The Cash Flow Statement MSE608C – Engineering and Financial Cost Analysis

advertisement

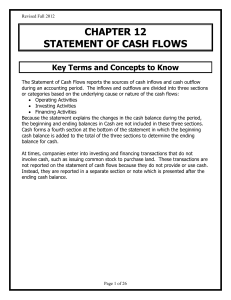

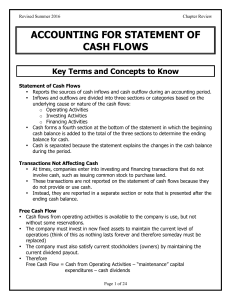

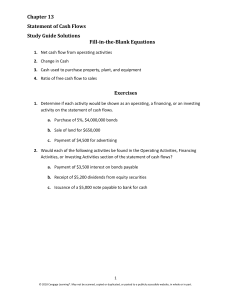

MSE608C – Engineering and Financial Cost Analysis The Cash Flow Statement What It Is! Why It Is! It provides a complete picture of: – The net change in the asset Cash and – In what areas did changes in cash appear and by how much. • While the Balance Sheet and Income Statement are based on Accrual accounting, Cash Flow is a Cash Basis report. • Cash: Important to maintain the operation of a business. – A company can be profitable but cash poor or – Can be cash-rich and losing money. MATADOR INC. Cash Flow Statement Year Ending December 31, 2004 (in OOOs) Cash Flows from Operating Activities Net income Depreciation Amortization Supplies Accrued liabilities Accounts receivable Inventory Accounts payable $135 30 10 14 5 (40) (30) (25) Cash Flows from Investing Activities Purchase of equipment Purchase of land (30) (62) Cash Flows from Financing Activities Increase (decrease) in Notes Payable Cash dividends Increase (decrease) in Common Stock Increase (decrease) in Paid-in Capital Increase (decrease) in Bonds Payable 10 (75) 10 40 (2) Increase (decrease) in Cash ($10) Sources and Uses of Cash • The Cash Flow Statement shows: – Sources of cash (funds) over the accounting period – Uses of cash (funds) over the accounting period – The change in cash due to cash infusions (sources) and expenditures (uses). • There are only four possible Sources and Uses of cash: • • • • Assets Liabilities Owners’ Equity Operations (profit generating activities) Sources of Cash • Assets – The Sales of an asset resulting in cash • Liabilities – An increase in borrowed money results in new cash. • Owners’ Equity – Investment of cash by owners or – The sale of stock results in new cash. • Operations – – – – Selling goods or services for a Profit resulting in cash A decrease in Inventory resulting in cash A decrease in Accounts Receivable provides cash. Depreciation of assets (a non-cash transaction) must be added back to reverse the reduction of Net Income. Uses of Cash • Assets – Purchase of equipment, property or other assets. • Liabilities – Payment of loans and Accounts Payable • Owners’ Equity – Repurchase of stock – Payment of dividends – Withdrawal of cash or other assets by owners • Operations – Purchase of inventory, supplies and other operating expenses will decrease cash. – An increase in Accounts Receivable consumes additional cash. – Business losses consume cash. Direct vs. Indirect Method • Direct Method: – Cash receipts and cash payments are used directly for determining Cash Flows from Operations • Indirect Method: – Changes in Current Assets, Current Liabilities and Net Income converts from Accrual accounting to Cash-basis accounting. • Cash Flows from Investing and Financing Activities are the same for both methods. Creating a Cash Flow Statement (Indirect Method) • Cash Flows from Operations are transactions affecting: – Net Income – Working Capital (WC = CA – CL) • Cash Flows from Investing Activities are transactions affecting: – Non-Current Assets • Cash Flows from Financing Activities are transactions affecting: – Non-current debt – Owners’ Equity Cash Flow from Operating Activities Cash flows from Operations Net Income Depreciation and Amortization Accounts Receivable Inventory Accounts Payable Other Current Liabilities Data Source Increase Decrease Income Statement Income Statement Balance Sheet Balance Sheet Balance Sheet Balance Sheet Source Source (Use) (Use) Source Source (Use) Source Source (Use) (Use) Cash Flows from Investing Activities Cash flows from Investing Investment in fixed assets Purchase of Marketable Securities Data Source Increase Decrease Balance Sheet Balance Sheet (Use) (Use) Source Source Cash Flows from Financing Activities Cash flows from Financing Data Source Long-term debt Payment of Dividends Invested Capital Increase Decrease Balance Sheet Source Statement of Retained (Use) Earnings or footnotes Balance Sheet Source (Use) (Use) Statement of Retained Earnings Retained Earnings, November 30, 2006 Add: net income Subtract: dividends paid $284.4 32.0 (30.5) Retained Earnings, December 31, 2006 $285.9 Metcalf Example Handout Assessment • The Cash Flow Statement shows _______ of cash and ________ of cash. • The format for the Cash Flow Statement categorizes cash flows into what three areas? • Which financial statement provides most of the data for the Cash Flow Statement? • What two items found on the Income Statement are typically used for the Cash Flow Statement?