Audit Guidelines for 4-H Club/Group Accounts

advertisement

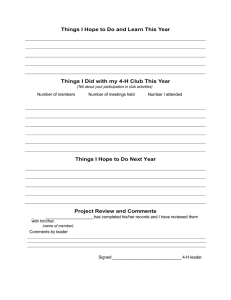

If your club does NOT have a Treasury, this can be ignored. Audit Guidelines for 4-H Club/Group Accounts Clubs checking/savings accounts must be audited annually within the club. A committee should be appointed to audit the financial records of the club/group. The committee should consist of three individuals who are not involved in the expenditure of funds. The individuals on the audit committee shall not be signatories on the bank account, nor shall they be related to those with signature authority. If there are not three individuals who fit this criteria, the club/group should work out an alternative arrangement with the local Extension Office to have their financial records audited. The suggested make-up of this group is that one person is a member, one a leader, and one a parent. Each year the Extension Office will select clubs to have in depth audits where the items listed below will be checked. Your club will receive a letter if you need to turn in all the listed items. The financial report in the Treasurer’s handbook should be prepared by the treasurer, signed by the audit committee and submitted to the Extension Office for review. This must be completed by Record Turn-in Days: August 28, 2015. In performing the audit, the following steps must be followed: 1. Ensure new signature cards are done annually. The club/group minutes should reflect who has authority to sign checks. 2. Ensure all income is deposited into the account. 3. Ensure all expenses are paid by check or receipted if cash is paid out. 4. Ensure the vendor and the amount of the check match the invoice. 5. Ensure all expenses are reviewed and approved by the appropriate authorizing person (noted in club/group minutes and approved by the leader). 6. Ensure checks have proper signatures and that signatures have been registered with the bank. Two signatures are required on all checks. Be sure that checks have not been pre-signed. 7. Ensure that all bank statements have been reconciled. They should be initialed and dated by the person who reconciled the bank statement. 8. Ensure the end of month book balances agree with the balances on the bank statement reconciliation. 9. Review the financial statement. 10. Ensure the figures appearing on the record of club finances agree with the financial statement. 11. After the steps above have been completed and when the audit committee verifies the facts, they sign the financial statement in the treasurer’s book. 4-H Club Treasurer Guidelines Club Year: 2014-2015 Club Name: ___________________________________________________ Criteria Completeness of record (accounts balance?) Neatness of record All transactions recorded? Required signatures Annual conducted by club leader, a parent, and another member besides the treasurer FEIN number listed on Financial Statement page Overall Comments and suggestions: Excellent Good Fair