Math 2355 - Lab 4 (9pts)

advertisement

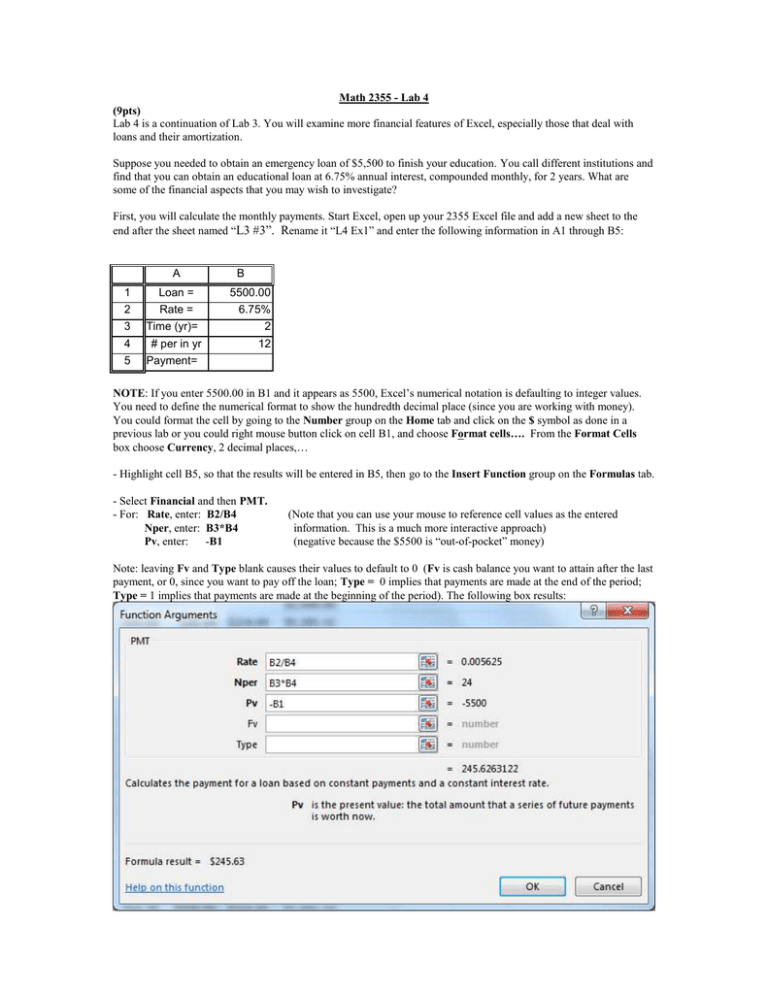

Math 2355 - Lab 4 (9pts) Lab 4 is a continuation of Lab 3. You will examine more financial features of Excel, especially those that deal with loans and their amortization. Suppose you needed to obtain an emergency loan of $5,500 to finish your education. You call different institutions and find that you can obtain an educational loan at 6.75% annual interest, compounded monthly, for 2 years. What are some of the financial aspects that you may wish to investigate? First, you will calculate the monthly payments. Start Excel, open up your 2355 Excel file and add a new sheet to the end after the sheet named “L3 #3”. Rename it “L4 Ex1” and enter the following information in A1 through B5: A B 1 Loan = 5500.00 2 Rate = 6.75% 3 4 5 Time (yr)= # per in yr 2 12 Payment= NOTE: If you enter 5500.00 in B1 and it appears as 5500, Excel’s numerical notation is defaulting to integer values. You need to define the numerical format to show the hundredth decimal place (since you are working with money). You could format the cell by going to the Number group on the Home tab and click on the $ symbol as done in a previous lab or you could right mouse button click on cell B1, and choose Format cells…. From the Format Cells box choose Currency, 2 decimal places,… - Highlight cell B5, so that the results will be entered in B5, then go to the Insert Function group on the Formulas tab. - Select Financial and then PMT. - For: Rate, enter: B2/B4 Nper, enter: B3*B4 Pv, enter: -B1 (Note that you can use your mouse to reference cell values as the entered information. This is a much more interactive approach) (negative because the $5500 is “out-of-pocket” money) Note: leaving Fv and Type blank causes their values to default to 0 (Fv is cash balance you want to attain after the last payment, or 0, since you want to pay off the loan; Type = 0 implies that payments are made at the end of the period; Type = 1 implies that payments are made at the beginning of the period). The following box results: 2 Note the value, 245.6263122, that appears toward the middle of the PMT box and the Formula result=$245.63 that appears in the bottom left corner of the box. This is the periodic payment. Now, click on OK, and the value 245. If ###### appears in B5, you need to increase the width of the column. By entering the values using cell referencing as demonstrated in the above box, you can now perform What-If analyses by simply changing any value(s) in cells B1 through B4, hitting Enter on the keyboard, and observing the results immediately in cell B5. For example, what if the loan you desired was $5500, over a 4-year period at 6.75% interest compounded monthly. Enter this information and you will observe the following results: A B 1 Loan = 5500.00 2 Rate = 6.75% 3 Time (yr)= 4 4 # per in yr 12 5 Payment= $131.07 Thus your payment would now be $131.07. You will now program Excel to perform an “in-depth” analysis to be able to observe details of what happens as you pay off your loan, and to play more intricate What-If analyses. Return to the original problem and create the table shown below by adding the titles for row 8 and the periods 0 & 1: A B C 1 Loan= 5500.00 2 Rate= 6.75% 3 Time (yr)= 4 # per in yr 12 5 Payment= $245.63 D E 2 6 7 Period Interest 8 0 9 1 Cum. Int. Principal Balance Note that you will detail the payments for 1 period, and then extend the formulas through the 24 periods using Excel’s copy feature. - in E8, enter: =B1 (this represents the initial loan amount) - in B9, enter: =E8*$B$2/$B$4 (this represents: loan balance * interest rate per period) (NOTE the absolute referencing for the interest since the interest rate is constant) - in C9, enter: =C8+B9 (this represents the cumulative amount of money paid on interest) - in D9, enter: =$B$5-B9 (this represents the principal applied to the loan; the principal applied to a loan is defined as: the payment MINUS the interest) (NOTE absolute referencing for the payment since the payment is constant) - in E9, enter: =E8-D9 (this represents the loan balance MINUS the principal) 3 You should now observe the following worksheet: A 1 2 3 4 5 6 7 8 9 B C Loan= $5,500.00 Rate= 6.75% Time (yr)= 2 # per in yr 12 Payment= $245.63 Period Interest Cum. Int. D Principal 0 1 E Balance $5,500.00 $30.94 $30.94 $214.69 $5,285.31 Extend the worksheet for additional periods by highlighting A9 through E9, positioning the arrow on the drag handle in the corner of E9, and then dragging the formulas through 23 (or more if you wish) additional periods (hold the left mouse key down until you reach the additional number of rows (periods) that you wish, then release it). Note that 23 additional periods would extend you to Row 32. The following worksheet results: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 A Loan= Rate= Time (yr)= # per in yr Payment= B $5,500.00 6.75% 2 12 $245.63 C D Period 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Interest Cum. Int. Principal $30.94 $29.73 $28.52 $27.29 $26.07 $24.83 $23.59 $22.34 $21.08 $19.82 $18.55 $17.27 $15.99 $14.70 $13.40 $12.09 $10.78 $9.46 $8.13 $6.79 $5.45 $4.10 $2.74 $1.37 $30.94 $60.67 $89.18 $116.48 $142.54 $167.37 $190.96 $213.30 $234.39 $254.21 $272.76 $290.03 $306.02 $320.72 $334.12 $346.21 $356.99 $366.45 $374.58 $381.37 $386.82 $390.92 $393.66 $395.03 $214.69 $215.90 $217.11 $218.33 $219.56 $220.80 $222.04 $223.29 $224.54 $225.81 $227.08 $228.35 $229.64 $230.93 $232.23 $233.53 $234.85 $236.17 $237.50 $238.83 $240.18 $241.53 $242.89 $244.25 E Balance $5,500.00 $5,285.31 $5,069.41 $4,852.30 $4,633.97 $4,414.41 $4,193.62 $3,971.58 $3,748.29 $3,523.75 $3,297.95 $3,070.87 $2,842.52 $2,612.88 $2,381.95 $2,149.72 $1,916.19 $1,681.34 $1,445.17 $1,207.68 $968.84 $728.67 $487.14 $244.25 $0.00 4 In the previous table, note that the cumulative interest, or total interest, that you paid on this loan was $395.03. This number may seem low for a loan but remember that the rate was ONLY 6.75%, and the period of the loan was ONLY 2 years. Interest rates on loans are often much higher, and time of re-payment is often longer. For example, the current interest rate on many credit cards is often over 20% and many house loans are for 30 years. Now, you will perform a simple What-If analysis. Suppose you pay an extra $30.00 per period on your loan, and also make a one-time lump-sum payment of $500 at period 15. By how many periods will you shorten the loan duration? The What-If analysis is easily calculated in EXCEL by: - change the formula in cell B5 from =PMT(B2/B4,B3*B4,-B1) to =PMT(B2/B4,B3*B4,-B1)+30 - change the formula for the loan balance in period 15 in cell E23 from =E22-D23 to: =E22-D23-500 The following worksheet results (you may need to adjust your column widths): 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 A Loan= Rate= Time (yr)= # per in yr Payment= B $5,500.00 6.75% 2 12 $245.63 C D Period 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Interest Cum. Int. Principal $30.94 $29.56 $28.18 $26.79 $25.39 $23.98 $22.56 $21.14 $19.71 $18.27 $16.82 $15.36 $13.90 $12.43 $10.95 $6.65 $5.13 $3.61 $2.08 $0.54 -$1.00 -$2.56 -$4.13 -$5.70 $30.94 $60.50 $88.68 $115.46 $140.85 $164.82 $187.39 $208.52 $228.23 $246.50 $263.32 $278.68 $292.58 $305.01 $315.96 $322.61 $327.74 $331.35 $333.43 $333.98 $332.97 $330.41 $326.29 $320.59 $244.69 $246.07 $247.45 $248.84 $250.24 $251.65 $253.06 $254.49 $255.92 $257.36 $258.81 $260.26 $261.73 $263.20 $264.68 $268.98 $270.49 $272.01 $273.54 $275.08 $276.63 $278.19 $279.75 $281.33 E Balance $5,500.00 $5,255.31 $5,009.25 $4,761.80 $4,512.96 $4,262.71 $4,011.07 $3,758.00 $3,503.51 $3,247.60 $2,990.24 $2,731.43 $2,471.17 $2,209.44 $1,946.24 $1,181.57 $912.59 $642.09 $370.08 $96.53 -$178.55 -$455.18 -$733.37 -$1,013.12 -$1,294.44 Note the negative numbers for the Balance starting in Period 20. This means that in Period 20 the loan was not only paid off, but that you overpaid the loan by $178.55; that is, you only really needed to pay ($275.63-$178.55= $97.08). Thus, you have reduced your number of payment periods by more than 4 periods, or in other words, you have reduced the loan duration by approximately one-sixth. 5 Lab 4 – Math 2355 – Spring 2016 (9pts) Name: ______________________________________ Discussion Section: ____________ Due Date: February 26th by 8:30a.m. 1. Create a new sheet after “L4 Ex1” or copy a previous sheet and move it to the end. To copy a sheet you right mouse click on the name of the sheet you want to copy and choose Move or Copy…, in the Move or Copy box place a check mark in the Create a Copy box and highlight the (move to end) option above it. Then hit enter. Rename the sheet “L4 #1”. A house costs $325,000. The terms of the sale are 20% down and the remainder to be paid in monthly payments for 30 years at an annual rate of 4.16% compounded monthly. (a) Which insert function will give you the answer to part (b)? ______________________ (b) What are the monthly payments? Answer: ______________________ (c) Using Excel, fill in the associated parts for the given periods: Period Interest Cum. Int. (total int. pd to date) Principal Balance 78 188 250 355 2. Add, or copy, a sheet at the end of your book and rename it “L4 #2”. Answer the following questions by performing steps shown in the lab. You obtain a $38,000 car loan for 5 years at 1.75% interest compounded monthly. (a) What are the monthly payments? Answer: ______________________________________ (b) How much interest will be paid over the 5 years? Answer: ______________________________________ (c) You decide to pay an extra $175 per period as you pay back the loan. By doing this, the last payment will occur in which period? Answer: ______________________________________ (d) In addition to paying an extra $175 per period as you pay back the loan, you decide to make an extra payment of $1500 at the 10th period and $2500 at the 15th period. By doing this, the last payment will occur in which period? Answer: ______________________________________ Type your name in D1, your W number in D2 and print, 1 page high by 1 page wide, portrait. Turn it in with this page. 3. Add a new sheet at the end of your book and rename it “L4 #3”. Suppose you wish to invest in an annuity so that you will have $2,000,000 at some future date for your retirement nest egg. You decide on an investment that has a history of averaging 9.1% compounded monthly. In addition, you wish to make $1500 monthly installments, with payments made at the beginning of each period. Use Excel’s financial function, NPER (returns the number of periods for an investment), to approximate the number of periods (months) required to attain the $2,000,000. Round your answer to the next nearest month. Answer: ______________________________________ If you expect to attain this goal by your 65th birthday, at what age, to the year and month, do you need to start investing in the annuity? Answer: ______________________________________