2002 Fruit and Vegetable Situation and Outook

advertisement

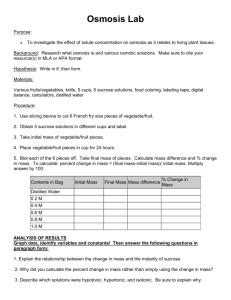

2002 FRUIT & VEGETABLE SITUATION & OUTLOOK Southern Ag. Outlook Conference Tunica, MS September 2002 Ed Estes, N.C. State University 1 Three areas of emphasis: F & V data inconsistently collected across states, & diversity of industry creates S & O problems so only limited USDA will be presented; Focus will be on major topics and issues that are important to industry such as safety, traceback, value added, Farm Bill impacts, contracts, etc. Present findings of an email survey of F&V extension specialists working in the South (10 states) plus national (USDA) S & O information. 2 U.S. Fruit and Vegetable Industry: Consumers spend ~$76 billion to buy fruits and vegetables (2000): $37 billion (49%) from retailers; $38 billion (50%) from foodservice; $1 billion (1%) direct from growers. Grower’s share was ~$19 billion (25%). Market margin was ~$57 billion (75%). Fresh produce often determines store choice. 3 Several issues and trends are important to the Fruit and Vegetable Industry 4 Most important issues/trends ranked by respondents: risk / price mgt. inattention to mkt. poor post harvest consolidation no mkt infrastruct. access to labor food safety decreased pesticides 17.5 12.5 11.5 11.25 11.25 11.0 9.5 8.25 5 Southern states survey conducted in September 2002: Survey sent to people in 10 states: AR, AL, GA, FL, KY, MS, NC, SC, TN, VA: No response from LA, OK, TX, MD. Extension economist +/or horticulturist; represents views and did not ask for evidence to support views; three page, choose or short answer form. 6 Survey ranking methods: Issues ranked from 1-8 with most important issue assigned a value of 1, second most important issue assigned a value of 2, etc; Responses ranked #1 were assigned a value of 20, #2 were assigned a value of 18, #3=16, #4=14, #5=12, #6=10, #7=8, and #8=6. Range was 17.5 to unranked. 7 Most important issues/trends ranked by respondents: risk / price mgt. inattention to mkt. poor post harvest consolidation no mkt infrastruct. access to labor food safety decreased pesticides 17.5 12.5 11.5 11.25 11.25 11.0 9.5 8.25 8 1. Risk - price management: Blank’s Crop Farming Hierarchy Model Profit squeeze exerts pressure to change plant mix to maintain income; generates more $/ac but also more risk; rising input costs & lower prices lead to another profit squeeze and more risk. As risk increases, farmer often sells an asset (usually land) to raise more money; use money from sale to stay in farming. 9 Fruit, vegetable, & specialty crop planting hierarchy : Commodity Investment, Fixity 4. High value perennial (Christmas trees) 3. High value annual (tomatoes, peppers) 2. Low value perennial (irrigated alfalfa) 1. Low value annual 4. Very high, fixed 3. High, inflexible 2. Moderate, flexible 1. Low, very flexible 10 2. Fruit, Vegetable, & specialty crop market assessment considerations: niche market Vs market niche concept; PHH availability & services for markets; item must fit image conveyance for food service, supermarket, or household; More DSD, coops, & fresh contracts Market success often requires high quality, safety & traceability, year-round supply, price contract, computer skills, labels, etc. 11 Examples of Niche Markets & Market Niches: Niche market: organic produce medicinal herbs elephant garlic microgreens Specialty outlets Demand dominates but often there is easy market saturation. Market niche: greenhouse tomatoes yellow peppers sweet onions seedless watermelon Mainstream grocery Supply availability & comparative price dominate buy decision. 12 3. PHH attributes now include safety dimension traceback (Q. Assurance): 3rd party audits, Good Handling Practices, certifications (added benefits & costs); Food safety, food recalls, GMOs,&organics often require flow-to-market documents; Leads to store and brand ‘label’ value;- new country of origin label in 2004; Shorter flow-to-market supply chain mgt. adds value & provides access if you provide offer enhanced quality (traceability). 13 4. Consolidation (bimodal) retailing: EDLP Vs. Value Creation Supermarkets: High service supermarkets try to reduce the importance of price in the buy decision by attribute bundling! Fresh Cut, cooked chickens, i.e, assembly meal rather than cook-from-scratch; Focus rewards & discounts on heavy shoppers (spend the most money) thru loyalty card use (less coupon use)! Produce image emphasis is on new & colors! 14 5. Refinement of market window concept as SCM impacts market: SCM hastened centralized procurement where retailer arranges with large companies (A. Duda, etc.) to source f & v needs over 52 weeks: Duda either grows, contracts, or imports item for the retailer; local grower then deals with Duda on contractual basis; contract price, yield, location often determined by market window. 15 Marketing Trends in Perishables: 1980 2000 70% commodity 30% 20% contracts 50% 10% value added 30% Due to biotech, internet info, media, free trade agreements, & consumer tastes & preferences 16 Changes in U.S. per capita consumption for selected fruits & vegetables, 1991-2002: WINNERS (+%) Leafy Let. (132%) Peppers (49%) Cucumbers (36%) Strawberries (25%) Carrots (23%) Cantaloupe (22%) Tomatoes (16%) Snap beans (15%) LOSERS (-%) Cauliflower (20%) Head Let. (15%) Apples (9%) Celery (8%) Sw. Pot. (6%) Fresh F&V’s PCC up 10% 1990-02. 17 “Weather” impacted yield, output, and price for many fruits and vegetables: VA, TX, MD, & Carolinas were extremely dry for most of spring and summer; upper Mississippi was extremely wet; most other areas were about normal temps and rainfall; Favorable weather in California & Florida plus increased imports resulted in adequate supply availability for most crops; Nationally, AH for fresh /processed vegetables, melons, potatoes, & dry beans up 9% above 2001 but fresh veggie AH mostly unchanged. 18 2002 statewide rainfall levels indicated by respondents: Precipitation Southern States Very dry GA, NC, SC Moderately dry AL, KY, North MS, VA, TX Normal rain AR, FL, TN Moderately wet Very wet Southern MS 19 2002 US Vegetable Highlights: Sweetpotato AH down 3.5%, demand weak so grower prices likely unchanged; USDA -expects 5% AH increase in fall potatoes; Spring and summer acreage was up slightly so ’02 output up 4.5%; Potato price likely higher despite lower fall ’02 price; Fall veggie AH, output down, prices up. 20 2002 US Fruit Highlights: Leaner apple crop in East and Central states (~ 16%) somewhat offset by larger Washington crop (up 5%). Carolinas, GA, AR, up but most down. Prices up. Strawberries AH up slightly but demand strong so prices up 6%; grapes output up and prices down 12%; Sweet cherry prod. <11%; tart off 95%. 21 U.S. Horticultural Crop Trade: Both F & V imports and exports are expected to increase in 2002 but fresh vegetable imports expected to decrease by about 3%; frozen veggies, potatoes, & specialty crop imports up 5%; grapefruit, apple, citrus exports down. NAFTA tomato wars continue despite some lawsuits dropped. 22 Food marketing purchases from US agriculture, 1990-00: Item Meat F & V Poultry Dairy 1990 36.9 16.5 11.1 20.5 2000 34.8 27.3 16.3 22.7 23 Other 2002 Survey Responses Email survey done in September 2002 24 Change in output over the 2000-2002, by category: Increase Vegetable AR, AL, KY Sm. Fruit AL, GA, FL, KY, MS, NC, TN, VA Tree AR, GA Fruit Decrease Same GA, FL, MS, SC NC, TN, VA AR, SC FL, KY, MS, NC, TN AL, SC, VA 25 Between 2000 and 2002, entry of new F & V farmers has: INCREASED DECREASED SAME GA,KY, NC NC-veggies, SC AL,AR,FL, MS,TN,VA 26 Since 2000 direct farm-toconsumer sales have: INCREASED DECREASED SAME AL, AR, GA,KY, MS, NC, SC FL,TN,VA 27 Since 2002, organic f & v sales have: INCREASED DECREASED AR, FL, MS, NC, SC KY SAME AL,GA,TN, VA 28 Since 2000, retailer interest in buying locally grown f & v has: INCREASED DECREASED AL, KY, MS, NC, SC, TN SAME AR, GA, FL,VA 29 Since 2000, number of F & V extension meetings has: INCREASED DECREASED SAME AR,GA, KY AL, SC, TN, VA FL, MS, NC 30 Interest in intensive F & V production systems has: INCREASED DECREASED SAME AR, FL, KY MS,SC, TN AL,GA, NC, VA 31 Grower interest in export sales, based on survey: Increase Decrease Same FL, GA, KY, NC, VA MS AL, AR, SC, TN 32 Farm Bill impacts: Some growers will view f&v’s as a less attractive alternative because of desire to build base & the attractiveness of FB so there will fewer ‘alternative’ growers; 2004 mandatory country-of origin labels; $2 M/yr. for food safety and $200 M/yr year in Sec. 32 purchases $50 M/yr. in school & military purchases. 33 Specialty Crop comments: Medicinal (nutriceuticals) & culinary herbs expanding rapidly in southeast US; NC Specialty Crops Center work on pyrethrum, garlic, grape tomatoes; Good success with sprite melon, savory & hot peppers, nursery & green industry. 34 5-point differential scale, broker survey, NCSU & NCDA, May 2000: grape tom. 4.5 color.peppers 4.5 seedless wat. 4.1 romaine let. 4 3.9 GH Tomato 3.7 Leaf Lettuce 3.2 hot peppers 0 1 2 3 4 5 35 2003 Fruit & Vegetable Summary (1): Fresh demand strength strong but renewed value added emphasis (fruit) Small fruit production strong but tree fruit demand weak; Vegetable output may be down slightly as it is a less attractive alternative for some given specialty crop demand & 2002 farm bill attractiveness. 36 2003 Fruit & Vegetable Summary (2): Despite few visible changes, global sourcing has changed the reality of fresh produce marketing and the new sourcing reality for fresh produce depends on strategy, alliances and contracts; Efforts to be more efficient in handling but neglect consumer preferences are doomed (K Mart vs. Wal-Mart) 37