Label the horizontal and vertical axes as well as the standard deviation and the mean. Shade the region that represents the probability of an observation falling within two standard deviations of the mean.

6.

Heights of college students follow a normal distribution H~N(66,36). a) Suppose a single college student is selected at random. Complete the following table using Excel to calculate the probability of the height of that student falling in the ranges indicated.

Probability

H > 69

H < 60

60 < H < 72 b) Suppose a sample of 25 students is taken. A mean height of the students is calculated

= H-bar. Complete the following table using Excel to calculate the probability of the sample mean falling in the ranges indicated.

H-bar > 69

Probability

H-bar < 60

7.

Open Gujarati data file “Table 2_7.xls”. a) Report the following descriptive statistics.

Mean

Price ($1000)

Standard deviation

INT (%) b) Let X=Price ($1000) and Y=INT (%). Regress Y on X and report the following amounts. Note: Ŷ

1

is the predicted value of Y for the first observation. b

1

Ŷ

1 b

2

Ŷ

2

∑x i y i

Ŷ

3

Ῡ ∑e i

2

8.

Assume that you wanted to do a Monte Carlo simulation, generating fictional data for wheat prices (P) and the quantity of wheat demanded (Q). Assume that you use the equation: Q = 300 – 15P + u i

. How would you generate sample data for the disturbance term? How would you ensure that the expected value of the disturbance term was zero and that the model was homoscedastic?

9.

Suppose you had a sample of 25 observations and regressed Y on X and obtain the following results (standard errors of the estimators are reported in parenthesis):

Y = 165.2

(211.5)

+ 13.7X

(5.4) a) Calculate the test statistic, t, and probability value (p-value) for the intercept (b

1

).

Note: Use the TDIST function in Excel to calculate the p-value. b

1 t-statistic

p-value b) Below, write the 90% confidence interval for the slope (B

2

). Note: critical t values can be found using the TINV function in Excel.