Test Bank for Quiz 2-FINA252.docx

advertisement

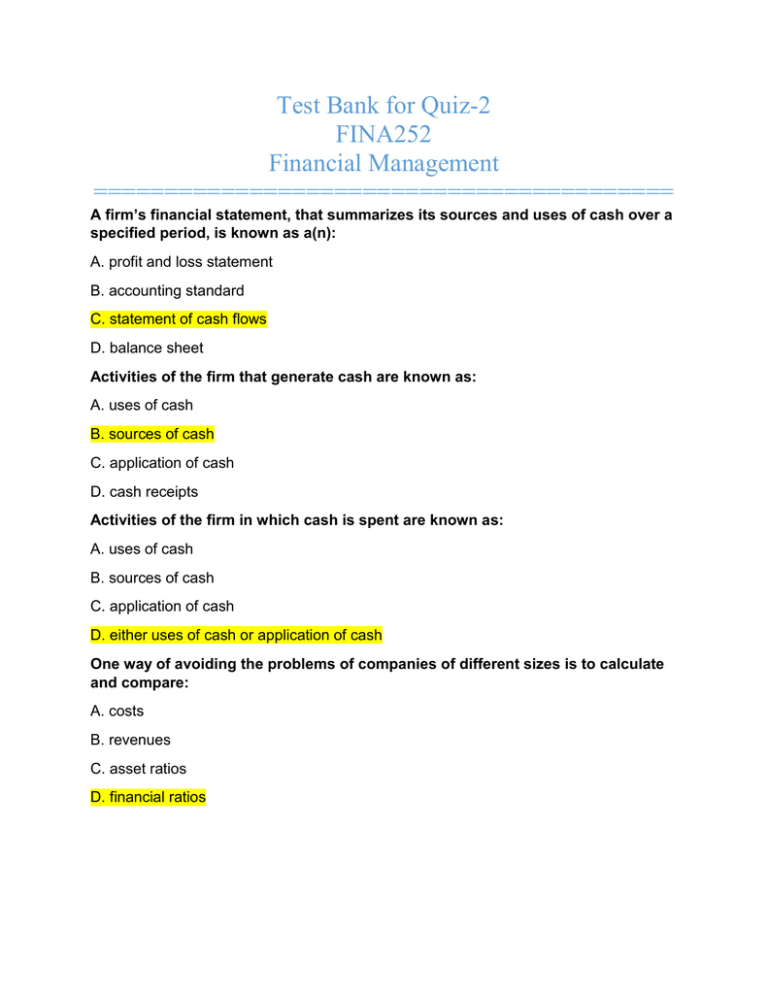

Test Bank for Quiz-2 FINA252 Financial Management ========================================= A firm’s financial statement, that summarizes its sources and uses of cash over a specified period, is known as a(n): A. profit and loss statement B. accounting standard C. statement of cash flows D. balance sheet Activities of the firm that generate cash are known as: A. uses of cash B. sources of cash C. application of cash D. cash receipts Activities of the firm in which cash is spent are known as: A. uses of cash B. sources of cash C. application of cash D. either uses of cash or application of cash One way of avoiding the problems of companies of different sizes is to calculate and compare: A. costs B. revenues C. asset ratios D. financial ratios Financial ratios are traditionally grouped into ________ categories. A. six B. four C. five D. three Liquidity ratios focus on ________ and ________. A. assets and liabilities B. current assets and current liabilities C. fixed assets and fixed liabilities D. total assets and total liabilities If the fixed asset turnover is 3.7 times it means that ________. A. for every dollar in current assets $3.70 in sales was generated B. for every dollar in total assets $3.70 in sales was generated C. for every dollar of its fixed assets generated $2.29 of revenue over the year. D. for every dollar in current assets the profit margin is $3.70 The current ratio is measured as: A. current assets less current liabilities B. current assets divided by current liabilities C. current assets less inventory, divided by current liabilities D. current assets divided by total liabilities Interest cover ratio is measured as: A. EBIT / interest B. Interest bearing debt / interest C. Interest / EBIT D. none of the above Liquidity ratios provide information about a firm’s: A. long term solvency B. short-term solvency C. short- and long-term solvency D. They focus not on solvency but rather on the ability to raise cash. The ratios that provide information on the firm’s long-run ability to pay liabilities is known as: A. turnover ratios B. leverage ratios C. profitability ratios D. valuation ratios Return on assets is defined as: A. net profit (income)/total current assets * 100 B. net profit (income)/total non-current assets * 100 C. net profit (income)/ average total assets * 100 D. net profit (income)/total equity * 100 Du Pont identity: A. breaks ROE into two parts B. breaks ROE into three parts C. breaks ROA not ROE D. breaks ROA into two parts If the days’ sales in inventory ratio is 100 days, it means that: A. it takes 100 days to get the payment B. it takes 100 days before the next lot of inventory is purchased C. it takes 100 days before it is sold D. none of the given answers In current ratio, the unit of measurement is dollars or times. True or False? A. True B. False Inventory is often the least liquid current asset. True or False? A. True B. False Using ratios eliminates the size problem since the size is effectively divided out. True or False? A. True B. False The P/E ratio measures how much investors are willing to pay per dollar of current earnings. True or False? A. True B. False Liquidity ratios focus on current assets. True or False? A. True B. False Liquidity ratios are particularly interesting to long-term creditors. True or False? A. True B. False A variation of interest cover is the debt to gross cash flow ratio. True or False? A. True B. False Net debt to equity ratio can be shown as interest bearing debt divided by net share equity. True or False? A. True B. False Interest cover can be shown as Interest bearing debt divided by interest. True or False? A. True B. False The days’ sales in receivables ratio is frequently called the receivables turnover. True or False? A. True B. False 1. According to ARAMCO's balance sheet, the finance manager reported $100,000 of current liabilities and only $25,000 of current assets. a. What is ARAMCO’s current ratio? Answer: Current ratio Current assets Current liabilitie s 25000 = ------------------------- = 0.25 100000 b. What is the explanation of the above result? Answer: ARAMCO’s current ratio is 0.25. this means that ARAMCO only has enough current assets to pay off 25 percent of his current liabilities. This shows that ARAMCO is highly leveraged and highly risky. 2. ARAMCO’s balance sheet included the following accounts: Current assets: $21,000 Inventory: $5,000 Current Liabilities: $15,000 a. What is ARAMCO’s quick ratio? Answer: Quick Ratio = (current assets – inventory)/ liabilities 21000 - 5000 = ------------------------15000 = 1.07 b. What is the explanation of the above result? ARAMCO’s quick ratio is 1.07. This means that ARAMCO can pay off all of her current liabilities with quick assets and still have some quick assets left over. 3. ARAMCO’s income statement included the following accounts: Profit before depreciation and amortization: $14,000 Current Liabilities: $15,000 a. What is ARAMCO’s profit before depreciation and amortization to current liabilities (PDACL)? Answer: PDACL Profit before depreciati on and amortizati on Current Liabilitie s = 14000/15000 = 0.93 b. What is the explanation of the above result? ARAMCO’s PDACL ratio is 0.93. This means that ARAMCO can pay off 93 cents of her 1 dollar current liabilities with profit that generated from trading operations. 4. ARAMCO’s income statement included the following accounts: Profit before depreciation and amortization: $14,000 Current Liabilities: $15,000 a. What is ARAMCO’s operating cash flow to current liabilities (OCFCL)? Answer: OCFCL Operating Cash Flow Current Liabilitie s = 14500/15000 = 0.97 b. What is the explanation of the above result? ARAMCO’s OCFCL ratio is 0.97. This means that ARAMCO can pay off 97 cents of her 1 dollar current liabilities with internal cash flow that generated from company’s operations. 5. ARAMCO’s income statement included the following accounts: Cash: $11,000 Inventory: $5,000 Current Liabilities: $15,000 a. What is ARAMCO’s cash balance to total liabilities (CBTL)? Answer: Cash Balance Current Liabilitie s = 11000/15000 = 0.73 CBTL b. What is the explanation of the above result? ARAMCO’s CBTL ratio is 0.73. This means that ARAMCO can pay off 73 cents of her 1 dollar current liabilities with its flow. So ARAMCO is in high risk because Higher risk companies typically have a lower value CBTL. 6. ARAMCO has $100,000 of bank lines of credit and a $500,000 mortgage on its property. The shareholders of the company have invested $1,200,000. a. What is ARAMCO’s Debt to equity ratio (DE ratio)? Answer: Debt/equit y ratio Total debt Total equity = (100,000 + 500,000)/1,200,000 = 0.5 b. What is the explanation of the above result? ARAMCO’s DE ratio is 0.5. A debt ratio of 0.5 means that there are half as many liabilities than there is equity. That means for every $1 of shareholder ownership in the company, the company owes $0.50 to creditors. So ARAMCO is in good position because a lower ratio generally indicates lower risk. 7. ARAMCO has $300,000 of bank lines of credit and a $500,000 mortgage on its property. The company have tangible assets for $500,000. a. What is ARAMCO’s total liabilities to total tangible assets (TLTAI)? Answer: TLTAI Total liabilitie s Total tangible assets = (300,000 + 500,000)/500,000 = 1.60 b. What is the explanation of the above result? ARAMCO’s TLTAI ratio is 1.60. That means for every $1 of tangible assets in the company, the company has $1.60 to creditors. So ARAMCO is in high risk because The higher the value of the TLTAI ratio, the higher the level of risk. 8. ARAMCO earns $50,000 before interest and taxes and her interest and taxes are $15,000 and $5,000 respectively. a. What is ARAMCO’s interest cover ratio? Answer: Interest cover ratio EBIT (Earnings before interest and taxes) Interest = 50,000/15,000 = 3.33 b. What is the explanation of the above result? ARAMCO’s interest cover ratio is 3.33. It means that ARAMCO makes 3.33 times more earnings than her current interest payments. She can well afford to pay the interest on her current debt along with its principle payments. This is a good sign because it shows her company risk is low and her operations are producing enough cash to pay her bills. 9. ARAMCO has interest bearing debt $3,500,000 and while her cash and shareholders’ equity $1,100,000 and $1,700,000 respectively. a. What is ARAMCO’s net debt to equity ratio? Answer: Net debt/equity ratio Interest bearing debt Cash Net ordinary share equity = (3,500,000 – 1,100,000)/1,700,000 = 1.41 10. According to ARAMCO’s financial statements, she has $1,000,000 of total assets and $900,000 of total equity. c. What is ARAMCO’s equity multiplier? Answer: Equity multiplier Total assets Total equity = 1,000,000/9000,000 = 1.11 d. What is the explanation of the above result? ARAMCO’s equity multiplier ratio is 1.11. This means that ARAMCO's debt levels are extremely low. Only 10 percent of his assets are financed by debt. Conversely, shareholders finance 90 percent of his assets. 11. According to ARAMCO’s financial statements, she has net income $50,000 and total outstanding shares $5,000 during the year. a. What is ARAMCO’s earnings per share (EPS)? Answer: EPS Net income Total outstanding shares = 50,000/5,000 = 10 b. What is the explanation of the above result? ARAMCO’s EPS ratio is 10. This means that ARAMCO's every share of the common stock earns 10 dollars of net income. So ARAMCO is doing well because higher earnings per share is always better, this means the company is more profitable and the company has more profits to distribute to its shareholders. 12. ARAMCO’s reported $5,000,000 in total revenue for the year and cost of goods sold (cost of materials and direct labor) of $2,500,000. a. What is ARAMCO’s gross profit margin? Answer: Gross Profit Margin Sales Cost of goods sold (direct cost) X100 Sales (5,000,000 - 2,500,000) = ---------------------------------------- x 100 5,000,000 = 50% b. What is the explanation of the above result? ARAMCO’s gross margin ratio is 50%. This means that ARAMCO uses 50% of its revenue to pay he direct costs of making its goods. The rest can be used for operating expenses, interest, taxes, dividend payouts etc. 13. ARAMCO’s reported $100,000 in total revenue for the year and net profit (income) is $30,000. a. What is ARAMCO’s net profit margin? Answer: Net Profit Margin Net Income X100 Sales 30,000 = -------------------x 100 100,000 = 30% b. What is the explanation of the above result? ARAMCO’s net margin ratio is 30%. This means that ARAMCO uses 30% of its revenue to pay all costs of making its goods. The rest is profit. 14. ARAMCO’s balance sheet shows beginning assets of $1,000,000 and an ending balance of $2,000,000 of assets. During the current year, ARAMCO had net income of $20,000,000. a. What is ARAMCO’s return on assets (ROA)? Answer: Return on assets(ROA) Net Income 100% Average Total Assets 20,000,000 = --------------------------------x 100 (1,000,000+2,000,000) = 1333.3% b. What is the explanation of the above result? ARAMCO’s ROA is 1333.3%. This means that 1 dollar that ARAMCO invested in assets during the year produced $13.3 of net income. Depending on the economy, this can be a healthy return rate no matter what the investment is. 15. ARAMCO’s balance sheet shows that her net income $90,000 during the year. ARAMCO also had 10,000, $5 par common shares outstanding during the year. a. What is ARAMCO’s return on equity (ROE)? Answer: Return on equity (ROE) Net Income 100 % Average Total Equity 90,000 = ------------------x 100 (10,000 x 5) = 180% b. What is the explanation of the above result? ARAMCO’s ROE is 180%. This means that every dollar of common shareholder's equity earned about $1.80 this year. In other words, shareholders saw a 180 percent return on their investment. 16. ARAMCO’s reported that its stock is currently trading at $50 a share and its earnings per share for the year is $5. a. What is ARAMCO’s price to earnings ratio (PE)? Answer: PE Price per share Earnings per share 50 = -------------5 = 10 b. What is the explanation of the above result? ARAMCO’s PE ratio is 10. This means that investors are willing to pay $10 for every dollar of earning. In other words, this stock is trading at a multiple of ten. 17. ARAMCO’s reported that its stock is currently trading with a PE ratio of 30. Let’s also forecast that growth in earnings per share of 40% for the next year. a. What is ARAMCO’s price/earnings to growth ratio (PEG)? Answer: PEG PE EPS growth rate 30 = -------------40 = 0.75 b. What is the explanation of the above result? ARAMCO’s PEG ratio is 0.75. This means that values of cost is 0.75 for each dollar of future earnings growth. 18. Let’s say you own 500 shares of ARAMCO, which pay $1.10 per share in annual dividends. If its stock is currently trading at $12 a share. a. What is ARAMCO’s Dividend yield? Answer: Dividend yield ratio Dividend per share 100 % Market value per share 1.10 = -------------x100 12 = 9.2% b. What is the explanation of the above result? ARAMCO’s dividend yield ratio is 9.2%. This means that the investors receive 0.09 dollar in dividends for every dollar they have invested in the company. In other words, the investors are getting a 9.2 percent return on their investment. 19. During the current year, ARAMCO reported cost of goods sold on its income statement of $1,000,000. ARAMCO's beginning inventory was $3,000,000 and its ending inventory was $4,000,000. a. What is ARAMCO’s Inventory turnover? Answer: Inventory turnover Cost of goods sold Average Inventory 1,000,000 = ------------------------------------------(3,000,000 + 4,000,000)/2 = 0.29times b. What is the explanation of the above result? ARAMCO’s inventory ratio is 0.29. This means that ARAMCO only sold roughly a third of its inventory during the year. It also implies that it would take ARAMCO approximately 3 years to sell her entire inventory or complete one turn. 20. During the current year, ARAMCO reported in its income statement that its revenue is $4,000,000. ARAMCO's beginning fixed asset was $1,500,000 and its ending fixed asset was $2,000,000. a. What is ARAMCO’s Fixed asset turnover? Net revenue Answer: Fixed asset turnover Average Fixed Assets 4,000,000 = ------------------------------------------(1,500,000 + 2,000,000)/2 = 2.29 b. What is the explanation of the above result? ARAMCO’s fixed asset turnover ratio is 2.29. This means that ARAMCO generated $2.29 of revenue per $1 dollar of its net fixed assets over the year. 21. During the current year, ARAMCO reported in its financial statement that its beginning assets is $50,000 and ending assets is $100,000. ARAMCO also reported that its net sales is $25000. a. What is ARAMCO’s Total asset turnover? Answer: Total Asset Turnover Net Sales Average Total Assets 25,000 = ------------------------------------------(50,000 + 100,000)/2 = 0.33 b. What is the explanation of the above result? ARAMCO’s total asset turnover ratio is 0.33. This means that ARAMCO generated $0.33 of revenue per $1 dollar of its total assets over the year. 22. At the end of the year, ARAMCO reported in its financial statement that its ending inventory is $50,000 and cost of good sold is $150,000. a. What is ARAMCO’s Day’s sales in inventory? Answer: Days' sales in inventory Ending Inventory X365 Cost of goods sold 50,000 = -------------------x365 150,000 = 122 b. What is the explanation of the above result? ARAMCO’s Day’s sales in inventory ratio is 122. This means company will turn her inventory into cash in the next 122 days. 23. At the end of the year 2013, ARAMCO reported that it had $800,000 in net credit sales. It also stated that its beginning and ending account receivables were $64,000 and $72,000 respectively. a. What is ARAMCO’s Receivables turnover? Answer: Receivable s turnover Net Credit Sales Average Accounts Receivable 800,000 = --------------------------(64,000+72,000)/2 = 11.76 b. What is the explanation of the above result? ARAMCO’s receivable turnover ratio is 11.76. This means that company collects her receivables about 11.76 times a year or once every 31.04 days (365/11.76). 24. At the end of the year 2013, ARAMCO reported that it had $175,000 in net credit sales and its beginning and ending account receivables were $10,000 and $20,000 respectively. a. What is ARAMCO’s Day’s sales in receivable? Answer: Days' sales in receivables Accounts Receivable X365 Net credit sales (10,000+20,000)/2 = ---------------------------x365 175,000 = 31.29 b. What is the explanation of the above result? ARAMCO’s days’ sales in receivable ratio is 31.29. This means that it takes company approximately 31 days to collect cash from his customers on average. This is a good ratio since company is aiming for a 30 day collection period.