On The Nature and Causes of The Wealth of Nations, 2007/08

advertisement

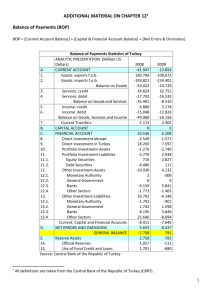

On The Nature and Causes of The Wealth of Nations, 2007/08 A. Erinç Yeldan Bilkent University IDEAs Network “something significant has changed in the way capitalism has been working since about 1970” David Harvey, 1989 Changes in the Global Environment • economic limits of Fordist production and mass consumption have been reached by the 1970s. • Profit rates in manufacturing in US and elsewhere started to decline as capital intensities increased 7 Rate of Profit and Organic Composition of Capital in the US Economy 0.25 Organic Composition of Capital (Left Axis) 6 Profit Rate (right axis) 0.2 5 0.15 4 3 0.1 2 0.05 1 0 0 Source: Moseley, Monthly Review, 2003 “Symbol tick = ‘MAN’ country ‘TURK” cusip = 56418H100” isin = ‘TURK56418H1005’ / symbol sign - change = ‘+’ caltype = ‘percent’ 2.5 / change price value = ’44.52’.” If you are still reading the above sentence, you are already too late! Emerging market economies net external financing (Billions US Dollars) 1996 2003 2007 2008E 2009F 161.4 236.7 928.6 465.8 165.3 Equity Investment Net 128.6 138.5 296.1 174.1 194.8 Resident Flows, Net1 123.7 -49.0 -384.4 -421.9 -271.7 -90.4 -272.5 -948.7 -444.3 -245.9 Current Account Balance -83.6 128.5 434.0 387.4 322.8 As % of GDP Total Foreign Reserves (excl. gold) Total External Debt -1.7 1.9 3.2 2.5 2.2 311.8 1,250.9 3,705.3 4,094.6 4,446.6 2,230.2 3,662.5 3,884.0 3,989.2 External Private Flows, Net Changes in Reserves ("-" indicates increase of reserves) Note: E: Estimate; F: Forecast 1: Including gold, other monetary lending and errors and omissions. Source: Institute of International Finance, January 2009. 5,000 Net Private Capital Inflows, External Debt and Gross Reserves in the Developing Economies (Billion US$) 4,500 Total International Reserves 4,000 Total External Debt 3,500 Net Private Capital Inflows 3,000 2,500 2,000 1,500 1,000 500 0 1996 2003 2004 2005 2006 2007 2008g 2009T Source: Wolff and Resnick, 2006, Advances in Marxist Theory USA: Labor Productivity and Real Wages, 2000-2005 120 USA Median real hourly wages 115 USA Labor Productivity - Output per hour in the business sector 110 105 100 95 90 2000 2001 2002 Source: EconomicPolicy Institute 2003 2004 2005 Turkey: Labor Productivity and Real Wages, 2000-2006 180 Labor Productivity (per hour worked) 160 Real Wage Earnings per Labor Employed (per hour) 140 120 100 80 60 40 2000.I 2000.III 2001.I 2001.III 2002.I 2002.III 2003.I 2003.III 2004.I 2004.III 2005.I 2005.III 2006.I 2006.III Rate of Depreciation in Selected EMEs 50 40 Argentina Brazil Hungary Korea Mexico Poland Romania Thailand Turkey 30 % 20 10 0 -10 -20 -30 Inflation Rate, CPI (2006 Jan=100) 140 130 120 110 100 Argentina Hungary Mexico Romania Turkey Brazil Korea Poland Thailand Industrial Production (2006 Q1=100 ) 125 120 Argentina Hungary Korea Mexico Poland Romania Turkey 115 110 105 100 Q1 2006 Q2 2006 Q3 2006 Q4 2006 Q1 2007 Q2 2007 Q3 2007 Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008 95 90 Unemployment Rate Selected EMEs 20.0 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 Hungary Korea Mexico Poland Romania Thailand Turkey Argentina Brazil Revised Growth Projections OLD NEW 2008 2009 2008 2009 IMF, World 3.9 3.0 3.7 2.2 IMF, Turkey 4.0 3.2 3.8? 2.3? Morgan Stanley, Turkey 2.7 2.5 2.3 1.9 3.3 2.7 CBRT Revised Growth Projections 2008 January 2008 November 2009 january 2008 2009 2008 2009 2009 IMF, World 4.5 4.0 3.8 2.2 0.5 IMF, Turkey 4.0 3.2 3.8? 2.3? Morgan Stanley 2.7 2.5 2.3 1.9 3.3 2.7 CBRT -0.5 Lessons “ the argument that ‘this time things are different’ is a statement that can only be made by fools that fail to take any lessons from history...” Kenneth Rogoff, IMF Chief Economist, 2005