Discussion of: Who is Easier to Nudge? Retirement Research Consortium Jack VanDerhei

advertisement

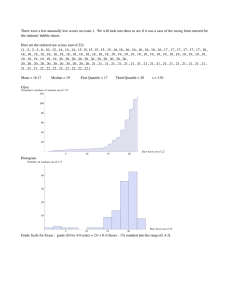

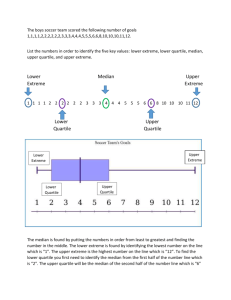

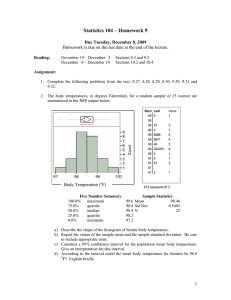

Discussion of: Who is Easier to Nudge? Retirement Research Consortium August 7, 2015 Jack VanDerhei EBRI Research Director vanderhei@ebri.org ® Employee Benefit Research Institute 201 2015 1 Alternative or complementary views of the issue • Are low income employees less likely to opt out of defaults? • • Less likely to increase contribution rates (from the default) but would appear more likely to decrease them Results depend on default contribution rates • 3 vs. 6 percent defaults for automatic enrollment • Impact of a Proposed Stretch-Match with Auto Escalation and a 6% default ® Employee Benefit Research Institute 201 2015 2 Distribution of Employee Contribution Rates Relative to the Default by Default Rate and Years of Tenure for Automatic Enrollment Plans Without Escalation (where 2013 assets > $0 and 2013 tenure < [2013 – plan implementation date]) 3 percent default 6 percent default 100% 100% 90% 90% 80% 80% 70% 70% 60% 60% 50% greater than 40% equal to 50% 40% less than 30% 30% 20% 20% 10% 10% 1 2 3 4 5 Tenure 6 7 low high low high low high low high low high low high low high high low 0% 8 0% high low high low high low high low high low 1 2 3 Tenure 4 5 Low: $10,000 < Salary < $30,000; high: Salary > $30,000 NB: based on cross-sectional 2013 data (not time-series) ® Employee Benefit Research Institute 2015 3 3 vs. 6 percent defaults for automatic enrollment* • Under a set of specified behavioral assumptions, more than a quarter of those in the lowest-income quartile who had previously NOT been “successful” under actual default contribution rates were found to be successful as a result of the change in deferral percentage. • Baseline threshold = 80 percent of pre-retirement income replaced by Social Security plus inflation-adjusted annuity of 401(k) + IRA rollovers (at 65) • When employees in the highest-income quartile were analyzed under the same set of assumptions, the percentage of those who had NOT previously been successful (under the actual default contribution rates) that now ARE successful as a result of the change in deferral rate was 18.4 percent. *Increasing Default Deferral Rates in Automatic Enrollment 401(k) Plans: The Impact on Retirement Savings Success in Plans With Automatic Escalation, EBRI Notes, September 2012 4 ® Employee Benefit Research Institute 201 2015 Impact of a Proposed Stretch-Match on Current 401(k) Participants • Measuring the impact of a proposed alternative to the PPA safe harbor: • • • Default at 6 percent Auto increase of 2 percent per year until 10 percent Employer match of: • 50 percent on the first 2 percent, and • 30 percent on the next 8 percent • How to model something that does not exist (yet)? • • Starts with the same technique developed for VE 401(k) plans • Looks at the incentives provided for each 1 percent of compensation • e.g., able to differentiate between employee behavior for a 50 percent match on the first 6 percent vs. 100 percent match on the first 3 percent Expands to isolate and simultaneously predict joint influence of: • Default contribution rates • Auto increase (yearly interval and maximum limits) • Level of employer match rates at each 1 percent of compensation ® Employee Benefit Research Institute 201 2015 5 Percentage increase in 401(k) accumulations* at age 65 from FUTURE employee contributions by age and income quartile if proposed stretch-match safe harbor was used instead of the PPA safe harbor (assumes employees revert back to default on job change) 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% Lowest income quartile Second income quartile Third income quartile Highest income quartile 25-29 16.5% 18.1% 19.0% 18.6% 30-34 16.8% 18.7% 20.0% 18.0% 35-39 17.2% 20.4% 20.2% 16.4% 40-44 16.3% 20.4% 19.6% 14.7% 45-49 15.5% 20.2% 18.0% 15.6% 50-54 16.5% 18.6% 17.7% 14.7% 55-59 14.0% 17.6% 19.2% 17.3% Source: Employee Benefit Research Institute Retirement Security Projection Model® Versions 2262 and 2263. * This includes 401(k) balances as well as IRA balances rolled over from 401(k) plans. ® Employee Benefit Research Institute 201 2015 6 Employer Match as a Function of Employee Contribution 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% PPA safe harbor Proposed stretch match proposal 0.5% 0.0% ® Employee Benefit Research Institute 201 2015 7 Percentage increase in 401(k) accumulations* at age 65 from FUTURE employee and employer contributions by age and income quartile if proposed stretch-match safe harbor was used instead of the PPA safe harbor 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Lowest income quartile Second income quartile Third income quartile Highest income quartile 25-29 2.6% 3.5% 5.5% 6.3% 30-34 3.0% 6.5% 6.6% 6.6% 35-39 3.7% 8.1% 8.2% 6.6% 40-44 2.8% 7.9% 8.3% 5.0% 45-49 2.6% 7.5% 7.3% 5.5% 50-54 2.9% 6.4% 7.4% 3.7% 55-59 3.4% 6.3% 7.1% 6.1% Source: Employee Benefit Research Institute Retirement Security Projection Model® Versions 2262a and 2263a. * This includes 401(k) balances as well as IRA balances rolled over from 401(k) plans. ® Employee Benefit Research Institute 201 2015 8