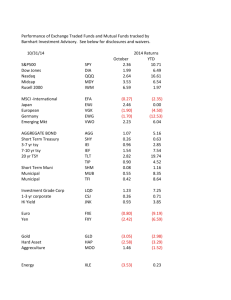

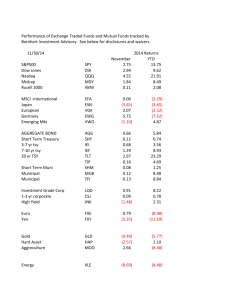

Tab 2 Defined Contribution Plan Fixed Income Active Manager Selection

advertisement

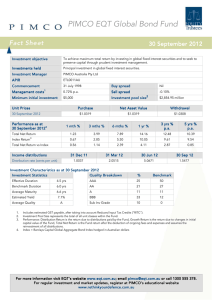

AGENDA ITEM SUMMARY 1. NAME OF ITEM: Defined Contribution Plans – Fixed Income Active Manager Selection 2. INITIATED BY: Karl W. Turner, Chair 3. BOARD INFORMATION: 4. BACKGROUND: BOARD ACTION: X Given the abrupt departure of the PIMCO Total Return’s lead fund manager, founder and chief investment officer, Bill Gross, CAPTRUST recommends terminating the PIMCO Total Return fund as an investment choice in the Defined Contribution Plan. While PIMCO is a large investment management firm with over $2 trillion in assets across a variety of asset classes and products, Bill Gross was a central investment process component. Across many PIMCO strategies, the firm incorporates a global “top-down” or macroeconomic viewpoint into their investment thinking, combining that with a “bottomup” or security- and sector-specific outlook, to drive portfolio decisions. Bill Gross had been a consistent contributor to the macroeconomic viewpoint for years, and without Gross’ skillset, PIMCO will need to adjust to missing a key input. PIMCO’s size necessitates that it have several talented individuals involved in its investment process, but Gross’ unique abilities, coupled with his cultural impact as a founder, make his resignation significant. Governance and division of labor is another key part of our due diligence process, and the recent announcement leaves PIMCO with some leadership vacancies. PIMCO had taken steps earlier this year to create a structure that involved promoting emerging leaders into deputy chief investment officer roles, which we viewed as a constructive step in succession planning. However, PIMCO has not developed “top down” expertise beyond Bill Gross to a point where we feel comfortable recommending strategies that have been reliant on Gross’ expertise. CAPTRUST is recommending replacing PIMCO with the Prudential Total Return Bond fund. The strategy is managed by Robert Tipp (2002), Michael Collins (2009), Richard Piccirillo (2012), and Gregory Peters (2014). The team seeks to outperform through a combination of sector rotation and security selection while minimizing interest rate bets in the portfolio. The fund will invest primarily in U.S. dollar denominated investment grade securities but may hold up to 30% in below investment grade debt or 30% in non-U.S. dollar denominated debt. The portfolio managers utilize sector teams to develop a relative value framework between sectors and aid in security selection. Diversification of alpha sources, with the dual emphasis on security selection and sector rotation as value adds, have allowed the fund to consistently outperform peers and the benchmark. CAPTRUST is recommending mapping all existing PIMCO Total Return Fund assets, and any future contributions to this Fund, to the Prudential Bond fund. 5. TEXT OF PROPOSED RESOLUTION: The Investment Committee approves the selection of the Prudential Total Return Bond Fund, replacing the PIMCO Total Return Fund in the Defined Contribution Plan. 11/21/2014