Competitiveness_report_final.docx (2.770Mb)

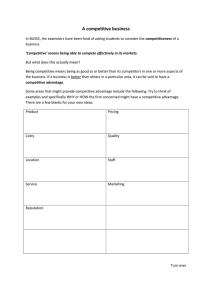

advertisement