– the Asset-Liability Management Case of Hungary London, March 6-7, 2007

advertisement

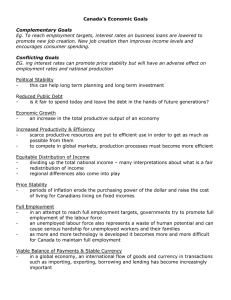

Asset-Liability Management – the Case of Hungary London, March 6-7, 2007 András Réz, Head of Planning, Research and Risk Management Asset-Liability Management (ALM) – Rationale During portfolio management or management of the balance sheet of a bank or a private company: • Market risks or financial risks can be reduced by having similar assets and liabilities characteristics (e.g. given liability structure by investing in instruments with similar terms of maturity, interest rate and currency. • Derivative instruments can also be used to reduce „gaps”, • With successful cover any market risks will affect assets and liabilities on a similar way therefore actual net losses (or gains) from market risks will be minimised. ALM – from a Debt Manager’s Point of View Liabilities: = debt and other obligations Assets: = ? (difficult to identify) • Equity, State ownership – only divident revenues, very long durations, state ownership usually not for profit making, not the primary goal of the Government >> Privatisation, • Other state assets (e.g. motorway, national parks, army) – theoretical value, good for balancing the State balance sheet, but no real revenue from them, Future discounted tax revenues – most accepted views, but difficult to use practically for ALM calculations. • ALM – a Possible Point of View of the Central Bank Assets – Foreign currency reserves, and other assets on the CB balance sheet: • Rationale of ALM – Foreign currency reserves and other (sterilisation) assets may be costly for the CB and the Government, • Coordinated ALM - With coordinated foreign currency issuance FX reserves (and other assets) can be reduced, potential cost savings. ALM – from the Point of View of the Government Liability: debt, Assets FX reserves: • FX debt is usually cheaper (lower yields, longer terms), • Coordination is difficult – institutional autonomy or independence, Coordinational problems – different time horizon (monetary policy – short term, inflation target, debt management long term, cost saving, growth), different objectives (e.g. level of local yields). • ALM – Problems Stock of Foreign Reserves (1997=100%) 800% Argentina 700% Turkey 600% Venezuela, Rep. Bol. Hungary 500% 400% Poland 300% Czech Republic 200% Thailand 100% Russia 0% 1997 1998 1999 2000 2001 2002 2003 2004 Rapid increase of foreign currency reserves in emerging countries – need to limit the rise ALM – Basics Ways of FX currency reserve reductions: • • Borrowed reserves – simple issue, reduce FX financing and reserves, Non-borrowed reserves: Buy-back of FX debt, Replace FX currency debt with domestic debt, Unnecessary FX currency reserves can be used to invest in higher yielding assets to avoid cost problems (advisable only if reserves are coming from good BoP position e.g. oil revenues). ALM – Buy-backs Stock of Brady Bonds Outstanding (USD billion face value) 60 40 30 20 Venezuela Russia Poland Mexico Croatia 0 Bulgaria 10 Brazil Remaining in April 2006 50 Argentina Peak Foreign currency reserves are already used actively to reduce outstanding foreign currency debt- limited future role ALM – Use of domestic market Foreign Investors Share in Total Debt Issuance (IMF Global Financial Stability Report April, 2006) 16,0% 14,0% 12,0% 10,0% 8,0% 6,0% 4,0% 2,0% 0,0% 2000 2001 2002 2003 2004 2005 By replacing foreign currency debt with domestic debt foreign owned debt may not decrease rapidly – FX risk replaced with interest rate risk ALM – Basics II. Non-borrowed FX currency reserve levels reduction can be difficult: • ALM management can work if good cooperation between fiscal and monatary policy, • Replacing FX currency debt with domestic debt can work but depends on market conditions, Coordination should work in case of outflow, CB cannot leave debt management alone, Slow process. • • ALM – the Hungarian Case Several institutional changes between 1990-2006: • Early years of setting up new systems until 1991, • • Intermediate system with the CB having a major role until 1997, Co-ordination with a strong emphasis on FXY currency reserve levels until 2002, • Balanced co-ordination from 2003. ALM – Early Years until 1991 Important measures to transform economic system, however debt management less effected: • Strengthening central bank position, limitation of monetary financing (no deficit problem projected), • NBH maintains its role as FX debt manager on behalf of the government and manages FX currency reserves, Underdeveloped local debt management by the Ministry of Finance. • Economic and deficit problems emerged in the mid 1990s ALM – Intermediate system until 1997 Economic austerity program includes development of domestic debt management: • Rapid development of domestic government securities market and institutions, • On the basis of local market monetary financing stopped, later prohibited by law, FX debt management done by the NBH according to FX currency reserve needs. • Previous funding relationship creates balance sheet problems for the NBH (devaluation losses) ALM – Co-ordination with a Strong Emphasis on FX reserve levels until 2002 NBH balance sheet problems solved by transformation of foreign currency debt and management to the government in 1997: • Foreign currency debt management becomes part of public debt management strategy, • NBH ensures strong coordination to reach FX currency reserve level targets, • Co-ordination also resulted in hedging FX debt and reserves (currency benchmarks), • Debt management strategy aims for renewing maturing FX debt (no domestic monetary effect), some ad hoc deviation from the rule by the initiative of the NBH. ALM – Coordination with a Strong Empasis on FX Reserve Levels – Role of Foreigners Ratios to total government debt 60,00% 50,00% 40,00% non-resident total holdings in HUF 30,00% foreign currency denominated government debt in HUF 20,00% Replacing FX debt did not reduce role of foreign investors 10,00% 0,00% 1998 1999 2000 2001 2002 2003 2004 2005 2006 ALM – Balanced Co-ordination from 2003 Fiscal loosening creates fiscal problems and smaller investors’ demand: • New debt management strategy adopted to decreased demand and medium term objectives (EMU accession), • Stable FX currency debt ratio, • NBH also ask for higher FX currency reserves (deteriorating BoP balance), • Net FX currency issuance exchanged at the NBH, avoidance of simultaneous activity on the FX market. ALM – Results in Hungary • FX currency reserve levels are relatively low vs. peer group, cost reduction target reached, • Several benchmarks (e.g. funding in domestic currency, FX debt composition) are set up using basic ideas of ALM, • With relative success of coordination policy, other possible measures to solve present problems (monetary, sterilisation assets) are less taken into consideration, • In time of economic problems, relatively small FX currency reserve levels is not an advantage (countries with too high levels are the benchmarks). Conclusions • Volatile international flows, and small local market may result in high FX currency reserve levels, causing problems in monetary policy and debt management • Unnecessary FX currency reserves levels are costly, reduction can be advisable • ALM may be introduced/implemented but practical use is difficult due to lack of comprehensive data, independent actors, and different objectives • Co-ordination is needed in case of both inflows and outflows of capital More information on www.akk.hu Thank you for your attention !