Presentation slide FIN434 (new slide).pptx

advertisement

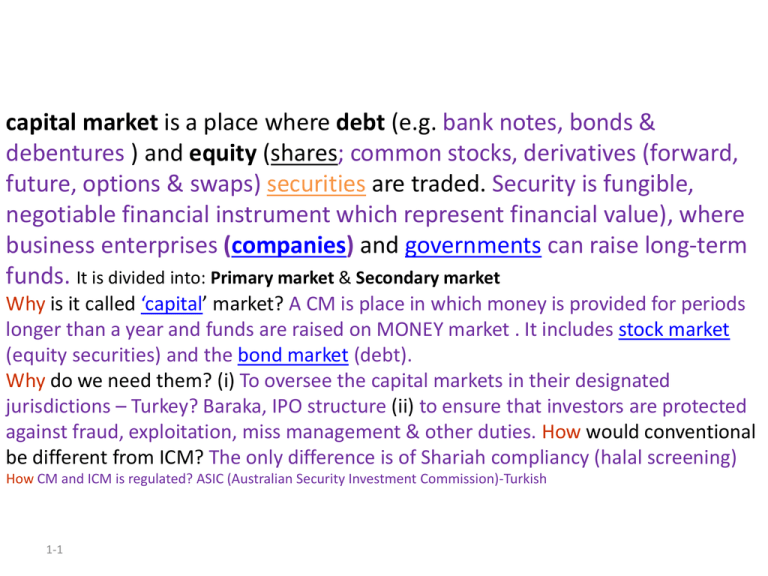

capital market is a place where debt (e.g. bank notes, bonds & debentures ) and equity (shares; common stocks, derivatives (forward, future, options & swaps) securities are traded. Security is fungible, negotiable financial instrument which represent financial value), where business enterprises (companies) and governments can raise long-term funds. It is divided into: Primary market & Secondary market Why is it called ‘capital’ market? A CM is place in which money is provided for periods longer than a year and funds are raised on MONEY market . It includes stock market (equity securities) and the bond market (debt). Why do we need them? (i) To oversee the capital markets in their designated jurisdictions – Turkey? Baraka, IPO structure (ii) to ensure that investors are protected against fraud, exploitation, miss management & other duties. How would conventional be different from ICM? The only difference is of Shariah compliancy (halal screening) How CM and ICM is regulated? ASIC (Australian Security Investment Commission)-Turkish 1-1