TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition

advertisement

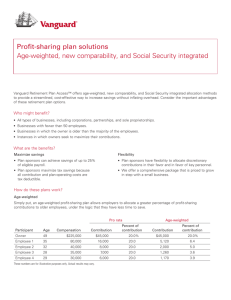

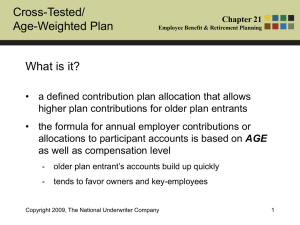

TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition College Course Materials Deanna L. Sharpe, Ph.D., CFP®, CRPC®, CRPS® Associate Professor CFP® Program Director Personal Financial Planning Department University of Missouri-Columbia Please Note: Correct answers for each question are indicated in bold type. After each question, the number of the page containing information relevant to answering the question is given. When a calculation is necessary or the reasoning behind a given answer may be unclear, a brief rationale for the correct answer is also given. Part A: Retirement Planning Defined Contribution Plans Chapter 21: Cross-Tested/Age-Weighted Plan True/False 21.1 A target plan is a pension plan that uses an age-weighted contribution formula. 21.2 A cross-tested plan uses a fixed age-weighted formula. The plan is designed to maximize benefits for a firm’s highly compensated employees while providing whatever is necessary for remaining employees to satisfy nondiscrimination regulations 21.3 A self-employed person can adopt an age-weighted or cross-tested plan. Answers: 21.1 true [p. 187] 21.2 false [p. 187] 21.3 true [p. 191] Multiple Choice 21.4 Advantages of an age-weighted plan include each of the following except: a. can maximize retirement benefits of employees who enter the plan at older ages b. can replace a defined benefit plan and give approximately the same benefit to most employees c. due to their predetermined structure, an age weighted plan is exempt from nondiscrimination rules d. provides tax deferral while account investment grows e. plan can favor owner and key employees Answer: C [p. 188] 21.5 Annual additions to an age-weighted plan include a. b. c. d. e. employer contributions to participants’ accounts employee contributions to own account forfeitures from other accounts all of the above only a and b Answer: D [p. 190] 21.6 Disadvantages of cross-tested plans include: a. b. c. d. e. hire of new employees can upset the age distribution in the plan discourages hire of older employees complex rules all of the above only a and b Answer: D [p. 188] Application 21.7 Sentenal Corp., a restaurant supply company, is a closely held business. Tom Brady, founder and owner of the business is 59. Jeff Alcorn, age 53, is a key employee. The business employs 10 other rank and file employees earning an average of $30,000 per year. Both Tom and Jeff would like to contribute between $30,000 and $40,000 per year to a qualified retirement account. The advantages of using a profit sharing, age-weighted plan at Sentenal rather than a defined benefit plan include: a. b. c. d. e. the age-weighted plan is simpler to install the age-weighted plan is less expensive to administer the age-weighted plan allows more flexibility in plan contributions all of the above only a and b Answer: D [pp. 187-88 – Age-weighted plans are simple to install and inexpensive to use. If an age-weighted plan is a profit sharing plan, the employer is not committed to any funding formula and may not fund the plan during some years, whereas a defined benefit plan must be funded each year in an amount that will meet contractual obligations.] 21.8 The law firm of Willie, Cheatum, and Howe is structured as a professional corporation that has three key employees between age 39 and 43, two law clerks in their late 20s, and two secretaries, both age 31. The three key employees earn $500,000 per year. The law clerks are paid $30,000 and the secretaries are paid $15,000 annually. Turnover for both the law clerks and secretaries has been rather high, with at least one law clerk and one secretary leaving about every 6 months for the past year. Characteristics of the firm that would make a cross-tested plan a less than optimal solution for the firm include: a. the plan would have to be reconsidered at each new hire b. the plan would provide relatively few advantages given the age of the highly compensated group c. having more than one highly compensated employee makes coverage tests related to the plan more difficult to apply d. all of the above e. only b and c Answer: D [p. 189] 21.9 Tom Smyth owns a business that sponsors a cross-tested defined benefit plan, but he wants to adopt an simpler alternative that would still allow a current tax deduction and be easier to explain, design, and administer. Tom’s best alternative, given his concerns, would be a. b. c. d. e. another defined benefit plan a money purchase plan a nonqualified deferred compensation plan an individual retirement savings plan a target benefit plan Answer: B [p. 191 – a defined benefit plan is complex to design and administer; tax deductions are deferred for nonqualified plans; an individual retirement plan does not provide a business deduction; target plans are difficult to explain] 21.10 Ocatagon Industries has an age weighted profit sharing plan that uses a fixed ageweighted formula for allocating employer contributions. The plan covers 50 employees. The owner and 2 key employees are highly compensated, each earning $500,000 per year. Average pay for the rank and file employees is $35,000 per year. This year, the company allocated $1,000 to each employee’s retirement account. The tax implications of such an allocation include which of the following: a. because the plan is top-heavy, Ocatagon cannot receive a tax deduction until an employee withdraws funds from his or her retirement account b. participant does not pay income tax on employer contributions and earnings until the plan participant withdraws the funds c. plan distributions for hardship withdrawals made to employees before age 59 1/2 are tax free e. a and c Answer: B [p. 190]