Mr. Mansoor Dailami

advertisement

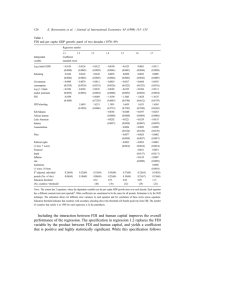

Mobilizing international resources for development: Foreign direct investment and other private flows Mansoor Dailami Manager, International Finance, Development Prospects Group, World Bank New York February 15th, 2008 Summary and key issues Private capital flows to developing countries have been on a strong upward trend, supported by domestic economic reforms and high growth FDI continues to be the largest and most stable capital flow with increasing focus on services Private capital flows expected to decline somewhat in the short term amid more moderate global growth and tighter credit conditions Private flows have gone through pronounced cycles against an upward trend Net private capital flows to developing countries, 1970-2007 $ billions Percent 1000 $998 billion in 2007 (7.3% of GDP) 800 6 600 400 8 Percent of GDP (right axis) $6.5 billion in 1970 (1.0% of GDP) 4 2 200 2006 2002 1998 1994 1990 1986 1982 1978 1974 0 1970 0 … dominated by cycles in international bank lending… Net private debt flows to developing countries , 1970-2007 Percent 4 3 Bank loans 2 1 Bonds 0 1970 -1 1975 1980 1985 1990 1995 2000 2005 ..with the corporate sector playing an increasingly important role in debt flows $ billions Gross debt flows to developing countries, 1991-2007 500 Corporate Sovereign 400 300 200 100 0 1991 1993 1995 1997 1999 2001 Source: World Bank Debt Reporting System and staff estimates. 2003 2005 2007e …and FDI accounting for about one-half of total private flows $ billions 3,500 3,000 2,500 Debt Portfolio equity 37% FDI 2,000 12% 1,500 42% 1,000 50% 11% 500 47% 0 1992-97 2002-07 …supported by strong growth in developing countries Real GDP, percent change 10 Developing economies 8 7.2% 6 High-income 4 2.7% 2 -2 Source: World Bank. 7 6 4 20 05 3 2 1 20 00 98 99 96 97 94 95 92 93 89 19 90 91 87 88 85 86 83 84 19 81 82 0 …and improved external payments positions --current account surpluses in many countries Current account balance of developing countries $ billions Percent $408 billion in 2007 450 4 3 300 2 Percent of GDP (right axis) 150 1 0 0 -1 -2 -150 -3 -300 -4 1990 1992 1994 1996 1998 2000 2002 2004 2006 ..along with large-scale foreign exchange reserve holdings… Foreign exchange reserves $billions 4000 3600 3200 2800 2400 2000 1600 1200 800 400 0 $3.6 trillion 1995 1999 2005 2007 $2.0 trillion $0.9 trillion Oil-exporting countries Emerging Asia Developing countries Increase in foreign exchange reserves $billions 2006 2007* China 247 431 Russia 120 169 Brazil 32 84 India 39 86 Malaysia 12 19 Algeria 22 33 Libya 20 21 Indonesia 8 12 * World Bank staff estimates …improved external financial policy… Many developing countries have moved to managed or free floating exchange rate regimes Mexico(1994), Indonesia(1997), Colombia(1999), Brazil(1999), Chile(1999), and Russian Federation(2002)... Capital controls have been eased Brazil, Chile, Hungary, Romania, and Slovak Republic... Some have adopted inflation targeting Brazil, Chile, Colombia, Mexico, Peru, Philippines, South Africa, and Thailand... …and better macroeconomic policies percent 30 1980s 20 2002-2004 10 0 Av. Tariffs -10 Median Inflation Fiscal Deficit Markets have recognized improved fundamentals in emerging markets -- priced in bond spreads Bond spreads (basis points) 1,600 1,400 Emerging market 1,200 bond spread (EMBIG) 1,000 800 600 400 200 0 1994M1 1996M1 1998M1 2000M1 2002M1 2004M1 2006M1 2008M1 Summary and key issues Private capital flows to developing countries have been on a strong upward trend, supported by domestic economic reforms and high growth FDI continues to be the largest and most stable capital flow with increasing focus on services Private capital flows expected to decline somewhat in the short term amid more moderate global growth and tighter credit conditions Growth in FDI flows driven by middle income countries… $ billions 500 percent $456 billion (3.2 percent of GDP) in 2007 3.5 450 3 400 350 2.5 Percent of GDP 300 Low-Income Countries 2 250 1.5 200 150 Middle Income Countries 100 1 0.5 50 0 0 1991 1993 1995 1997 1999 2001 * 2007 data is World Bank staff projection 2003 2005 2007p …and highly concentrated in just a few large economies FDI inflows to developing countries 500 400 $ billions Top 5 countries account for 46 % in 2007 China Russia Turkey Mexico Brazil 300 200 Other Countries 100 0 2000 2001 2002 2003 2004 2005 2006 2007p * 2007 data is World Bank staff projection …but relative to GDP, FDI to low-income countries is on par with middle income countries FDI to GDP Ratio percentage 4.0 3.5 3.0 2.5 2.0 1.5 Low Income (excluding India) 1.0 Middle Income 0.5 0.0 1991 1994 1997 2000 * 2007 data is World Bank staff projection 2003 2006 FDI inflows are closely related to income per capita FDI per capita vs GDP per capita, 2001-06 8 China log(FDI per capita) Equatorial Guinea Trinidad & Tobago Romania 6 Azerbaijan Oman Chad Turkey Venezuela Gambia 4 South Africa Bolivia Congo, Dem. Rep. 2 Iran India Zimbabwe y = 1.27x - 5.5 R2 = 0.69 Central African Republic 0 Malawi 4 5 Rwanda 6 7 -2 log(GDP per capita) 8 9 10 And increasing focus on FDI in services, facilitated by technological change and liberalization Share in FDI Stock in 2005 70 percent Almost all services sector FDI is in infrastructure and financial sectors 60 50 Manufacturing Primary 40 Services 30 20 10 0 Developing Countries AFRICA LAC ECA EAP Low income countries still attract very limited private capital flows Net private capital flows to developing countries $ billions 2400 China 2000 Mexico Brazil Russia Poland India 1600 1200 52 % 800 Middle Income 40% 400 Low Income 8 % 0 1995-1999 2001-2006 Steady expansion in migrant remittance flows Migrant remittance flows Migrant remittance flows / GDP $200 billion $ billions 200 Percent Middle-income countries Low-income countries 4 150 Low-income countries 3 100 2 50 1 0 0 2000 2001 2002 2003 2004 2005 2006 Middle-income countries 2000 2001 2002 Source: World Bank staff estimates. 2003 2004 2005 2006 Summary and key issues Private capital flows to developing countries have been on a strong upward trend, supported by domestic economic reforms and high growth FDI continues to be the largest and most stable capital flow with increasing focus on services Private capital flows expected to decline somewhat in the short term amid more moderate global growth and tighter credit conditions Global financial conditions have worsened noticeably Moderate slowdown in global growth Tighter credit conditions Large losses in major financial institutions More stringent credit standards * Impact of financial turmoil on emerging markets limited so far… Private capital flows expected to ease… Net private capital flows to developing countries $ billions 1000 $998 billion in 2007 (7.3% of GDP) 800 Projected Percent 2008-09 8 Percent of GDP (right axis) 600 6 5.25% 3.5% of GDP average 1990-02 4 400 2 200 0 0 1991 1993 1995 1997 1999 2001 2003 2005 2007e 2009P …but long-term prospects for increased capital flows remain positive Developing countries’ favorable demographic profiles Scope for increasing investment and growth (Per capita investment $500 in 2006, compared to $6000 in developed countries ) About 84% of world Population reside in developing world Less than 5% of global bonds issued in recent years originated in developing countries. Further room for integration in the world economy