2009 Correlation Table for Employee Benifits Planning

advertisement

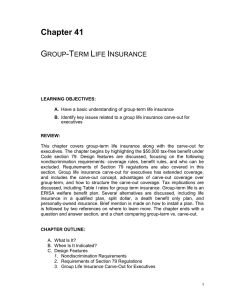

CFP® Certification Examination Topics List Correlation Table EMPLOYEE BENEFITS PLANNING (8%) Tools and Techniques of Employee Benefit and Retirement Planning 11th Edition Supplemental Reading Tax Facts on Insurance & Employee Benefits (2009) 27. Group Life Insurance A. Types and basic provisions 1. Group term Chapter 41: Group-Term Life Insurance 2. Group permanent Chapter 41: Group-Term Life Insurance 3. Dependent coverage Chapter 41: Group-Term Life Insurance B. Income tax implications Chapter 41: Group-Term Life Insurance C. Employee benefit analysis and application D. Conversion analysis E. Carve-out plans Tax Facts on Insurance & Employee Benefits (2009): Q 138, Q 139 Tax Facts on Insurance & Employee Benefits (2009): Q 150, Q 151 Tax Facts on Insurance & Employee Benefits (2009): Q 142 Tax Facts on Insurance & Employee Benefits (2009): Q 142, Q 143 Chapter 29: Designing the Right Life Insurance Plan; Chapter 41: Group-Term Life Insurance Chapter 41: Group-Term Life Insurance Chapter 41: Group-Term Life Insurance Tax Facts on Insurance & Employee Benefits (2009): Q 146 28. Group Disability Insurance A. Types and basic provisions 1. Short-term coverage 2. Long-term coverage B. Definitions of disability C. Income tax implications June 29, 2009 Chapter 50: Sick Pay (Short Term Disability) Chapter 51: Long Term Disability Insurance Chapter 51: Long Term Disability Insurance Chapter 50: Sick Pay (Short Term Disability); Chapter 51: Long Term Disability Insurance Page 1 of 5 Tax Facts on Insurance & Employee Benefits (2009): Q 193, Q 194 Tools & Techniques of Employee Benefit and Retirement Planning, 11th edition CFP® Certification Examination Topics List Correlation Table D. Employee benefit analysis and application E. Integration with other income Chapter 28: The Process of Employee Benefit Planning; Chapter 50: Sick Pay (Short Term Disability); Chapter 51: Long Term Disability Insurance Chapter 51: Long Term Disability Insurance 29. Group Medical Insurance A. Types and basic provisions 1. Traditional indemnity 2. Managed care plans a. Preferred provider organization (PPO) b. Health maintenance organization (HMO) c. Point-of-service plans B. Income tax implications C. Employee benefit analysis and application Chapter 30: Designing the Right Health Benefit Plan; Chapter 45: Health Insurance Chapter 30: Designing the Right Health Benefit Plan Chapter 46: Health Maintenance Organization Chapter 30: Designing the Right Health Benefit Plan Chapter 30: Designing the Right Health Benefit Plan; Chapter 45: Health Insurance Chapter 30: Designing the Right Health Benefit Plan D. COBRA/HIPAA provisions Chapter 45: Health Insurance E. Continuation Chapter 45: Health Insurance Tax Facts on Insurance & Employee Benefits (2009): Q 154 to Q 172 Tax Facts on Insurance & Employee Benefits (2009): Q 173 to Q 191 Tax Facts on Insurance & Employee Benefits (2009): Q 173 to Q 191 F. Savings accounts 1. Health savings accounts (HSA) Chapter 47: Health Savings Account (Section 223 Plan) 2. Archer medical savings account (MSA) Chapter 47: Health Savings Account (Section 223 Plan) 3. Health reimbursement arrangement (HRA) Chapter 48: Health Reimbursement Arrangement (HRA) June 29, 2009 Page 2 of 5 Tax Facts on Insurance & Employee Benefits (2009): Q 195 to Q 208 Tax Facts on Insurance & Employee Benefits (2009): Q 209 Tax Facts on Insurance & Employee Benefits (2009): Q 168 Tools & Techniques of Employee Benefit and Retirement Planning, 11th edition CFP® Certification Examination Topics List Correlation Table 30. Other employee benefits A. §125 cafeteria plans and flexible spending accounts (FSAs) B. Fringe benefits Chapter39: Cafeteria Plan; Chapter 40: Flexible Spending Account Chapter 52: Fringe Benefits (Section 132) C. Voluntary Employees Beneficiary Association (VEBA) Chapter 59: VEBA Welfare Benefit Trust D. Prepaid legal services Chapter 56: Legal Services Plan E. Group long-term care insurance Chapter 49: Long-Term Care Plan F. Dental insurance G. Vision insurance Chapter 45: Health Insurance Chapter 45: Health Insurance Tax Facts on Insurance & Employee Benefits (2009): Q 100 to Q 109 Tax Facts on Insurance & Employee Benefits (2009): Q 513 to Q 516 Tax Facts on Insurance & Employee Benefits (2009): Q 312 to Q 321 31. Employee stock options A. Basic provisions 1. Company restrictions 2. Transferability 3. Exercise price 4. Vesting 5. Expiration 6. Cashless exercise B. Incentive Stock Options (ISOs) 1. Income tax implications (regular, AMT, basis) a. Upon grant b. Upon exercise c. Upon sale 2. Holding period requirements 3. Disqualifying dispositions 4. Planning opportunities and strategies June 29, 2009 Chapter 35: Stock Option Chapter 38: Restricted Stock Plan Chapter 36 Incentive Stock Option (ISO) Chapter 35: Stock Option; Chapter 36 Incentive Stock Option (ISO); Chapter 37: Employee Stock Purchase Plan Chapter 38: Restricted Stock Plan Chapter 35: Stock Option Chapter 35: Stock Option Chapter 36 Incentive Stock Option (ISO) Page 3 of 5 Tax Facts on Insurance & Employee Benefits (2009): Q 131, Q 132 Tax Facts on Insurance & Employee Benefits (2009): Q 130 Tools & Techniques of Employee Benefit and Retirement Planning, 11th edition CFP® Certification Examination Topics List Correlation Table C. Non-qualified stock options (NSOs) 1. Income tax implications (regular, AMT, basis) a. Upon grant b. Upon exercise c. Upon sale 2. Gifting opportunities a. Unvested/vested b. Exercised/unexercised c. Gift tax valuation d. Payment of gift tax 3. Planning opportunities and strategies 4. Employee benefits analysis and application D. Planning strategies for employees with both incentive stock options and nonqualified stock options E. Election to include in gross income in the year of transfer (§83(b) election) Chapter 35: Stock Option Tax Facts on Insurance & Employee Benefits (2009): Q 130 Chapter 35: Stock Option Appendix E: Long-Term Incentives: A Comparative Analysis Appendix E: Long-Term Incentives: A Comparative Analysis Appendix E: Long-Term Incentives: A Comparative Analysis; Chapter 38: Restricted Stock Plan Chapter 38, Restricted Stock Plan 37. Stock plans A. Types and basic provisions 1. Restricted stock 2. Phantom stock 3. Stock appreciation rights (SARs) 4. Employee Stock Purchase Plan (ESPP) B. Income tax implications June 29, 2009 Chapter 38, Restricted Stock Plan Appendix E: Long-Term Incentives: A Comparative Analysis Appendix E: Long-Term Incentives: A Comparative Analysis Chapter 37: Employee Stock Purchase Plan (Section 423 Plan) Appendix E: Long-Term Incentives: A Comparative Analysis; Chapter 35: Stock Option Page 4 of 5 Tax Facts on Insurance & Employee Benefits (2009): Q 131, Q 132 Tools & Techniques of Employee Benefit and Retirement Planning, 11th edition CFP® Certification Examination Topics List Correlation Table C. Employee benefit analysis and application D. Election to include in gross income in the year of transfer (§83(b) election) 33. Non-qualified deferred compensation A. Basic provisions and differences from qualified plans B. Types of plans and applications Appendix E: Long-Term Incentives: A Comparative Analysis; Chapter 35: Stock Option Chapter 38: Restricted Stock Option Tax Facts on Insurance & Employee Benefits (2009): Q 111 1. Salary reduction plans 2. Salary continuation plans 3. Rabbi trusts Chapter 26: Nonqualified Deferred Compensation 4. Secular trusts Tax Facts on Insurance & Employee Benefits (2009): Q 111 Tax Facts on Insurance & Employee Benefits (2009): Q 111 Tax Facts on Insurance & Employee Benefits (2009): Q 119 Tax Facts on Insurance & Employee Benefits (2009): Q 112 C. Income tax implications Tax Facts on Insurance & Employee Benefits (2009): Q 116 Tax Facts on Insurance & Employee Benefits (2009): Q 113 Tax Facts on Insurance & Employee Benefits (2009): Q 117 1. Constructive receipt 2. Substantial risk of forfeiture 3. Economic benefit doctrine D. Funding methods E. Strategies CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP (with flame logo)® are owned by Certified Financial Planner Board of Standards Inc. and are awarded to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. June 29, 2009 Page 5 of 5