The US-China Marriage of Convenience: Prospects for Global Imbalances and Economic Recovery

advertisement

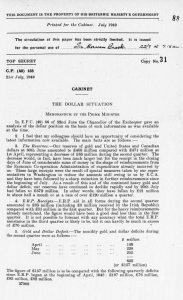

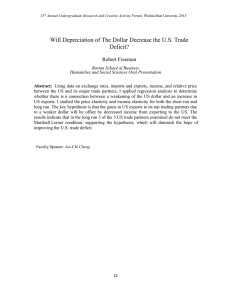

The US-China Marriage of Convenience: Prospects for Global Imbalances and Economic Recovery Terry McKinley Director, Centre for Development Policy and Research, School of Oriental and African Studies Presentation, 29 January 2010, Delhi Conference, ‘Recovery or Bubble? The Global Economy Today’ 1 The Starting-Point of The Debate The US and China remain locked together in interdependence: China has relied, for some time, on the US as a market for its exports The US now relies on China as the prime lender that can continue financing its massive current-account deficits Is China equally to blame for global imbalances and the failure to reduce them? Will the US continue to run huge current-account deficits and undermine the basis for global recovery? 2 Pinning the Blame on China for Global Imbalances China is often blamed for causing global imbalances, mainly through ‘exchange-rate manipulation’ (US Treasury Secretary Geithner’s early 2009 criticism) China has pegged the value of renminbi to the US dollar (for a while loosely, until 2008) Martin Wolf, the well-known columnist of the Financial Times, has laid the basis for blaming China in a series of columns on the global crisis: “The driving force behind these [global] imbalances has been the policies of surplus countries and particularly China” (January 20, 2009) “The world cannot safely absorb the current account surpluses that [China] is likely to generate under its current development path” (April 7, 2009) 3 What Is the Main Source of Global Instability? The main source of global instability is located not in China but in the US, which is the world’s dominant, reserve-currency country, and its most profligate spender: It has regularly spent beyond its income level, based on borrowing from abroad (e.g., from China!!!) Being the dominant reserve-currency country gives it greater freedom to do so (adjusting at its own pace) A Major Question: Will US current-account deficits undergo enough adjustment in order to substantially reduce global imbalances and remove the basis for renewed crisis? 4 The Basis for the US Over-Consumption Binge What were the origins of the US crisis? During the 1990s, current-account deficits were substantially increasing and Reagan’s huge fiscal deficits from the 1980s were being reduced by the Clinton administration External demand and public-sector demand for goods and services were declining. But the biggest problem was the ballooning current-account deficits This drag implied that the private sector (either households or corporations) had to be the main source for supplying additional aggregate demand to the US economy in order to maintain economic growth 5 The Basis for the US Over-Consumption Binge The US household sector began to spend well above its income level: its net savings declined from 3% of GNP in the early 1990s to a deficit of -4% of GNP! Households were increasingly borrowing to sustain higher levels of consumption and housing investment But why did households borrow so heavily? Their personal assets (equities and housing stock) seemed to be inexorably appreciating in value This process was sustainable only as long as asset appreciation kept pace with the rise of household liabilities—and interest rates remained low 6 The Basis for the US Over-Consumption Binge But the stock market bubble burst in 2001 The US government responded with very expansionary fiscal and monetary policies—keeping interest rates low and fuelling, in effect, a larger ensuing financial crisis caused by the realestate bubble (exacerbated, indeed, by new complex forms of leveraging of risk and lax regulation) US current-account deficits began to balloon dramatically in the early 2000s, requiring the need for more external borrowing, that is, more purchase of US Treasury Securities by foreign central banks (such as China’s) Identifying such purchases of securities by China and other surplus countries—as is often done—as the source of the global financial crisis misinterprets its origins: The crisis was due to US over-consumption, not Chinese excessive savings 7 Has There Been a ‘Global Savings Glut’? Critics of China in the West attribute global imbalances primarily to a so-called ‘Global Savings Glut’, which has supposedly made the US borrowing binge much cheaper to finance Developing Asia and the Middle East have been the major regions running large current-account surpluses and accumulating foreign-exchange reserves (often in low-interest US Treasury Securities): Reserves of Developing Asia in 2009: $ 2.8 trillion projected Reserves of the Middle East in 2009: $ 870 billion projected These regions have been the major Savers at the global level: their domestic savings rates significantly exceed their domestic investment rates: they are ‘exporters of savings’ 8 Stock of Foreign-Exchange Reserves (US $ Billions) Region 2001 2007 2009 proj. All Developing 857 4,378 5,323 --Africa 64 289 318 --CIS 44 549 483 380 2,132 2,867 216 1,531 2,240 --Middle East 135 696 870 --W. Hemisphere 159 445 517 --Developing Asia China 9 Has There Been a ‘Global Savings Glut’? By running a huge current-account surplus, China has allegedly been contributing to a ‘global savings glut’ This assumption is endorsed by a wide range of mainstream economists, Martin Wolf, Ben Bernanke and Lawrence Summers—and been used to shift global blame onto China Although widely embraced, does this assumption make any sense? At the global level, total savings must equal, by accounting definition, global investment (unless there are errors in estimation) In other words, excess savings in one grouping of countries, such as Asia, must be balanced out by deficient savings in another part of the world, such as the US 10 Has There Been a ‘Global Savings Glut’? Another interpretation of the ‘savings glut’ is that global savings has been rising relative to global income The table shows that broad averages since the late 1980s do not support such a claim As a ratio to global income, savings has been relatively stable, at 22-23% So there has been no pronounced upward savings trend, no evidence of a ‘savings glut’ But there has been a marked downward trend in the savings of Advanced Economies, which has been compensated by a substantial rise in the savings of Emerging and Developing Economies 11 Savings as a Ratio to GDP (%) 1986-1993 1994-2001 2002-2008 Global 22.7 22.1 22.7 Advanced Economies 22.2 21.6 19.8 USA 16.3 17.0 13.9 24.3 24.2 31.1 Middle East 17.6 25.5 38.7 Developing Asia (including China) 28.8 32.7 41.2 Emerging and Developing Economies 12 What Is the Main Source of Global Instability Now? The US is currently trying to replace huge privatesector spending deficits (mainly of households) with massive public deficits in order to stimulate economic recovery The 2009 US fiscal deficit is projected by the IMF to reach 12.5% of GDP (and to still be 10% in 2010) Such a fiscal deficit tends to enlarge the currentaccount deficit: increased domestic spending spills over into increased imports The alternative is to devalue the US dollar, making its exports cheaper—and thereby reduce the US current-account deficit 13 The Impact of a Depreciated US Dollar When this option is taken, relative to the US dollar, the currencies of many other countries will appreciate, worsening their trade balances Just as importantly, the US will lower the relative value of its external debt The US can effectively ‘inflate away’ its external debt by printing more dollars (the internationally reserve currency, for which there remains a global demand) Countries holding their reserves in US Treasury Securities will find their value reduced in their own currencies (will suffer a loss of asset value) To some degree, the US remains in the ‘driver’s seat’ 14 The Depreciation of the US Dollar Generally, the US dollar has been depreciating since February 2002 (because of current account deficits): about 21%, overall, in nominal terms Its value hit a low point in April 2008, having fallen in nominal terms by 26% since 2002 But the dollar appreciated between roughly April 2008 and April 2009 as money flooded, seemingly perversely, into US securities as a ‘safe haven’ As global economic conditions worsen (including US recession), the US dollar becomes more valued!! Along with global recovery, the US dollar should depreciate further, but currently it has been holding fairly steady as prospects for a speedy recovery remain uncertain. Figure 15 Ja n02 Ju l-0 2 Ja n03 Ju l-0 3 Ja n04 Ju l-0 4 Ja n05 Ju l-0 5 Ja n06 Ju l-0 6 Ja n07 Ju l-0 7 Ja n08 Ju l-0 8 Ja n09 Ju l-0 9 Ja n10 Depreciation of the US Dollar Nominal Broad Index, Jan. 2002 – Jan. 2010 140 120 100 80 60 40 20 0 16 Who Gains from Depreciation of the US Dollar? Continued depreciation of the US dollar is necessary in order to reduce global imbalances but its reservecurrency status impedes this adjustment But if depreciation of the US dollar proceeds too far and too fast, interest rates on US securities will have to rise to compensate foreign investors in its securities, possibly choking off recovery from recession, and jeopardizing global recovery If China too quickly shifts its foreign-exchange reserves out of US securities, the US dollar will depreciate faster, and more dangerously: Thus there is a continuing uneasy strategic Marriage of Convenience! 17 Capital Has Been Flowing Uphill As a result, China, along with other Low-income and middleincome countries, have ended up exporting huge quantities of capital to the richest countries (primarily the US) This is not only inequitable but also inefficient globally: Emerging and developing economies have mounted a massive ‘foreign aid program’ to the US since they have to borrow from the US at high interest rates but lend their reserves to it at very low rates Large Current Account Deficits, % of GDP 2007: US -5.2%, UK -2.7%, Spain -10.0%, Australia -6.3% Large Current Account Surpluses, % of GDP 2007: Developing Asia 7.0% (China 11.0%) Middle East 18.1% (Saudi Arabia 24.3%) CIS 4.2% (Russia 5.9%) Africa 2.9% (Nigeria 18.8%) 18 Why Has China (and East & Southeast Asia) Adopted Export-Led Growth? The historical roots of the Export-led Model are in the successes of Japan and the East Asian Tigers, and in the bitter lessons of the Asia Financial Crisis The countries that had hastily liberalized their trade and capital flows (based on IMF advice) learned from the 1997-98 Crisis that they must avoid, at all costs, current-account deficits (especially if those deficits are financed by short-term external loans) They were subjected to speculative attacks on their currencies and sharp painful recessions—attacks on otherwise sound economies They were forced to endure a heavy and humiliating burden of IMF conditionalities (an experience that they wished never to repeat) 19 Why East & Southeast Asia Adopted Export-Led Growth Afterwards, East and Southeast Asian countries began to run sizeable yearly current-account surpluses, amassing large stocks of foreignexchange reserves The reserves were seen as a necessary form of ‘precautionary’ savings designed to deal with any attacks on their currencies Is it necessary to invest a country’s reserves in lowyielding, risky foreign assets, such as US T-bills? Is it necessary to amass such large stockpiles of reserves—beyond precaution? Does this stockpiling have a deflationary global impact, diverting funds from more productive outlets? 20 Does China Save Too Much? If a country’s current-account balance is in surplus, then macroeconomic accounting will show that its total domestic savings exceeds its domestic investment: it saves too much or invests too little The country is recorded as having ‘Excess Savings’ (adding to its overall savings rate) Has China been investing too little? Its Gross Capital Formation approached 40% of GDP during 1990-2004 and more recently has approached 45%. Figure China has an exceptionally high savings rate, i.e., over 50% of GDP in recent years; and the gap between savings and investment has widened ominously: savings have become misaligned with investment 21 Investment and Savings in China 1990-2007 (% of GDP) Gross Domestic Savings Gross Capital Formation Difference between the Two 1990-1994 1995-1999 2000-2004 2005-2007 41.2 42.0 41.1 52.4 39.5 38.8 38.7 44.1 1.7 3.2 2.4 8.3 22 Savings, Investment and Current-Account Surpluses China has been a high-savings, high-investment economy for a long time, growing rapidly and channelling its huge rural labour surplus into the production of higher-productivity tradables, i.e., it has been ‘developing’ Its current fiscal stimulus (5% of GDP), mostly in investment, is designed to continue this momentum during the global recession It has ample ‘fiscal space’ to expand domestic demand without creating unsustainable public debt Critics argue that China should boost domestic consumption (and thus imports) to rebalance its economy (and the global economy) Would this improve China’s economic conditions? 23 Rebalancing China’s Growth Rebalancing China’s growth model by stimulating more domestic consumption is certainly feasible since its domestic market is large Its consumption has continued to grow rapidly (9.3% in 2009) but its investment has still been growing faster (14.8%) Striving for ‘consumption-led’ growth makes no sense for an underdeveloped economy, especially since China’s equity and housing markets are showing signs of an incipient bubble The transition to a Chinese growth model based more on domestic demand (particularly household consumption) would necessarily be a protracted process, in any case, based on fundamental restructuring of the economy In the meantime, China is operating as an engine of growth for the rest of Asia, whose exports to China are now booming 24 Rebalancing China’s Growth Global imbalances have recently diminished: The US current- account deficit is expected to decline to -2.2% of GDP in 2010 and China’s current-account surplus to decline to 8.6% (IMF World Economic Outlook) China will continue, for a while, to rely on the export of manufactured exports as the engine of rising productivity and growth—but probably to more diversified markets China does need to shift from low-return and risky reserve accumulation to higher yielding direct foreign investment in other developing countries Such a shift already appears to be happening as the previous surplus on its capital account is diminishing But, like Brazil and India, China still faces the problem of increased inflows of speculative capital 25 China’s Trade Diversification China’s trade has been diversifying for some time Since only 16% of China’s exports were directed to the US market in 2007 (with a falling trend), pegging strictly to the US dollar does not necessarily make sense China should continue managing the exchange rate but could peg the renminbi to a more diversified set of major currencies since its trade is becoming increasingly diversified But pegging to the dollar makes more sense precisely for maintaining the renminbi value of its dollar-denominated foreign-exchange reserves Otherwise, China would incur huge book-value losses on these assets as the US dollar depreciates 26 The Direction of China's Exports 2000-2007 (% of total) 35 33 33 29 30 % of Total Exports 25 20 20 16 16 16 15 15 10 14 7 5 0 Developing Asia Japan United States 2000 2007 European Union Other 27 Widening Fault-Lines in The International Monetary System The constraints on China’s reliance on Export-Led Growth: the US Dollar no longer appears to be a reliable ‘store of value’ How can it continue functioning as the world’s prime Reserve Currency? Does supplying the ‘world’s monetary needs’ imply that the US has to run a current-account deficit? The US has tended to run such deficits since the break-up of the Bretton Woods system: it has almost invariably run deficits since the early 1980s. Figure Its current-account deficits ballooned beginning in the early 1990s, reaching a floor of -6% of its GDP in 2006—before recovering modestly, to -5.2% in 2007 and -4.9% in 2008 28 US $ billions 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 US Current-Account Deficits $ Billion, 1980-2008 0 -50 -100 -150 -200 -250 -300 -350 -400 -450 -500 -550 -600 -650 -700 -750 -800 -850 29 Widening Fault-Lines in The International Monetary System Because the US current-account deficits remain large and recent US domestic counter-cyclical monetary and fiscal policies have added pressure, the main question is not whether the US dollar will depreciate. It is: how fast will it depreciate? When the US administration states that it favours a ‘strong dollar’, this means that it favours gradual depreciation (any prolonged appreciation is unrealistic) Holders of US-denominated reserves, such as China, are already suffering losses. And if they significantly withdrew such investment, the value of the dollar would drop even further The Problem: This is an inherently unstable situation, which could trigger future crises 30 Why Does China Continue Investing in US Reserves? In a way, China was obliged to invest its foreignexchange reserves in US T-Bills The Central Bank had to sterilize the large and recurrent monetary impact of both current-account and capital-account surpluses (foreign investment) It had to build up reserves: otherwise the injection of additional money into the economy would have driven up imports, and wiped out net exports There were very few highly liquid financial markets in which such a large yearly stock of reserves could be parked Huge US current-account deficits conveniently created just such a market. However, there remains a clear continuing downside risk 31 Will Global Imbalances Now Disappear? The IMF projects the US current-account deficit to decline to US$ -325 billion in 2010 but to rise back up to US$ -475 by 2014 The US fiscal deficit is still projected to be -6.7% of GDP in 2014 and thus there should be continuous global marketing of US Treasury Securities Hence, there is likely to be recurrent pressure for depreciation of the US dollar Developing Asia is projected to run a current-account surplus of US$ 677 billion and the Middle East a surplus of US$ 307 billion in 2014 The gargantuan global imbalances of recent years might have been modestly diminished in the recent period but the basis for recurrent global imbalances and instability will likely remain 32 Resultant Calls for International Monetary Reform A 2008 paper by Bruce Greenwald and Joe Stiglitz has provided a Keynesian perspective on reserve accumulation, viewing it as a subtraction from global purchasing power (‘A Modest Proposal for International Monetary Reform’) As the US increasingly absorbs the reserves of surplus countries (by borrowing to finance its growing current-account deficits), the world becomes increasingly flooded with dollars But the world economy is also subjected to a deflationary bias, they claim, because of the unnecessary stockpiling of reserves by individual countries Some precautionary savings is necessary but the recent build-up has been excessive (this is wasted investment) US debt-fuelled consumption and government deficit spending have merely counteracted this deflationary bias without providing a sustainable basis for global growth While the continuous threat of dollar depreciation still poses a destabilizing threat to the global economy 33 Modest Reform of the International Monetary System Their ‘Modest Proposal’: Issue Special Drawing Rights on a substantial and regular basis SDRs could be a stable store of value linked to a diversified set of convertible currencies Reserves could be credited to the IMF accounts of member countries in proportion to their IMF funding positions Each country would no longer have to ‘bury in the ground’ some of its purchasing power by the precautionary accumulation of its own reserves Any country could run a deficit (enjoy net imports of more real resources), which would be equal to its mandated receipts of new reserves from the IMF Countries would not have to worry so much about pressure on their currency and recurrent financial crises associated with global imbalances 34 How Realistic and Equitable Are Such Monetary Reforms? Current imbalances are based on a dynamic under which the richest country in the world continues to spend beyond its means in order to prop up global aggregate demand The US remains in a stronger position to do so than any other country or grouping of countries (e.g., Europe): it can force adjustment onto other countries There is no immediate alternative to the US dollar—not even the Euro (which accounts for about 30% of all reserves) Emerging and developing countries are not yet in a strong enough position to negotiate a new international monetary system that would be in their own interests Note the disadvantages of current reform proposals: 1) they centre on the IMF (without fundamental governance reforms) and 2) they allocate international reserves according to measures such as GDP (namely, not equitably) 35