Contact strategy

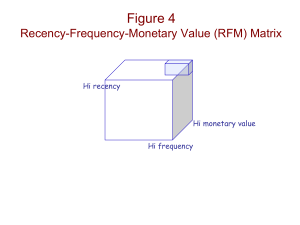

advertisement

Contact strategy Contact Strategy: What is it? • Contact strategy deals with using information about • Customer purchases • Promotion patterns • Interests, and • Preferences • In order to • Regulate the frequency and sequence of customer contact • Customize the offer, creative thrust, and positioning of contacts What is new in today’s Contact Strategy • All the key decision criteria are based at the customer or individual level • A customer is included in a promotion or campaign depending on whether there is any incremental profit from contacting the customer What is new in today’s Contact strategy • Previously all customers who did not own product A were mailed promotions about product A. • Today, a customer is mailed promotions about product A depending on • How long a person has been a customer? • What products the person has previously bought? • What were the person’s responses to previous mailings, or contacts? • What are the purchase patterns of the person? • These factors are then combined to compute the Return on Investment (ROI) for a particular customer Customer Lifetime Value • Lifetime value is the NPV of the profit that you will realize on a new customer during a given number of years • Factors in calculation of CLTV - Retention rate - Spending rate - Acquisition cost - Discount rate - NPV calculation - Referral rate Customer Lifetime Value • Ridgeway Fashions is in fashion retailing • Wants to test idea of a Birthday Club • Women provide their fashion preferences and their husband’s business address. Ridgeway sends husbands a reminder and hints for gifts before wife’s birthday • We will look at Ridgeway before and after the Birthday Club • Look at 20000 customers over a 3 year period Customer Lifetime Value • Retention rate - The single most important number in the lifetime value table - Is calculated by a simple formula: RR=year X customers/year 1 customers eg RR=8000/20000=40% - Year X customers represent those Year 1 customers who are still buying in the later year Customer Lifetime Value • Spending rate - Average amount spent by the average customer each year - Calculated by dividing total sales for group being studied in a given year by the number of customers in the group - Year 2 rate represents revenue from customers who are still active out of the original year 1group - Typically the longer customers are with you, the more they will spend per year, per visit, per order Customer Lifetime Value • Acquisition cost - Add up all money spent on advertising, marketing and sales efforts during the year - Divide this by the number of new customers who actually make purchases from you each year • Discount rate used because profits are received from customers over many years Customer Lifetime Value • Net Present Value - Once you have the discount rate for each year, each of your profits must be discounted by the corresponding rate - NPV profits=gross profits/discount rate - Add up NPVs of all profits to get cumulative NPV Customer Lifetime Value • Lifetime value is simply the cumulative NPV profit (CUM-NPV) in each year divided by the original group of customers • CLTV=CUM-NPV/acquired customers 3rd year CLTV in above example is $1201057/20000=$60.05 • Represents the average profit that you can expect to receive, after a given number of years, from the average new customer whom you can sign up Customer Lifetime Value • Referral rate - Management assumes that the Birthday Club will be successful enough that 5% of it’s customers will recommend Ridgeway to friends/relatives • Usually referred people are more loyal and have higher retention and spending rate than the average new acquisition RFM: The Workhorse • Key variables to consider for contact strategy: – Recency – Frequency – Monetary Value • Additional help comes from – Promotion History – Demographic Data – Survey data RFM definitions • Recency • How recently has a customer bought? • Frequency • How frequently does a customer purchase? • Monetary Value • How much does a customer spend on each purchase? How does RFM work? • Rank Customers according to each variable into say 5 groups. • Give preference to contacting customers who are in the top groups for each variable • Give the most preference to contacting customers who are in the top group for all the variables How does RFM work? • An RFM chart depicting the groups and the response rates for each group Response Rates by Recency 4 3 Response Rate (%) 2 1 0 5 4 3 2 1 Recency Group How does RFM work? • An RFM chart depicting the groups and the response rates for each group Response Rates by Frequency Response Rate (%) 2 1 0 5 4 3 2 1 Frequency Group How does RFM work? • An RFM chart depicting the groups and the response rates for each group Response Rates by Monetary Value 2 Response Rate (%) 1 0 5 4 3 2 1 Monetary Value Group Purchase History Information • Time or Tenure of being a customer – Treat new and old customers differently • For new customers send welcome packages • For old customers send offers that recognize their tenure • Offer special privileges to long life customers Purchase History Information • Total Sales Dollar or Total Sales Dollar over Time – Calculate Revenue Velocity Revenue Velocity (RV) = total amount customer spent total time customer has been purchasing – RV for a customer who has spent $100 in 2 months = 50 – RV for a customer who has spent $100 in 20 months = 5 – First customer preferred over the second Purchase History Information • Product Ownership – Avoid offending customers by recommending them to buy a product they already have – Very critical for expensive items like cars, insurance, and financial services – Contact customers who do not have a do-not-contact code and are outside the too-soon to contact limit Purchase History Information • Product Ownership over time – How do you effectively eliminate customers who first sign-up for all offers and then cancel them all within a month? – Look for customers who have owned products/services for a long time and offer only them additional offers Promotion History • Used to define who is eligible for an upcoming contact • Helpful in creating a market segment • Propensity Indicator – Person’s response rate over time Promotion History Propensity Indicator (PI) = (# of times bought/ # of times promoted/ time period) • Customer A was promoted 6 times, and bought twice in the last 12 months, PI = (2/6/12)= 0.027 • Customer B was promoted 6 times, and bought twice in the last 18 months, PI = (2/6/18)= 0.018 • Customer C was promoted 4 time, and bought twice in the last 6 months, PI = (2/4/6) = 0.08 • Customer C > Customer A > Customer B Demographic Information • Create relatively similar customer segments based on demographic and lifestyle characteristics • Characteristics include • Gender, marital status, age, income, home value, presence of children, education level, etc. • Age, marital status, income, presence of children best bets!!! Attitudinal Information • Survey data used to find • Motivation for purchase • Barriers to purchase • Brand’s impression as compared to a competitor • Brand Equity • Loyalty within a category • Takes a long time to collect • Not very reliable • Use in combination with purchase history and demographic data to profile segments Combining all Types of Information • Sequentially rank customers based on – First by Purchase History – Second by Demographic Information – Third by attitudinal information • Give preferences to customers who are ranked first in all three categories, then to the ones ranked first in purchase history and so forth Example: Consumer Products Company • Situation – A number one market share company finds that its market share is eroding – Fall-off in store traffic by loyal and previously high spending customers – High Ad-spending, target trade promotions and in-store promotions don’t work Example:Consumer Products Company • Strategy – In-store survey designed to collect data on • Name, address, phone number, birthday • How many of a certain product were purchased in the last 10 months? • How many were purchased in this store? • What were the primary reasons/occasions the customer bought the product? – Used this information to target customers as discussed before – The contact strategy involved multiple mailings over 12 months that involved a gift, and valuable tips to use the product. Example:Consumer Products Company • Outcome – Market share increased for the product line and for the overall brand – Customers in the program purchased at a higher rate Example: Using RFM for a Promotion • A database marketer with a customer database of 2.1 million names • Wants to do a promotional Rollout • Does a Test promotion first on 30,000 customers • It sent videos costing $100 and it made $40 on each successful sale. Cost of mailing was $0.55 per piece Example: Using RFM for a Promotion • First all 2.1 mn customers were coded by Recency, Frequency and Monetary Value • Then database was sorted by recency and divided into 5 equal parts (quintiles) which were numbered from 5 (most recent) to 1 (most ancient) • Then each of the 5 recency quintiles was further sorted by Frequency (total no of times a customer purchased from you) and divided in to 5 equal parts • Each recency quintile was thus numbered from 5 (most frequent) to 1 (least frequent) • Then each of the 25 Recency-Frequency combinations was further sorted by Monetary Value and divided into 5 equal parts. Each combo was numbered from 5(most value) to 1(least value) Example: Using RFM for a Promotion • The Test group of 30000 was selected using an Nth • A Breakeven Index is calculated for each of the 125 cells using the actual responses • Breakeven is the response rate required for the net profit from promotion to a test group to exactly equal cost Example: Using RFM for a Promotion • The company found that only 34 of the 125 RFM cells broke even • The final promotional offer was mailed to only people in the 34 cells with positive breakeven • Response rate and profits were higher by not promoting to people unlikely to respond