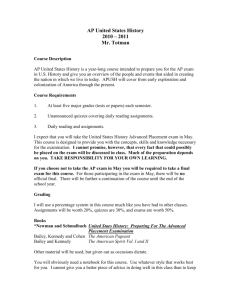

Course SyllabusHybrid.doc

advertisement

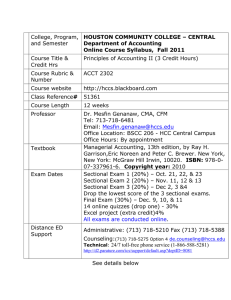

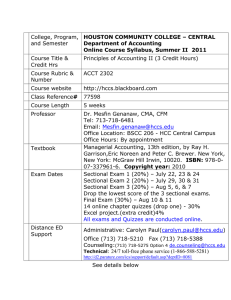

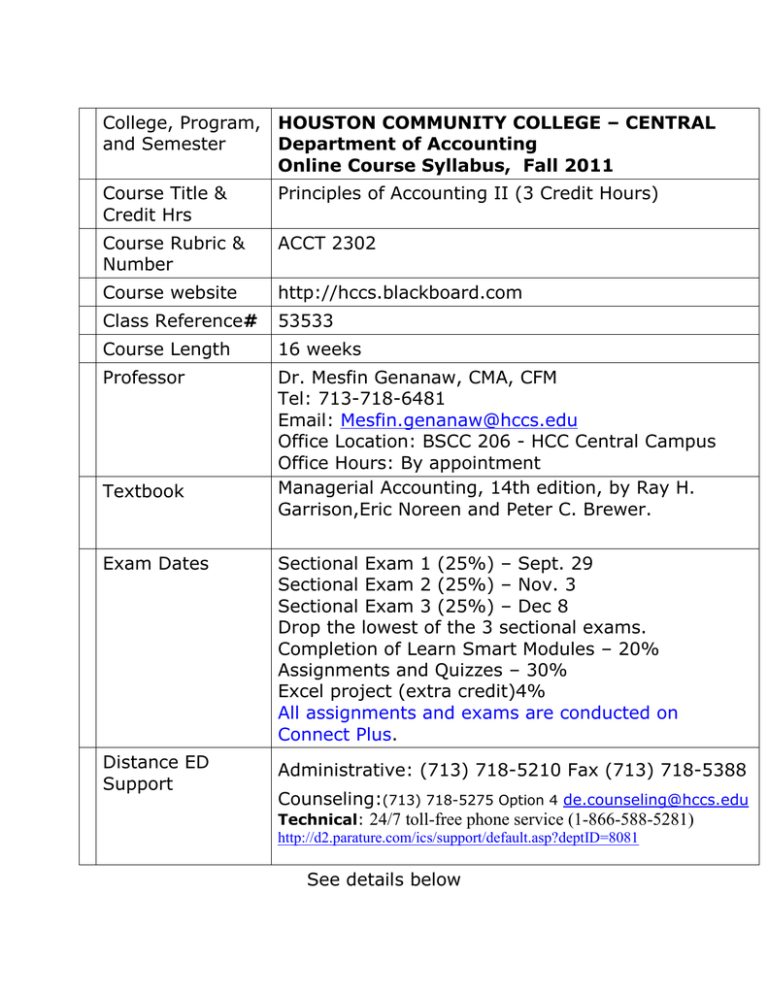

College, Program, HOUSTON COMMUNITY COLLEGE – CENTRAL Department of Accounting and Semester Online Course Syllabus, Fall 2011 Course Title & Credit Hrs Principles of Accounting II (3 Credit Hours) Course Rubric & Number ACCT 2302 Course website http://hccs.blackboard.com Class Reference# 53533 Course Length 16 weeks Professor Dr. Mesfin Genanaw, CMA, CFM Tel: 713-718-6481 Email: Mesfin.genanaw@hccs.edu Office Location: BSCC 206 - HCC Central Campus Office Hours: By appointment Managerial Accounting, 14th edition, by Ray H. Garrison,Eric Noreen and Peter C. Brewer. Textbook Exam Dates Sectional Exam 1 (25%) – Sept. 29 Sectional Exam 2 (25%) – Nov. 3 Sectional Exam 3 (25%) – Dec 8 Drop the lowest of the 3 sectional exams. Completion of Learn Smart Modules – 20% Assignments and Quizzes – 30% Excel project (extra credit)4% All assignments and exams are conducted on Connect Plus. Distance ED Support Administrative: (713) 718-5210 Fax (713) 718-5388 Counseling:(713) 718-5275 Option 4 de.counseling@hccs.edu Technical: 24/7 toll-free phone service (1-866-588-5281) http://d2.parature.com/ics/support/default.asp?deptID=8081 See details below Course Description ACCT 2302 is a Continuation of ACCT 2301 focusing on fundamentals of managerial accounting including manufacturing operations and planning and control. Other topics include budgets, introduction to cost accounting, cost control techniques, methods of measuring performance, and financial statement analysis. Prerequisites ACCT 2301 Principles of Accounting I Course Goal The primary purpose of Principles of Accounting II is to provide the students with a comprehensive and in depth course in managerial accounting. The course is designed to meet the needs of those students who are preparing for a career in accounting. Course Student Learning Outcomes (CLO) Students will: 1. Show understanding of manufacturing operations, and, planning and control 2. Show understanding of budgets, and, cost accounting 3. Show understanding of cost control techniques 4. Show understanding of methods of measuring performance 5. Show understanding of financial statement analysis Course Description: In-depth analysis of managerial accounting including manufacturing operations and planning and control. Other topics include budgets, introduction to cost accounting, cost control techniques, methods of measuring performance, and financial statement analysis End-of-Course Outcomes: Develop understanding of manufacturing cost categories; flow of costs in a job-order, and, process costing system; cost prediction, and, costvolume-profit relationship; variable, absorption, and, activity-based costing; budgets and performance analysis; direct materials & labor standards, and, segmented income statement; analysis to drop or retain a product line or business segment; and Compute and interpret financial ratios useful to a common stockholder or creditor. Learning objectives The student will be able to: 1. Show understanding of manufacturing cost categories 2. Show understanding of flow of costs in a job-order, and, process costing system 3. Show understanding of cost prediction, and, cost-volumeprofit relationship 4. Show understanding of variable, absorption, and, activitybased costing 5. Show understanding of budgets and performance analysis 6. Show understanding of direct materials & labor standards, and, segmented income statement 7. Show understanding of analysis to drop or retain a product line or business segment 8. Compute and interpret financial ratios useful to a common stockholder or creditor SCANS or Core Curriculum Statement The Secretary’s Commission on Achieving Necessary Skills (SCANS) from the U.S. Department of Labor was asked to examine the demands of the workplace and whether our students are capable of meeting those demands. Specifically, the Commission was directed to advise the Secretary on the level of skills required to enter employment. In carrying out this charge, the Commission was asked to do the following: Define the skills needed for employment Propose acceptable levels of proficiency Suggest effective ways to assess proficiency, and Develop a dissemination strategy for the nation’s schools, businesses, and homes SCANS research verifies that what we call workplace knowhow defines effective job performance today. This knowhow has two elements: competencies and a foundation. This report identifies five competencies and a three-part foundation of skills and personal qualities that lie at the heart of job performance. These eight requirements are essential preparation for all students, whether they go directly to work or plan further education. Thus, the competencies and the foundation should be taught and understood in an integrated fashion that reflects the workplace contexts in which they are applied. Workplace Competencies Resources: allocating time, money, materials, space, staff Interpersonal Skills: working on teams, teaching others, serving customers, leading, negotiating, and working well with people from culturally diverse backgrounds Information: acquiring and evaluating data, organizing and maintaining files, interpreting and communicating, and using computers to process information Systems: understanding social, organizational, and technological systems, Foundation Skills Basic Skills: reading, writing, arithmetic and mathematics, speaking and listening Thinking Skills: thinking creatively, making decisions, solving problems, seeing things in the mind’s eye, knowing how to learn, and reasoning Personal Qualities: individual responsibility, selfesteem, sociability, selfmanagement and integrity monitoring and correcting performances, and designing or improving systems Technology: selecting equipment and tools, applying technology to specific tasks, and maintaining and troubleshooting technologies SCANS workplace competencies and foundation skills have been integrated into Introduction to Accounting, and are exhibited in the SCANS schedule. Study guide and Homework Assignments Study guides are available at the course website. They help students master the basic content of the text. Students must complete homework assignments as scheduled in the course syllabus. You do not have to submit homework assignments. Solutions to homework problems and exercises are provided at the course website. However, students are not advised to look into the solutions before attempting to solve the assignments on their own. Course website We will be using the Blackboard Vista for our virtual classroom. You can access the course website at http://hccs.blackboard.com. All students registered for this course must have internet access. This course website allows you to access course resource sites and audio/video lectures, participate in discussions, take online quizzes, seequiz results, and much more. Student Resources After accessing the course website at http://hccs.blackboard.com, click on “Course content” icon on the navigation bar to find course instructions, powerpoint lectures, homework solutions and other resources. Click on “ Course book” to access extensive amount of chapter-bychapter materials. Click on any chapter and you will find resources that include Flashcards, Online Quizzes, practice exams, sample study guides, Internet Exercises, Key Terms, Learning Objectives, Chapter Summary, SPATS, Narrated Powerpoints, Excel Walkthroughs, Electronic Exhibits, Factory Tour, and Hot New Materials on that chapter. Especially the Narrated Powerpoints and Excel Walkthroughs give you an excellent highlight of the entire chapter. Please surf through and read all links provided on the course website. You are expected to complete at least one chapter every week. The practice exams and quizzes have questions similar to the sectional exams and the final exam for this course. Don't wait until exam periods to study these online resources. Audio and Video Resources: After accessing the course website, you may click on “Audio Resources” icon under the course menu to listen to short and summarized chapter-bychapter audio lectures. These lectures provide key concepts and ideas in each chapter of the course syllabus. The video library showcases chapter-by-chapter videos of real life managerial issues. Evaluation and Requirements: This class represents an alternative method of teaching and learning Managerial Accounting. While we use the Internet to communicate, our goal is to maintain as much of the traditional experience of the classroom as possible. Therefore, the course objectives, course schedule and assessment criteria are, as much as possible, in this online environment as it is in the face-to-face managerial Accounting classes that I teach. You are expected to read and complete all end of chapter assignments. You do not have to submit end of chapter homework assignments. Learning accounting is like learning a foreign language. It is very much learning by doing and by practice. The learning process is cumulative. That means that what we learn today builds upon what we learned last week, which presupposes that you actually learned the procedure and used the concepts last week. If you did a half-hearted job last week, you have a weak foundation upon which to build. The textbook does a good job of explaining the material, but you have to read it, and do the assignments on a timely basis to be successful in the course. It is extremely important that you be actively involved in the learning process. You have to read each chapter on the textbook, read the student resources on the course website, and apply the ideas to the homework problems. This will require a considerable commitment of time and effort from you. Your final grade for this course will be based on how well you do in meeting the evaluation requirements and applying the grading scale listed below. Grades will be posted after completion of each quiz period. Grading Scale 90%–100% = A 80%– 89% = B 70%– 79% = C 60%– 69% = D Below 60% = F Examinations As stated above, there will be 11 assignments and quizzes, three sectional examinations (drop one). If a student misses a sectional exam, that becomes the dropped exam. Assignments and quizzes are conducted online on Connect Plus and are multiple choice questions. Grades are posted as soon as exam is submitted. Online assignments provide multiple accesses over the opening period. Exams provide only one time access during the opening hours. All exams are conducted in BSCC 208 – accounting lab. There will be no make-up on these exams or quizzes. Your grades on all exams, online assignments, and completion of the learning Smart modules will be used to compute your final grade for the course. Student who misses only the final exam for valid and reported reason, will get a grade of “I”. If you receive an “I,” you must arrange to complete the course work by the end of the following term (excluding Summer Semester). After the deadline, the “I” becomes an “F.” An assignment schedule is attached to this syllabus. This schedule will be followed throughout this course unless modification is announced in class. Academic Honesty Students are responsible for conducting themselves with honor and integrity in fulfilling course requirements. Penalties and/or disciplinary proceedings may be initiated by College System officials against a student accused of scholastic dishonesty. “Scholarly dishonesty” includes, but is not limited to, cheating on a test, plagiarism, and collusion. See the 1999-2001 Student handbook for more information. Tutoring/Lab Hours Accounting tutors are available at different HCCS locations. The instructor will provide you with the information about their locations, days and times on the course website. HCC DISTANCE EDUCATION POLICIES AND PROCEDURES The Distance Education Student Handbook contains policies and procedures unique to the DE student. Students should have reviewed the handbook as part of the mandatory orientation. It is the student's responsibility to be familiar with the handbook's contents. The handbook contains valuable information, answers, and resources, such as DE contacts, policies and procedures (how to drop, attendance requirements, etc.), student services (ADA, financial aid, degree planning, etc.), course information, testing procedures, technical support, and academic calendars. Refer to the DE Student Handbook by visiting this link: http://de.hccs.edu/de/de-student-handbook Tutoring/Lab Hours Accounting tutors are available at different HCCS locations. The instructor will provide you with the information about their locations, days and times on the course website. . Assignment Schedule: This schedule will be followed throughout this course. Any modifications to this schedule will be announced in class. ACCT 2302 – Principles of Accounting II wk Chap Topics ter 1 Managerial Accounting: An Overview 2 Managerial Accounting & Cost Concepts Assignments Ex 2-1 thru Ex2-8; Ex2-10 thru Ex2-13, Prob. 2-14 3 4 5 Job-Order Costing Process Costing Exam #1(Chapters 1 – 4) Cost-Volume-profit Relationships 6 Variable Costing and Segment Reporting: Tools for management 8 Profit Planning 9 Flexible Budgets and Performance Analysis 10 Exam #2 (Chapters 5, 6,8,9) Standard Costs & Variances 11 Performance Measurement in Decentralized Organizations 12 Differential Analysis: The Key to Decision Making Ex 3-1 thru Ex 3-4; Ex 3-6 thru Ex3-11; Prob. 3-21 Ex 4-1 thru Ex 4-6; Ex 4-8 thru Ex4-10; Prob. 4-13 Ex 5-1 thru Ex 5-10; Prob. 5-19 Ex 6-1 thru Ex 6-10; Prob. 6-17 Ex 8-1 thru Ex 8-11; EX. 8-15 Ex 9-1 thru Ex 9-10; Prob. 9-19 Ex 10-1 thru Ex 108; Prob. 10-9 Ex 11-1 thru Ex 113; Ex 11-5 thru Ex 11-9 Ex 12-1 thru Ex 12- 7; Ex 12-10 Exam #3 (Chpts. 10-13)