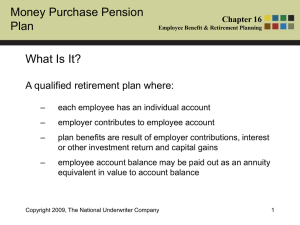

Chapter 16 M P

advertisement

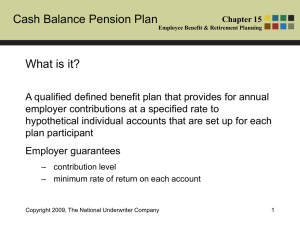

Chapter 16 MONEY PURCHASE PENSION PLAN LEARNING OBJECTIVES: A. Have a basic understanding of money purchase pension plans REVIEW: This chapter begins with a quick overview of money purchase plans, and then briefly discusses when an employer might use such a plan. Following coverage of advantages and disadvantages, the chapter discusses money purchase plan design features. Tax implications and a few alternatives are then discussed. This chapter directs the reader back to Chapter 10 for information on how to install a money purchase plan. The chapter closes with a reference for learning more, and a brief question and answer section. CHAPTER OUTLINE: A. B. C. D. E. F. G. H. I. J. K. What Is It? When Is It Indicated? Advantages Disadvantages Design Features Tax Implications Alternatives How To Install A Plan Where Can I Find Out More About It? Questions And Answers Chapter Endnotes FEATURED TOPICS: Money purchase pension plan 1 Chapter 16 FIGURES: Figure 16.1 Account Balance Relative to Annual Salary Increase Figure 16.2 Account Balance Relative to Entry Age and Rate of Return CFP® CERTIFICATION EXAMINATION TOPIC: Topic 61: Types of retirement plans B. Types and basic provisions of qualified plans 1. Defined contribution a. Money purchase COMPETENCY: Upon completion of this chapter, the student should be able to: 1. Have a basic understanding of money purchase pension plans KEY WORDS: money purchase pension plan, nondiscriminatory contribution formula DISCUSSION: 1. Discuss advantages and disadvantages to using a money purchase plan. 2. Discuss when an employer might want to establish a target benefit plan or a profit sharing plan rather than a money purchase plan. QUESTIONS: 1. Which one of the following is true about employer contributions into a money purchase plan? a. contributions cannot exceed 30% of an employee’s compensation Chapter 16 b. in 2005, the maximum dollar amount of annual contributions to an employee’s account cannot exceed $50,000 c. plan contributions go into a pooled account rather than into individual employee accounts d. plan benefits accumulate in individual employee accounts which will be available at retirement or termination of employment Chapter 16, p. 147 2. Which one of the following may be considered a disadvantage for employees to money purchase pension plans? a. employees bear investment risk under the plan b. employers bear investment risk under the plan c. plan distributions may be eligible for the 10-year special averaging computation d. good investment results increase plan benefits Chapter 16, p. 149 3. Which one of the following correctly identifies the term used to identify a plan benefit formula that can be integrated with Social Security? a. b. c. d. offset formula social insurance rider permitted disparity compensation analysis formula Chapter 16, p. 150 4. Which of the following are true regarding money purchase plans? (1) self-employed persons can adopt a money purchase plan (2) plans in S corporations cannot cover shareholder-employees (3) money purchase plans can allow after-tax employee contributions (4) salary reductions allowing pre-tax contributions are not allowed for post1974 plans a. b. c. d. (1) and (3) only (1) (3) and (4) only (2) (3) and (4) only (1) (2) (3) and (4) Chapter 16, pp. 151-52 Chapter 16 ANSWERS: 1. d 2. a 3. c 4. b