ACCTG833_f2007_CHPT04D2_OVHDS.ppt

advertisement

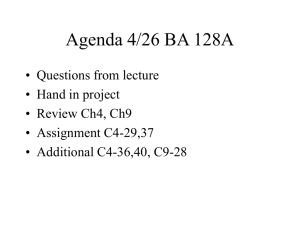

Slide 7-1 Assignments For next class: Problems: C4-33, C4-34, C4-35, C4-37, C4-38, C4-40, C4-41, C4-42 Chapter 4 Corporate Nonliquidating Distributions C Corporations Earnings and Profits Slide 7-4 Earnings and Profits (E&P) Current E&P Calculation: Regular taxable income (loss) - Federal income taxes (paid or accrued) +/- E&P adjustments = Current E&P Slide 7-5 Earnings and Profits (E&P) Accumulated E&P Calculation: Beginning accumulated E&P + Current period E&P - Distributions paid out of E&P = Ending accumulated E&P Slide 7-6 Earnings and Profits (E&P) Problems C4-28 and C4-29 Slide 7-7 Earnings and Profits (E&P) Reminder: Dividends are distributions paid out of current and accumulated E&P But what if one is negative and the other is positive? Slide 7-8 Example 1: E&P Ordering Rules Assume: Beginning accumulated E&P is $(100,000) Current period E&P is $120,000 Cash distributions during the year were $140,000: $30,000 on 3/31 $30,000 on 6/30 $40,000 on 9/30 $40,000 on 12/31 Q: What portion of the distribution is paid out of current E&P? Slide 7-9 E&P Ordering Rules [IRC §316(a) and Reg. §1.316-2(a)] Distributions of property made during the year are first deemed to be paid out of current E&P Calculated on last day of year, without reducing by current year distributions [Reg. §1.316-2(b)] Allocated on pro rata basis regardless of when distributions are actually made during the year (distribution/total distributions) [Reg. §1.316-2(b)] Slide 7-10 E&P Ordering Rules [Reg. §1.316-2(b)] Distributions of property made during the year that exceed current E&P are next deemed to be paid out of accumulated E&P in chronological order (earliest year first) Slide 7-11 Example 1: E&P Ordering Rules Assume: Beginning accumulated E&P is $(100,000) Current period E&P is $120,000 Cash distributions of $30,000 on 3/31 and 6/30, $40,000 on 9/30 and 12/31, total of $140,000 Current E&P is prorated to each distribution: $30,000 on 3/31 ($25,714 is paid out of E&P) $30,000 on 6/30 ($25,714 is paid out of E&P) $40,000 on 9/30 ($34,286 is paid out of E&P) $40,000 on 12/31 ($34,286 is paid out of E&P) Slide 7-12 Example 2: E&P Ordering Rules Assume: Beginning accumulated E&P is $135,000 Current period E&P is ($76,000) Cash distribution during the year (paid on April 1st) was $145,000 Q: What portion of the distribution is paid out of accumulated E&P? Slide 7-13 E&P Ordering Rules [Reg. §1.316-2(b)] When current E&P is negative and beginning accumulated E&P is positive Negative current E&P is prorated to the distribution date (excluding the distribution date itself) and subtracted from beginning accumulated E&P Distribution is deemed to be paid out of E&P to the extent that the number above is positive Slide 7-14 Example 2: E&P Ordering Rules Assume: Beginning accumulated E&P is $135,000 Current period E&P is ($76,000) Cash distribution during the year (April 1st) was $145,000 Prorated current period E&P deficit: Days from 1/1 to 4/1 = 90 90/365 x ($76,000) = ($18,740) E&P on 4/1 = $135,000 + ($18,740) = $116,260 $116,260 dividend, $28,740 return of capital C Corporations Taxation of Property Distributions Slide 7-16 Taxation of Shareholders [IRC §301(c)(1)] Distributions of property that are dividends are included in the shareholder’s taxable income Maximum 15% tax rate for qualifying dividends received by individual shareholders [IRC §1(h)(11)] Dividends received deduction allowed for dividends received by corporate shareholders [IRC §243(a)] Slide 7-17 Taxation of Shareholders [IRC §301(c)(2) & (3)] Distributions of property that are not dividends: Are applied against and reduce the shareholder’s adjusted basis in the stock (but not below zero) Are treated as gains from the sale or exchange of property if they exceed the stock’s adjusted basis (capital gain if the stock is a capital asset) Slide 7-18 Taxation of Shareholders [IRC §301(d)] The shareholder’s basis in noncash property received as a distribution from a C corporation is the property’s FMV on the date of the distribution (not reduced by any liabilities assumed) Slide 7-19 Example 3 - Distributions A corporation distributes $100,000 to its sole shareholder, $80,000 of the distribution is paid out of the corporation’s current and accumulated E&P. The shareholders basis before the distribution is $30,000. $80,000 is taxable dividend income $20,000 is nontaxable but reduces the shareholder’s basis to $10,000 Slide 7-20 Example 4 - Distributions A corporation distributes $100,000 to its sole shareholder, $45,000 of the distribution is paid out of the corporation’s current and accumulated E&P. The shareholders basis before the distribution is $30,000. $45,000 is taxable dividend income $30,000 is a nontaxable return of capital that reduces the shareholder’s basis to $0 $25,000 is a taxable capital gain Slide 7-21 Taxation of C Corporation [IRC §311(a)(2)] Except as otherwise provided in subsection (b), no gain or loss is recognized to a corporation on the distribution of property with respect to its stock Slide 7-22 Taxation of C Corporation [IRC §311(b)] C Corporations must recognize gains on distributions of appreciated property to shareholders as if the property were sold at its FMV (appreciated means FMV > adjusted basis) Gain increases taxable income and FIT Gain increases E&P (based on E&P basis) If shareholder assumes a liability as part of the distribution, the FMV of the property transferred is deemed to be no less than the amount of the liability Slide 7-23 Taxation of C Corporation E&P is reduced (but not below zero) by Cash distributed [IRC §312(a)(1)] Principal amount of the corporation’s debt obligations distributed [IRC §312(a)(1)] The FMV of any appreciated property distributed [IRC §312(b)(2)] The E&P adjusted basis of any other property distributed [IRC §312(a)(3)] E&P reduction for distributions is net of any liabilities that shareholder assumes in connection with the distribution [IRC §312(c)] Slide 7-24 Example 5 – Noncash Distributions A corporation distributes land with a FMV of $100,000 and an adjusted basis of $108,000 to its sole shareholder. The shareholder assumes a $35,000 mortgage on the land. The corporation’s E&P before considering this distribution is $120,000. The corporation’s tax rate is 34%. What are the tax consequences to the shareholder and the corporation? Slide 7-25 Example 5 – Noncash Distributions Shareholder: Distribution amount equals $65,000 [$100,000 (FMV) less $35,000 (liability assumed)] $65,000 of taxable dividend income Basis in land is $100,000 (FMV) Corporation: No gain or loss on the distribution E&P is reduced by $73,000 [$108,000 (basis) less $35,000 (liability assumed)] to $47,000 Slide 7-26 Example 6 – Noncash Distributions A corporation distributes land with a FMV of $125,000 and an adjusted basis of $108,000 to its sole shareholder. The shareholder assumes a $35,000 mortgage on the land. The corporation’s E&P before considering this distribution is $120,000. The corporation’s tax rate is 34%. What are the tax consequences to shareholder and corporation? Slide 7-27 Example 6 – Noncash Distributions Shareholder: Distribution amount equals $90,000 [$125,000 (FMV) less $35,000 (liability assumed)] $90,000 of taxable dividend income Basis in land is $125,000 (FMV) Slide 7-28 Example 6 – Noncash Distributions Corporation: $17,000 recognized gain [$125,000 (FMV) less $108,000 (basis)] on the distribution E&P effects: Increases by $17,000 gain recognized Decreases by $5,780 FIT on gain (at 34%) Decreases by $90,000 distribution [$125,000 (FMV) less $35,000 (liability assumed)] E&P balance is $41,220