Chapter 8 Q P :

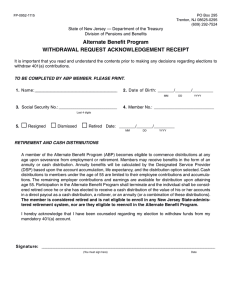

advertisement

Chapter 8 QUALIFIED PLANS: DISTRIBUTIONS AND LOANS LEARNING OBJECTIVES: A. Have a basic understanding of qualified plan distributions and loans B. Identify key plan provisions regarding spousal benefits and qualified domestic relations orders (QDROs) C. Understand provisions relating to defined benefit and defined contribution plan distributions D. Have a basic understanding of tax issues related to qualified plan distributions, including premature withdrawal and minimum distributions requirement penalties E. Have a basic understanding of retirement plan rollovers REVIEW: This chapter covers distributions and loans from qualified plans. It begins with a discussion about planning retirement distributions, which includes a good section on questions to consider. The chapter continues by covering required spousal benefits, including pre-retirement survivor annuities and joint and survivor annuities. Next, the chapter covers a number of defined benefit and defined contribution plan distribution provisions. The tax impact of plan distributions is covered next, including coverage of nontaxable and taxable amounts, taxation of annuity payments, lump sum distributions, taxation of death benefits and federal estate tax relative to plan distributions. Loans are then briefly covered, followed by information on qualified domestic relations orders (QDROs). Penalty taxes are considered, with coverage of the early distribution penalty, minimum distribution requirements and the penalty for not meeting those requirements. After this, the chapter covers retirement plan rollovers by discussing when rollovers are used, tax treatment of rollovers, and alternatives to rollovers. 1 Chapter 8 CHAPTER OUTLINE: A. Planning Retirement Distributions B. Plan Provisions–Required Spousal Benefits 1. Qualified Pre-Retirement Survivor Annuity 2. Qualified Joint and Survivor Annuity C. Plan Provisions–Other Benefit Options 1. Defined Benefit Plan Distribution Provisions 2. Defined Contribution Plan Distribution Provisions D. Tax Impact 1. Nontaxable and Taxable Amounts 2. Taxation of Annuity Payments 3. Lump Sum Distributions 4. Taxation of Death Benefits 5. Federal Estate Tax E. Loans F. Qualified Domestic Relations Orders (QDROs) G. Penalty Taxes 1. Early Distribution Penalty 2. Minimum Distribution Requirements and Penalty H. Retirement Plan Rollovers 1. When are Rollovers Used? 2. Tax Treatment of Rollovers 3. Alternatives to Rollovers I. Where Can I find Out More About Retirement Plan Distributions? J. Chapter Endnotes FEATURED TOPICS: Retirement plan distributions: planning, plan provisions, tax impact, minimum distribution requirements and penalties Required spousal benefits Qualified Domestic Relations Orders (QDROs) Retirement plan rollovers FIGURES: Figure 8.1 Uniform Lifetime Table Chapter 8 CFP® CERTIFICATION EXAMINATION TOPIC: Topic 62: Qualified plan rules and options E. Loans from qualified plans Topic 67: Distribution rules, alternatives, and taxation A. Premature distributions B. Election of distribution options C. Required minimum distributions D. Beneficiary considerations/Stretch IRAs E. Qualified Domestic Relations Order (QDRO) F. Taxation of distributions COMPETENCY: Upon completion of this chapter, the student should be able to: 1. Have a basic understanding of qualified plan distributions and loans 2. Identify key plan provisions regarding spousal benefits and qualified domestic relations orders (QDROs) 3. Understand provisions relating to defined benefit and defined contribution plan distributions 4. Have a basic understanding of retirement plan rollovers KEY WORDS: retirement distributions, spousal benefits, qualified pre-retirement survivor annuity, qualified joint and survivor annuity, grandfathered, federal estate tax, loan, qualified domestic relations order (QDRO), early distribution, minimum distribution DISCUSSION: 1. Discuss reasons for making premature withdrawals from qualified retirement plans along with reasons why the rules tax, and often penalize these withdrawals. 2. Discuss required spousal benefit provisions, including QDROs. Include potential hardships for either spouse as a result of these provisions. Also discuss what would likely happen if these provisions were withdrawn. Chapter 8 QUESTIONS: 1. Which of the following are survivorship benefits for spouses required by pension plans? (1) qualified pre-retirement survivor lump sum (2) qualified pre-retirement survivor annuity (3) qualified joint and survivor annuity (4) qualified joint and survivor lump sum a. b. c. d. (1) only (1) and (2) only (2) and (3) only (2) (3) and (4) only Chapter 8, pp. 75, 76 2. Which of the following defined benefit plan distribution options is usually the automatic form of benefit for an unmarried plan participant? a. b. c. d. life annuity joint and survivor annuity period-certain annuity lump sum distribution Chapter 8, p. 76 3. What percentage of each annuity payment will normally be considered taxable income to a plan participant who has no cost basis in the plan? a. b. c. d. 25% 50% 75% 100% Chapter 8, p. 78 4. Which of the following are requirements (as set out in Code section 4975(d)(1)) which must be met before loans from a qualified plan may be allowed? (1) loans are available to all participants and beneficiaries on a reasonably equivalent basis Chapter 8 (2) loans are not made available to highly compensated employees in an amount greater than for other employees (3) loans bear reasonable rates of interest (4) loans are adequately secured a. b. c. d. (1) and (3) only (1) (2) and (3) only (2) (3) and (4) only (1) (2) (3) and (4) Chapter 8, p. 81 ANSWERS: 1. c 2. a 3. d 4. d