THE ECONOMICS OF JERUSALEM

advertisement

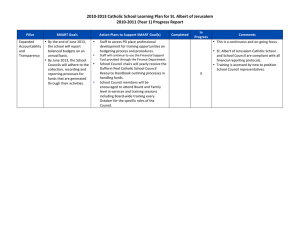

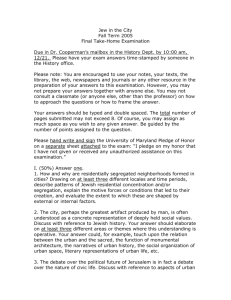

The Economics of Jerusalem Leila Farsakh University of Massachusetts Boston CIS- MIT New York, June 12 2006 The Economics of Jerusalem What are the economic realities of Jerusalem today and how can they impact the future? Economic growth in Jerusalem has relied on 3 main factors: Its religious dimension: a double edged sword Population growth State intervention Can it be any different in the future: markets versus states, globalization versus nations Which Jerusalem? East and West Municipal Jerusalem Greater Jerusalem Metropolitan Jerusalem The Wall: Israel and the West Bank Religion and Jerusalem Its raison d’etre, but is it also its source of growth? Potentially a means to generate growth via its effect on Tourism: Tourism generates $2.4-4.5 billion, roughly 4% of Israel’s GNP Jerusalem accounts for 31% of all overnight staying tourists 2004, higher than Tel Aviv Yet it accounts for 20% of total income from tourism Income from accounts for 20% of the Jerusalem city’s income Historically an obstacle to economic activity Source: Israeli Central Bureau of Statistics The population of Municipal Jerusalem, 2005: Consumers or Producers? 67% of the population is Jewish 30% of which are Haredi, or ultra-orthodox, Jews 31% of the population under the age of 15 22% of households live under the poverty line 33% of the population are Palestinian - 41% of the population under the age of 15 42% of live under the poverty line Jerusalem is considered one of the poorest cities in Israel, per capita income is 1/3 the Israeli national average Migration: More people leaving Jerusalem than entering it: Net loss of 81,700 residents between 1990 and 2002, 50% of which moved to metropolitan Jerusalem Source: ICBS, Statistical Abstract of Jerusalem The Labor Force in Jerusalem Less than 32% of the population is economically active compared with 40% in Tel Aviv Increasing number of foreign workers: estimated 20% of the estimated 250,000-350,000 foreign workers live in Israel, mainly in low skilled jobs Different economic structure between Israelis and Palestinians The Economically Active Jerusalemites: Israelis 49% of all employment in the public sector 26% in tourism industry 10% in high tech, a particularly growing and promising sector 49% work in East Jerusalem 51% in work West Jerusalem 59% of the population living in Metropolitan Jerusalem work in Municipal Jerusalem, Jewish Sector of the city growing between 2-4% per annum since 1996 Source: ICBS: Statistical Yearbook of Jerusalem Employment Distribution in Jerusalem and Tel-Aviv, 2005 60% 50% Jerusalem 40% Tel-Aviv 30% 20% 10% rt y Po ve en t ne m pl oy m U To ur ism ur in g M an uf ac t to r Bu si ne ss Se c Pu bl ic se c to r 0% Source: Israeli Central Bureau of Statistics The Economically Active Jerusalemites: Palestinians 85% of total employment in the private sector 20% in construction, mainly in the Israeli sector 27% in commerce and tourism 5% in public services 55% work in West Jerusalem 44% work in East Jerusalem Economic activity in East Jerusalem has been falling by 10% since 2000 Implications for the Future Changing demographics: More people leaving Jerusalem than those living in it Jerusalem more a dormitory than an economic hub? How can the future change this tendency The doubling of the Palestinian population by 2050: how to deal with them: Population in Municipal Jerusalem, 1995-2050 80% 70% 60% 50% 40% 30% 20% 10% 0% 1995 2005 Jewish population 2015 2020 2050 Arab population Source: ICBS: Statisti of Jerusalem Sources of Growth for the Future Religion: Population growth: State versus market: Globalization: of industries and people Investment in technology Open borders