Prices vs. Q. lecture

advertisement

Prices vs. Quantities

• Distributional Issues

Baumol and Oates (I believe)

• Uncertainty

Weitzman, Martin. “Prices vs. Quantities.”

Review of Economic Studies. Oct 1974 61(4):

477-491

– Simplify: make benefits deterministic

(c) 1998 by Peter Berck

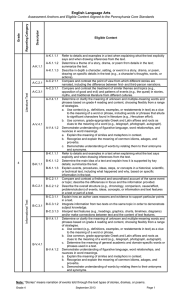

Tax

Before regulation profits are

dark green and purple areas

mc

If, instead, tax T=mc-mcf at

reg Q: Q is still Reg Q, green

area is tax take and only purple

remains as profit

When regulation reduces Q

Profits are the purple plus

green areas (mcf > mr as drawn)

mcf

mcp

Reg Q

Unreg. Q

The Uncertainty Problem

• A private producer needs to be motivated to

produce a good that is not sold in a market.

• The government does not know the costs of

producing the goods.

• In particular it does not know a, a mean

zero variance 2 element of the cost

function

Quantity Regulation

• The firm can be told to produce a quantity

certain, qr.

• The level of benefits will be certain, since

qr is certain, but

• the level of costs isn’t known so the

government will accept the uncertainty in

the cost to be paid.

Price Motivation

• Or, the Government can offer to pay a price,

p for any units produced.

The firm will observe which cost they incur and

react to the the true supply curve and set p=mc

correctly,

but the level of production and level of benefits

will be variable

Which to choose?

• Professor Weitzman (to the best of my

ancient memory) gave the example of

medicine to be delivered to wartime

Nicaragua.

Too little and people die

Too much not worth anything more

cost doesn’t matter that much

so, choose qr and get the right amount there for

certain

In quantity mode,

• the regulator chooses a quantity, qr,

• then the state of nature becomes known,

• then the firm produces and costs are

incurred and benefits received.

• B(q) is benefits and B’ is marginal benefit.

• C(q,a) is cost and is a function of the state

of nature, a.

B’ = MC

qr = argmaxq E( B - C).

• Gives the optimal choice of qr.

• Of course, E[B’ - Cq] = 0 at qr.

Approximate About qr

• Approximate B and C about qr.

• Note that the uncertainty in marginal cost is all in a,

which is just a parallel shift in mc. Could also have a

change in slope.

C(q,a) = c +( c’ + a) (q-qr)

+ .5 c’’ (q-qr)2

B(q) =b + b’ (q-qr) + .5 b’’ (q-qr)2

• b and c are benefits and costs at qr

Obvious algebra.

• mc = c’ + a+ c’’ (q-qr)

• marginal cost

E[mc(qr,a)] = c’ + E[a] = c’

• mb = b’ + b’’ (q- qr)

• marginal benefit

E[B’(qr) ] = b’

• FOC for qr implies b’=c’

A picture.

•mc = c’ + a+ c’’ (q-qr); here a takes on the

values of

+/- e with equal probability

qr

.

c’+e + c’’ (q-qr)

c’-e + c’’ (q-qr)

c’ + c’’ (q-qr)

B’

Deadweight Loss using qr.

+e

Half the time each triangle is

the DWL

qr

-e

As the slope of B’

approaches vertical

DWL goes down

B’

The Supply Curve

• The firm sees the price, p, and maximizes

its profits after it knows a, so

• p = mc

• p = c’ + a + c’’ (q-qr)

• Solving gives the supply curve:

• h(p,a) = q = qr + (p - c’ - a) / c’’

The center chooses p …

• The center chooses p to maximize expected

net benefits:

• p* = argmaxp E[ B(h(p,a) - C(h(p,a))]

B-C = b-c +(b’-c’- a)(q-qr) + (b’’-c’’).5(q-qr)2

substitute q-qr = (p - c’ - a) / c’’

= b-c - a (p - c’ - a) / c’’

+ (b’’-c’’).5 ((p - c’ - a) / c’’ )2

Zero by FOC for qr

Take Expectations

B-C = b-c - a (p - c’ - a) / c’’

+ (b’’-c’’).5 ((p - c’ - a) / c’’ )2

• E[B-C] = b-c + 2/c” +

(b’’-c’’) {(p-c’)2 + 2}/ {2c”2}

• 0 = DpE[B-C] = p - c’

• E[B-C]

• = b-c + 2/c” + {(b’’-c’’) 2}/ {2c”2}

Advantage of Prices over Quant.

•

•

•

•

•

Under price setting

E[B-C]

= b-c + 2/c” + {(b’’-c’’) 2}/ {2c”2}

Less E[B-C] under quantity: = b-c

Advantage of price over quantity….

The advantage of prices over

quantities

b' '

c' '

+

2

2

2 c' '

2 c' '

2

2

Deadweight Loss using p*.

+e

Half the time each triangle is

the DWL

-e

P*

As the slope of B’

approaches vertical

DWL goes up

B’