contractedservicespowerpoint

advertisement

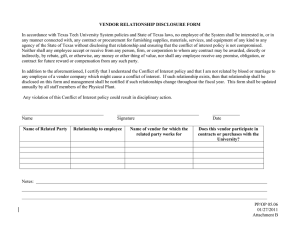

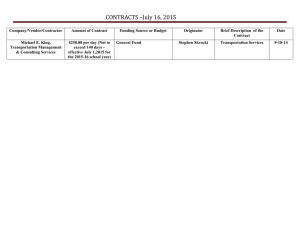

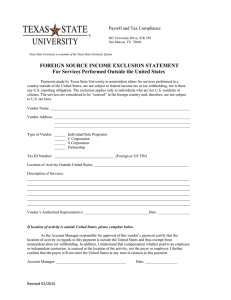

Contracted Personal Services Including Consultants, Speakers, and Other Services 1 Contracted Personal Services Presenters Presented by: Jacque Allbright Introductions Director of Purchasing Marcy Young Employee vs. Independent Contractor Tax Specialist, Office of Payroll and Tax Compliance Jackie Price or Marketa Willis Vendor Maintenance Accounting Clerk II, FI Master Data Center Jacque Allbright Purchase Requisitions & Contracts Director of Purchasing Yolanda Strey HUB HUB Specialist, Contract Compliance Linda Clark Payment Vouchers & Invoices Accountant III, Accounts Payable 2 Outline 1. Introduction – Jacque Allbright 2. Case Study 1 - (JA) 3. Contracted Personal Services and Independent Contractors - Marcy Young 4. Case Study 2 – (MY) 5. Vendor Maintenance – Jackie Price or Marketa Willis 6. Case Study 3 – (JP or MW) BREAK (after an hour)– 7. Purchase Requisitions and Contracts – J Allbright 8. HUB Specialist – Yolanda Strey 9. Case Study 4 – (YS) 10. Payables – Paying Contractors and Other Types of Payments – Linda Clark 11. Case Study 5 – (LC) 12. Paying Foreign Visitors & Other Tax Issues – Marcy Young 13. Questions & Answers 14. Evaluations 3 Introduction Jacque Allbright Director of Purchasing 4 Round of introductions: introduce speakers and participants Our Goals with this workshop: To recognize the importance of communication – between Financial Services & various departments on campus. To work together as a team. To keep up with the changes at the university, its policies and state & federal regulations. To discover and solve problems. To allow you to participate, ask questions and discuss. 5 “Warm Up” - Case Study 1 The Physics Department at Texas State is hosting a five day research conference at the San Marcos Embassy Suites and you are the Administrative Assistant. Your assignment is as follows: Hire two well known lecturers, Mark Zoloft, Physics professor from the University of Colorado. Pay him $5,000 for three one-hour lectures. Emily Anode, Physics professor from MIT. Pay her $7,500 for a 2 day workshop. Pay Lawrence Gant, Texas State Mathematics professor, $1,000 for a onehour lecture, and Pay a student worker, Mary Jean Jones, currently working for the Mathematics department 15 hours a week, to work at the registration table for the first weekend at $10/hour. The Account Manager wonders if the department can pay each of these persons as independent contractors. What do you think? Here are the facts (following slide): 6 Case Study 1 - Challenges Both Mark Zoloft ($5,000) and Emily Anode ($7,500) will be new vendors for Texas State. Which of the following do they need? • FS-06 form - Employee vs. Independent Contractor Determination • FS-01 form - Vendor Maintenance form • Contract • FS-03 and Purchase Order form - Contracted Services Payment Voucher Lawrence Gant is a Mathematics Professor at Texas State for the Math department. He will be speaking at the Physics conference during hours that he is not teaching classes at Texas State. Can he be paid as an independent contractor? Can the student worker, Mary Jean Jones, who is working at another department, be paid as an independent contractor? 7 Case Study 1 - Answers Name Forms Brief description of process: Mr. Zoloft and Ms. Anode FS-06 form Account manager submits one form for each person to Tax Specialist for approval (Employee vs. Independent Contractor Determination form) FS-01 form (Vendor Maint form) Contract and PO - (FS-04 Contracted Services Agreement) FS-03 form or Invoice – (Contr. Services Payment Voucher) or Vendor Inv Lawrence Gant PCR Each vendor completes the form online, prints, and signs, and sends to FIMDC. Each vendor needs a contract and purchase requisition because pmts are $5K or >. Complete form for each vendor payment, Account Mgr signs and asks vendor to sign. Submits to Tax Specialist. Another assignment is created, and he is paid as per course lecturer (Consult with Faculty Records & UPPS 04.04.12) Mary Jean Jones PCR Another assignment is created, and she is paid hourly rate. (Consult with Career Services) 8 Contracted Personal Services Marcy Young, Tax Specialist 9 Types of Contracted Personal Services Academic Services - Artists, entertainers, lecturers, speakers, and other service providers. Professional Services - Accountants, architects, surveyors, medical providers, engineers, etc. Consulting Services - A consultant studies or advises a State agency. (Texas Government Code § 2254) 10 Employee vs. Independent Contractor An independent contractor: a) Works independently and is not working under supervision of university personnel. b) Is working on a task by task basis with a beginning and end date. c) Operates their own business as a sole proprietor. d) Offers similar services to the public. e) Is professionally certified or has specific expertise for the project. (Not limited to these definitions) 11 Form FS-06 – Employee vs. Independent Contractor Determination form T:\TAX SPECIALIST ARCHIVE FILES\CONTRACTED SERVICES\MEETING JUNE 2\Form+FS-06+Rev+062911x.pdf 12 Case Study 2 The History Department at Texas State is having a Texas Music History concert, and you are the Administrative Assistant. They want to hire several local well-known musicians to perform at the concert. They are catering dinner for performers and VIP staff, and They want to give an award to a faculty member. Payment Amounts: Jimi Jones ($2,000), Janis Butler ($2,000), Elvis Brown ($2,000) Caterer: Johnny B. Good BBQ ($900) Award to: Ella Fitzgerald Hughes, Music professor at Texas State ($100) 13 Case Study 2 - Challenges: 1) You have researched SAP and found that: • Jimi Jones is a new vendor. • Janis Butler was setup as a vendor last year. Should you worry about her address and banking information being different now? • Elvis Brown was setup as a vendor 4 years ago. Should you worry about his address and banking information being different now? • The caterer Johnny B. Good BBQ is a new vendor. (Another question: does the caterer need to be on the approved caterer’s list?) • Ella F. Hughes is a Music professor at Texas State. 2) The musicians all request to be paid on the night of performance ($2,000 each). Do we need a contract or a purchase order? 3) Do we need a contract or purchase order for the caterer ($900)? 4) What kind of form is needed for payment? 5) Can we just cut Ella F. Hughes a check through A/P ($100 award)? 14 Case Study 2 - Correct Answers: 1 New vendors . Jimi Jones, musician JBG Barbeque, caterer a) Employee vs. Independent Contractor Determination (Form FS-06) b) Vendor Maintenance Form – (Form FS-01) Existing vendors Janis Butler, musician c) Contact Ms. Butler. Her record is less than 2 years, but check to see if address and banking information are the same. If so, no action is needed. Elvis Brown, musician d) Contact Mr. Brown. Ask him to complete a new Form FS01 because his record is 2 years old or more. Dr. Ella F. Hughes e) She is in the Human Resources database, so no action is needed for setup. 2 Contracts: . Special Payment Request Jimi Jones, musician Janis Butler, musician Elvis Brown, musician Contracts (Form FS-04) - A separate agreement is needed with each of the musicians because they request special payment terms. The vendor’s own contracts may be submitted if approved. Purchase orders are not needed because the amounts (cumulative for the fiscal year) are less than $5,000. 3 No Contract: . Payment less than $5,000 JBG BBQ, caterer Neither a contract nor a purchase order is needed with the caterer because the cumulative amount for the fiscal year is less than $5,000. 4 Payment . vouchers Musicians: Jimi Jones, Janis Butler, Elvis Brown, and Caterer: JBG BBQ Submit a Contracted Services Payment Voucher (Form FS03) for each of the 3 musicians and the caterer. 5 PCR . Dr. Ella F. Hughes Submit a PCR to pay the faculty award. Faculty 15 Vendor Maintenance: Jackie Price, Acct Clerk II, FI Master Data Center or Marketa Willis, Acct Clerk II, FI Master Data Center 16 Is the vendor in our system and is information current? Or is this a new vendor? Existing vendor: The Account Manager and/or the Administrative Assistant will review the existing vendor file in SAP, and confirm the information listed with the vendor. If the vendor has moved or changed banks, the Vendor completes a new Form FS-01, Vendor Maintenance form. New vendor: The Account Manager asks the vendor to complete a Form FS-01, Vendor Maintenance form. Instructions for the vendor: The vendor prints, signs, and sends to the FI Master Data Center via fax or mail. Form FS-01, Vendor Maintenance form includes the W-9 information. 17 Vendor Information Due to the confidential nature of the vendor maintenance form the departments should not receive or keep a copy of the form. Allow time for information to be verified and entered into our system. Contact FI Master Data Center for assistance. – (Jackie Price, jp54, or Marketa Willis, mw34) http://www.txstate.edu/gao/fimd/forms 18 Are vendors required to provide social security number? (Privacy Act of 1974) Yes - According to the Privacy Act of 1974 an individual is not legally compelled to provide Social Security number -- unless involved in a transaction in which the IRS requires notification. If we pay a contractor, we need to have a taxpayer number on file. We retain the taxpayer number in our files for identification purposes, and because the IRS requires a W-9 of all vendors. The Vendor Maintenance form is a substitute W-9 under IRS guidelines. The VMR form is only kept on file by the FI Master Data Center and is secure information. 19 Case Study 3 Archaeology is having a seminar in September 2011, and wants to invite two well known scientists from outside the university to speak. You are the Administrative Assistant assigned to the project. They want to pay each as independent contractors as follows: Dr. Tremblar Bunian ($20,000) in two payments, the first payment due upon signing the contract, the second payment paid within 30 days after the seminar. Dr. Rachel Darknells ($10,000) one time payment, to be paid within 30 days after the seminar. 20 Case Study 3 - Challenges You have researched SAP and found that: Dr. Tremblar Bunian is a new vendor for Texas State. (He will be paid $10,000 on signing contract, and $10,000 on completion.) Dr. Rachel Darknells is an existing vendor. She was entered into the system 4 years ago, and has been paid every year for the same conference. (She will be paid $10,000 on completion.) How do you set up / maintain the vendor records? Do you need a contract & purchase order for these payments? How do you submit the payment vouchers? 21 Case Study 3 - Answers Dr. Tremblar Bunian Dr. Rachel Darknells Form FS-06 Submit to the Tax Specialist, and wait for approval. Form FS-01 Completed by vendor, submit to FIMDC Form FS-04 (Contracted Services Agreement) needed with the deposit requirement included in the contract language, signed by both parties, submitted with purchase requisition. Purchase Order Purchase requisition and purchase order needed Vendor Invoice Vendor invoice is needed for each payment request. Stipulate the date due for the deposit. Include the PO# on the invoice and have account manager sign. Submit to Accounts Payable. FS-06 not needed If previously approved as a vendor, and an FS-06 is on file. Form FS-01 not needed unless information has changed. Contact Dr. Darknells to confirm current address and banking information. Form FS-04 (Contr. Services Agreement) Contracted Services Agreement needed. Purchase Order Purchase requisition and purchase order needed Vendor Invoice Vendor invoice is needed for the payment request. Include the PO# on the invoice & have account manager sign. Submit to A/P. 22 Create a Contract and a Purchase Ordera Contract and a Purchase Order Jacque Allbright, Director of Purchasing 23 Information Regarding All Service Contracts or Agreements If UPPS 05.02.02 “Texas State Purchasing Policy” requires competitive solicitation to be done to select the best value contractor prior to contract execution, a “good faith effort” is required to include “historically underutilized businesses” or “HUB’s” in the solicitation of bids, quotes, proposals or other expressions of interest. 24 Information Regarding All Service Contracts or Agreements If a contractor submits to Texas State their own contract boilerplate, or requires additional terms and conditions be added to Texas State’s boilerplate, the contract must be reviewed by the university’s legal counsel or the Texas State University System Office Attorney prior to being signed by a Texas State authorized contracting officer. 25 University Policy and Procedure Statements 03.04.07 “Interagency or Interlocal Cooperation Contracts or Agreements”. Special process for contracts between state agencies or local governments. 03.04.04 “Processing, Approving and Executing Contracts, Purchases, and Agreements” Process for getting approval of most university contracts 03.04.02 “Contracting Authority” All contracts must be signed by an authorized Texas State contracting officer or authorized designate. 03.04.01 “Contracted Services and Consultants, Speakers and other Services” This policy covers contracted personal services. 26 When is a Contract and Purchase Order Required? A Contract & a Purchase Order Is Not Required when: Paying a one time payment of less than $5,000. A Contract & a Purchase Order Is Required if: Paying $5,000 or more to a vendor. But also if making several payments to a vendor, which will cumulatively amount to $5,000 or more during the fiscal year. A Contract Only is Required if: When paying less than $5,000, and special payment arrangements are requested by the vendor, or travel is included. For instance, if someone is paid a deposit in advance, or several payments are to be made to the vendor, or travel is included, a written agreement (contract) is required. 27 A Contract Is…… An agreement between the university and an outside vendor: Describes the work to be performed. Describes the expectations of both parties. Has an amount to pay, terms of payment, and a “not to exceed” amount. Has a beginning and ending date. A contract puts a verbal agreement into writing. Review Contracted Services Agreement (FS-04) http://www.txstate.edu/payroll/taxspec/forms.html 28 Purchase Order Create Purchase Order through the SAP Requisition system. You must already have a vendor number, and a fully executed contract. The purchase order should match the “not to exceed” amount on the contract. This amount can be estimated, and increased or closed out. Contact the Purchasing Office if you need assistance. Jacque Allbright, ja14, Priscilla Hernandez, ph23, Velia Espinoza, ve01 29 Case Study 4 The Education Department at Texas State wants to pay 4 different persons for a special project that will be completed in 3 months. Each month will have a certain milestone completion date, and the contractors will be paid on that date if they have completed the work. The first milestone date is 8/15, the second is 9/15 and the third is 10/15. You are the Administrative Assistant. How will you process these payments? Bob Roberts, project manager - $2500 for each milestone completion. Assam Scribe, specialist - $3000 for each milestone completion. Anita House, writer - $5000 for the entire project, in three payments. Veri M. Portain, graduate assistant for the Education Department, will be doing data entry at her current rate of $15 per hour data entry. 30 Case Study 4 - Challenges Bob Roberts, project manager, is a new vendor. He will be paid $2500 for each milestone completion. Since there are 3 milestones, the total he will be paid if he successfully completes his work is $7500. Does he need a contract? A purchase order? When do you turn in the invoice? Assam Scribe, specialist, is an existing vendor. He will be paid $3000 for each milestone’s successful completion, totaling $9,000.00. Does he need a contract? A purchase order? When do you turn in the invoice? Anita House, writer, is an existing vendor. She will be paid in three payments of $1,666.67, not to exceed $5,000. Does she need a contract? A purchase order? When do you turn in the invoice? Veri M. Portain, data entry is a graduate assistant She is being currently paid through Payroll, and is working for the same department. Can she be paid as an independent contractor? 31 Case Study 4 - Answers Mr. Roberts (new vendor) Form FS-06 Submit to the Tax Specialist, and wait for approval. Form FS-01 Completed by vendor, submit to FIMDC Mr. Scribe and FS-06 not needed If previously approved as a vendor, and an FS-06 is on file. Form FS-01 not needed unless information has changed. Contact each vendor to confirm current address and banking information. Form FS-04 (Contracted Services Agreement) Contract needed - with the milestones and requirements for successful completion included with the contract, or as an attached Addendum. Signed by both parties, submitted with purchase requisition. Purchase Order Purchase requisition and purchase order needed because the total to be paid will be equal to or greater than $5,000. Vendor Invoice Vendor invoice is needed for each payment request. Include the PO# on the invoice and have account manager sign. Submit to Accounts Payable. The invoice should be submitted after completion of each milestone. Payroll She will submit her hours as usual, since she is a graduate assistant in the same department. Ms. House Mr. Roberts, Mr. Scribe and Ms. House Ms. Portain 32 Texas Statewide Historically Underutilized Business (HUB) Program Yolanda Strey HUB Specialist, Contract Compliance 33 Case Study 5 Grant Participants The Astronomy Department has an NSF grant which provides for award payments to all grant participants. This program is a direct benefit to the university. There are 25 grant participants who will be paid $150 each. What is the best process to pay them? 34 Case Study 5 - Challenges Grant Participants Some of the grant participants are existing vendors. Some of them are new vendors. Which forms should be used? FS-06 - Employee vs. Independent Contractor form FS-01 - Vendor Maintenance form FS-04 - Contracted Services Agreement FS-03 – Contracted Services Payment voucher AP-2 – Grant Participant form 35 Case Study 5 - Answers Form FS-06 Not needed. Grant participants do not need to complete form FS06 - Employee vs. Independent Contractor form, because they are not being paid as independent contractors. Form FS-01 Needed for new vendors. Completed by vendor, submit to FIMDC Needed for existing vendors if information has changed. Contact each vendor to confirm current address and banking information. Form FS-04 (Contracted Services Agreement) Not needed. Purchase Order Not needed. Form FS-03 (Contracted Services Payment Voucher) Not needed, use AP-2, Grant Participant Stipend form instead. AP-2 Form (Grant Participant Stipend form) The grant participant form must include the pages from the grant that stipulate the type of payment and amount to be paid. All participants can be listed on one form with separate vendor numbers and payment amounts. 36 How to Process the Payment Linda Clark Accountant III, Accounts Payable 37 \ Accounts Payable webpage: http://www.txstate.edu/gao/ap/ Accounts Payable forms page: http://www.txstate.edu/gao/ap/forms.html Travel office: http://www.txstate.edu/gao/ap/travel/ 38 Payment Voucher Review The Accounts Payable office audits each payment voucher or invoice prior to payment. If any information is incomplete or appears incorrect, payment is withheld until information is corrected. Review each voucher prior to submitting to assure that information is complete and correct: Vendor Name & vendor number Description: Describe work that has been completed. Performance Dates- Payment cannot be paid until performance end date. Exception – deposit required by contract. Vendor signature, unless vendor’s invoice is attached. Amount to pay Fund and cost center, or purchase order number Signature of Account Manager 39 Payment Voucher Review Contact Information: Provide the contact information for the Administrative Assistant, or the person working on the documents. This is our contact for questions. Advance Payment or Deposit Request: If the vendor requires advance payment, or a deposit, or a check to be presented on the night of performance, a written agreement (contract) is necessary. Advance payments or check pickup must be approved by Asst Dir of Accounting Accounts Payable (Sergio Rey). 40 Texas Prompt Payment Law \ Texas Prompt Payment Law Interest must be paid for invoices older than 30 days – turn in Payment Vouchers or vendor invoices promptly. The earliest date stamp on the payment voucher is used to comply with the “Prompt Payment” state law. 41 Payment Voucher as a Substitute Invoice The Contracted Services Payment Voucher (Form FS-03) is considered a substitute invoice. When the department wants to pay for services, but the vendor being paid does not issue an invoice, form FS-03 is used. If there is a purchase order, the vendor’s invoice alone can be used. Write the purchase order number on the invoice, and have it approved by the Account Manager with signature. If the department attaches the vendor’s invoice to form FS-03 (when there is no purchase order), all information on the invoice must match the payment voucher. 42 Possible Reasons for Processing Delay New vendor – must be set up in SAP system Vendor information is incorrect Vendor is on “State Hold” Vendor is or was an employee of TS < the past 12 months Signatures or information missing Purchase order or contract needed Approval of OSP is needed for grants Foreign vendor Future performance date 43 Gifts or Awards Payments for Gifts. Payment for small gifts for retirees, speakers, etc can be processed through A/P. The value of a gift may be taxable to an employee, depending on the amount and the type of award. Cash awards are taxable. For employees – use a PCR. For students, or other non-employees, use the AP-1 form. Gift Cards. Small value gift cards can be purchased as an incentive for Human Subject Research studies or for student incentive programs. Otherwise, gift cards are not allowed. Reimbursement of gift certificates or gift cards purchased with personal funds or personal credit cards is prohibited. UPPS 03.01.03 - “Purchase of Food, Refreshments…Achievement Awards” http://www.txstate.edu/effective/upps/upps-03-01-03.html 44 Travel reimbursements to contractors – Most independent contractors pay their own travel. Under certain circumstances, travel expenses can be included with a contract agreement with a vendor. This is usually the case for conferences held at Texas State, or payments to nonresident aliens. Under the Accountable Plan: Without Receipts : Travel expenses will be coded as part of the contractor’s fee if travel receipts are not included with the payment voucher. With Receipts: Travel will be coded as 725100, Independent Contractor travel. Business Purpose: Travel reimbursement requests must state the university business purposes and must benefit the university. Travel reimbursement to a contractor, when paid, must be included in contract agreement. (Contract Form FS-04, Part II-C.) 45 Case Study 6 The School of Journalism at Texas State held their annual Spanish Documentary Film Festival, Punta de Vista a month ago. They want to award two nonresident aliens as the winners of best documentary film. How do they begin? One time payment to each person: Juan Luis Montego, citizen of Bolivia, First Place ($1,000), Viviana Chaco, Second Place ($500) 46 Case Study 6 - Challenges Juan Luis Montego is a citizen of Bolivia and is a J-1 student studying at University of Texas in Austin. He created the film in Bolivia. (First place, $1,000) Viviana Chaco is a citizen of Argentina, and she came to Texas State to participate in the film festival on a B1 visitor visa. (Second place, $500) 47 Case Study 6 - Answers Foreign National Information Form Ask each nonresident alien to complete this form before they come to Texas State, and return it to the Tax Specialist. It can be emailed, mailed or faxed. Mr. Montego only DS-2019 Ask the J-1 scholar to send his DS-2019 form to the Tax Specialist. This will allow the T.S. to ask permission of the sponsor. Mr. Montego Setup meeting with Tax Specialist Arrange for a meeting with the nonresident alien(s) and the Tax Specialist so that the T.S. can copy the necessary documents. Form FS-01 Needed for each, assuming each nonresident alien is a new vendor. Completed by vendor, submit to FIMDC Form FS-03 (Contracted Services Payment Voucher) Needed. Complete this form for each award. 30% withholding may be required. Form FS-06 Not needed. Form FS-04 (Contracted Services Agreement) Not needed. Purchase Order Not needed. Mr. Montego and Ms. Chaco and Ms. Chaco: Forms not needed: 48 Nonresident Alien Tax Issues Marcy Young Tax Specialist, Office of Payroll & Tax Compliance 49 Paying Nonresident Aliens through Contracted Services B1/B2 Visa, Business/tourist visa. INS honorarium rules: Can only perform services at university for 9 days or less Can only have received payment from 5 other institutions within 6 month prior period. Travel: Nonresident aliens may be paid or reimbursed for travel without tax if they provide receipts. J1 Visa: Nonresident aliens with a J1 visa sponsored by another institution can be paid if permission is granted in writing by sponsor. (Need DS-2019 form to find sponsor’s RO) NRA Staff or Faculty: Nonresident aliens who are hired as employees by Texas State University are paid through payroll only. 50 Forms for Nonresident Aliens: One-time payments to NRA visitors to Texas State: Foreign National Information Form (FS-05) NRA completes online, sends to T.S. via fax, mail or email. Setup Meeting with Tax Specialist and NRA When the NRA comes to campus, he/she meets with Tax Specialist. Vendor Maintenance Form (FS-01) Vendor completes form, prints and sends directly to FI Master Data Center. Contracted Services Payment Voucher (FS-03) – Account Manager and vendor complete form and send to Tax Specialist. J1 sponsored by another university – need DS-2019 Send DS-2019 to T.S. so that T.S. can request permission from sponsor to pay the NRA. NRA Staff or Faculty Employee Packet, meet with Payroll NRA Specialist, PCR NRA must have original I-9, W4, copy of DS-2019. Workshop: Payment Requirements for International Employees and Independent Contractors This is a workshop to be held September 13th & 14th at Texas State. It is sponsored by the International Office. 51 http://www.txstate.edu/payroll/taxspec/forms.html Tax Withholding and Tax Treaties Call Tax Specialist when planning for a foreign visitor Tax Withholding - NRAs have tax withheld at 30% from honoraria paid, unless there is a tax treaty. Travel expenses paid with receipts are not taxable, therefore no tax is withheld. Tax Treaties – With a tax treaty, no tax need be withheld, however, the Tax Specialist must apply for a taxpayer number (ITIN) and tax treaty exemption. Get paperwork signed while visitor is on campus. This process may take up to 30 days. Certification of Original Passport and Visa – The Tax Specialist must see the original passport and visa or have a notarized copy on file, and complete a certification form for the IRS. Vendor Maintenance form – The Tax Specialist reviews all new vendors who are NRA or a foreign corporations. 52 Summary 53 Forms FS-06 - Independent Contractor FS-03 - Contracted Services Payment Determination Voucher FS-01 - Vendor Maintenance form FS-05 - Foreign National Information FS-02 – Vendor Maintenance form for staff & faculty FS-04 - Contracted Services Agreement (a.k.a. University contract) • FS-04-A – Addendum to Contract • FS-04-B – Addendum for Intellectual Property Form AP-1 – Texas State Payment Request form AP-02 – Grant Stipend form AP-9 – Student Organization Payment Request form AP-10 – Agency Account Payment Request form 54 Where to Route Forms Employee vs. Independent Contractor Form (FS-06) Send to Tax Specialist. Vendor Maintenance Form (FS-01) – Vendor completes form online, prints and sends directly to FI Master Data Center. Contracted Services Payment Voucher (FS-03) and Contracted Services Agreement (FS-04) Send contract and payment vouchers to Tax Specialist. (Send only one original copy of payment voucher!) SAP Purchase Requisition – Account Manager creates PO in SAP Requisition system. 55 Review process Tax Specialist Payments to foreign persons Travel for independent contractors Contracts and payment vouchers for non-major contracts for services. OSP and Tax Specialist Payments for subcontractors under grant Travel Office Travel for employees or grant participants Accounts Payable – (AP-1 form) Payment Vouchers, Prizes to students (cash not required to be spent on education) Financial Aid Educational Awards and Scholarships to Students Contract Compliance Major contracted services (> $100,000) Consulting services under Texas definition(> $25,000) Purchasing Major Contracts, Purchase of products, furniture Human Resources, Payroll Gifts or Awards to Employees 56 Other Tax Needs University’s W-9 – Contact Tax Specialist University’s Tax Exempt Status – Contact Tax Specialist Hotel Tax Exemption – Available for University employees only – See Travel Website Sales Tax Exemption – Available for University business related purchases – Tax Specialist website Research on tax issues – Contact Tax Specialist 57 Closing… Please complete the evaluation forms for us. Thank you to all the presenters and participants! 58 59