ACCT 5306 International Income Tax Summer 2014

advertisement

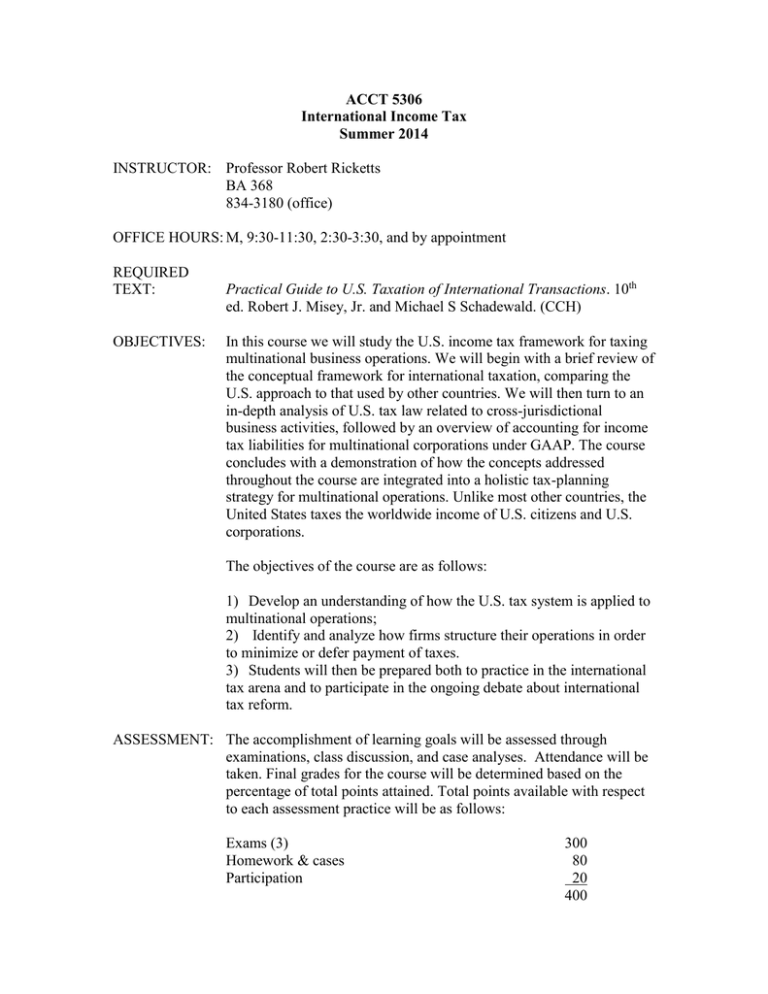

ACCT 5306 International Income Tax Summer 2014 INSTRUCTOR: Professor Robert Ricketts BA 368 834-3180 (office) OFFICE HOURS: M, 9:30-11:30, 2:30-3:30, and by appointment REQUIRED TEXT: OBJECTIVES: Practical Guide to U.S. Taxation of International Transactions. 10th ed. Robert J. Misey, Jr. and Michael S Schadewald. (CCH) In this course we will study the U.S. income tax framework for taxing multinational business operations. We will begin with a brief review of the conceptual framework for international taxation, comparing the U.S. approach to that used by other countries. We will then turn to an in-depth analysis of U.S. tax law related to cross-jurisdictional business activities, followed by an overview of accounting for income tax liabilities for multinational corporations under GAAP. The course concludes with a demonstration of how the concepts addressed throughout the course are integrated into a holistic tax-planning strategy for multinational operations. Unlike most other countries, the United States taxes the worldwide income of U.S. citizens and U.S. corporations. The objectives of the course are as follows: 1) Develop an understanding of how the U.S. tax system is applied to multinational operations; 2) Identify and analyze how firms structure their operations in order to minimize or defer payment of taxes. 3) Students will then be prepared both to practice in the international tax arena and to participate in the ongoing debate about international tax reform. ASSESSMENT: The accomplishment of learning goals will be assessed through examinations, class discussion, and case analyses. Attendance will be taken. Final grades for the course will be determined based on the percentage of total points attained. Total points available with respect to each assessment practice will be as follows: Exams (3) Homework & cases Participation 300 80 20 400 UNIVERSITY POLICIES Integrity. Academic dishonesty will not be tolerated. All students are required to adhere to the Texas Tech University Policy on Academic Honesty. Students using or providing assistance during an examination will receive an F for this course. Students working on homework or cases with classmates outside their assigned groups will receive a zero on the assignment. Civility in the Classroom. “Students are expected to assist in maintaining a classroom environment which is conducive to learning. In order to assure that all students have an opportunity to gain from time spent in class, unless otherwise approved by the instructor, students are prohibited from using cellular phones or beepers, eating or drinking in class, making offensive remarks, reading newspapers, sleeping or engaging in any other form of distraction. Inappropriate behavior in the classroom shall result in, minimally, a request to leave class.” ADA Requirements. Classroom accommodations will be made for students with disabilities, if requested. Religious Holidays. A student who intends to observe a religious holy day should make that intention known to the instructor prior to an absence. A student who is absent from classes for the observance of a religious holy day shall be allowed to take an examination or complete an assignment scheduled for that day within a reasonable time after the absence. Tentative Schedule The following is a tentative schedule of topics, readings, and assignments. You are expected to have read all assigned materials each day before attending class. PART 1: General Framework 08/24 Conceptual framework for international taxation 08/31 Foreign Tax Credit 09/07 No class (but homework will be assigned!) 09/18 Source of Income Rules 09/21 EXAM 1 PART 2: Measurement, Timing & Accounting 09/28 Accounting for Income Taxes 10/05 Subpart F 10/12 Foreign Currency Translation Code Sec. 367: outbound, inbound & foreign-to10/19 foreign transactions 10/26 EXAM 2 PART 3: Planning 11/02 Transfer Pricing 11/09 Planning for Foreign Operations 11/16 Planning for Foreign-owned U.S. Operations Taxing Ex-Pats (including domestic ex-pats of foreign 11/23 companies) 11/30 Tax Treaties 12/09 Final Exam Ricketts, Ch 9 provided online Text, Ch 4 Text, ¶804 Text, Ch 3 Take home Handout Text, Ch 5 Text, Ch 6 Text, Ch 14 Take home Text, Ch 12 Text, Ch 8 Text, Ch 11 Text, Ch 2 Text, Ch 13 Take home